í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

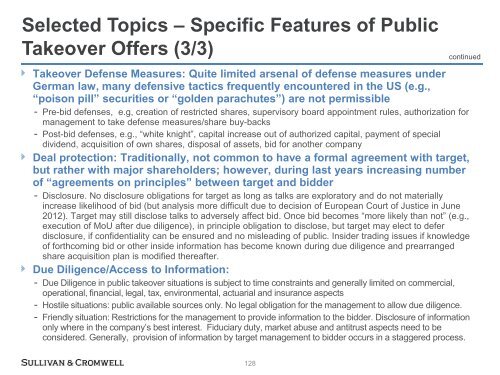

Selected Topics – Specific Features of Public<br />

Takeover Offers (3/3)<br />

continued<br />

Takeover Defense Measures: Quite limited arsenal of defense measures under<br />

German law, many defensive tactics frequently encountered in the US (e.g.,<br />

“poison pill” securities or “golden parachutes”) are not permissible<br />

- Pre-bid defenses, e.g, creation of restricted shares, supervisory board appointment rules, authorization for<br />

management to take defense measures/share buy-backs<br />

- Post-bid defenses, e.g., ―white knight‖, capital increase out of authorized capital, payment of special<br />

dividend, acquisition of own shares, disposal of assets, bid for another company<br />

Deal protection: Traditionally, not common to have a formal agreement with target,<br />

but rather with major shareholders; however, during last years increasing number<br />

of “agreements on principles” between target and bidder<br />

- Disclosure. No disclosure obligations for target as long as talks are exploratory and do not materially<br />

increase likelihood of bid (but analysis more difficult due to decision of European Court of Justice in June<br />

2012). Target may still disclose talks to adversely affect bid. Once bid becomes ―more likely than not‖ (e.g.,<br />

execution of MoU after due diligence), in principle obligation to disclose, but target may elect to defer<br />

disclosure, if confidentiality can be ensured and no misleading of public. Insider trading issues if knowledge<br />

of forthcoming bid or other inside information has become known during due diligence and prearranged<br />

share acquisition plan is modified thereafter.<br />

Due Diligence/Access to Information:<br />

- Due Diligence in public takeover situations is subject to time constraints and generally limited on commercial,<br />

operational, financial, legal, tax, environmental, actuarial and insurance aspects<br />

- Hostile situations: public available sources only. No legal obligation for the management to allow due diligence.<br />

- Friendly situation: Restrictions for the management to provide information to the bidder. Disclosure of information<br />

only where in the company‘s best interest. Fiduciary duty, market abuse and antitrust aspects need to be<br />

considered. Generally, provision of information by target management to bidder occurs in a staggered process.<br />

128