- Page 1 and 2:

September 26, 2012 | Seoul 해외 M

- Page 3 and 4:

Traditional Role of IP in M&A

- Page 5 and 6:

Why does IP matter? continued Monet

- Page 7 and 8:

Primary IP Objectives in M&A contin

- Page 9 and 10:

Selected IP Risks in M&A continued

- Page 11 and 12:

IP Allocation in a Spin-Out continu

- Page 13 and 14:

Spin-Outs ‒ Key IP Questions cont

- Page 15 and 16:

Emerging Role of IP in M&A 지적

- Page 17 and 18:

What to expect

- Page 19 and 20:

Patent Market - Trends 특허권

- Page 21 and 22:

Case Study: Skype 2003: Niklas Zenn

- Page 23 and 24:

Case Study: Microsoft/Novell Attach

- Page 25 and 26:

Biography of Nader A. Mousavi R eco

- Page 27 and 28:

Biography of Nader A. Mousavi conti

- Page 29 and 30:

Thank You

- Page 31 and 32:

Acquiring a U.S. Public Company: Wh

- Page 33 and 34:

Fundamental Deal Structuring Decisi

- Page 35 and 36:

―One Step‖ Transaction Structur

- Page 37 and 38:

―Two Step‖ Transaction Structur

- Page 39 and 40:

Deal Consideration: Stock versus Ca

- Page 41 and 42:

The Role of Stockholder Rights Plan

- Page 43 and 44:

Unsolicited Deal Schematic continue

- Page 45 and 46:

Target Options Regarding the Sale P

- Page 47 and 48:

When Must Negotiations be Disclosed

- Page 49 and 50:

―Public Company‖ Due Diligence

- Page 51 and 52:

―Public Company‖ Due Diligence

- Page 53 and 54:

Key Terms of Negotiated Deal contin

- Page 55 and 56:

Material Adverse Effect continued C

- Page 57 and 58:

Document Creation continued From be

- Page 59 and 60:

Transaction Litigation: Significant

- Page 61 and 62:

Transaction Litigation: Focal Point

- Page 63 and 64:

Transaction Litigation: Acquirer‘

- Page 65 and 66:

Implications for Acquirer During Ea

- Page 67 and 68:

Importance of PR and Governmental R

- Page 69 and 70:

Certain U.S. Legal Regimes Implicat

- Page 71 and 72:

Summary: Key Elements of Acquiring

- Page 73 and 74:

Appendix B: Illustrative Timeline:

- Page 75 and 76:

Illustrative Timeline: Cash Tender

- Page 77 and 78:

Fiduciary Duties of Directors in a

- Page 79 and 80:

Appendix D: Speakers Profile Franci

- Page 81 and 82:

Biography of Francis J. Aquila cont

- Page 83 and 84:

Biography of Michael G. DeSombre co

- Page 85 and 86:

Biography of Michael G. DeSombre co

- Page 87 and 88:

September 26, 2012 | Seoul 해외 M

- Page 89 and 90:

해외 M&A 단계별 조세상 고

- Page 91 and 92:

1. 해외 M&A 단계별 조세상

- Page 93 and 94:

1. 해외 M&A 단계별 조세상

- Page 95 and 96:

2. 해외 M&A와 조세전략 수

- Page 97 and 98:

2. 해외 M&A와 조세전략 수

- Page 99 and 100:

2. 해외 M&A와 조세전략 수

- Page 101 and 102:

2. 해외 M&A와 조세전략 수

- Page 103 and 104:

2. 해외 M&A와 조세전략 수

- Page 105 and 106:

2. 해외 M&A와 조세전략 수

- Page 107 and 108:

2. 해외 M&A와 조세전략 수

- Page 109 and 110:

Partner Profile 김 규 동 회계

- Page 111 and 112:

September 26, 2012 | Seoul 해외 M

- Page 113 and 114:

1. 해외 M&A의 일반적인 절

- Page 115 and 116:

1. 인수 검토 및 예비 분석

- Page 117 and 118:

3. 본 계약 체결과 Closing 효

- Page 119 and 120:

투자의사결정 관련 내부

- Page 121 and 122:

기업결합 신고의무 우리나

- Page 123 and 124:

해외직접투자 신고 (신규

- Page 125 and 126:

신고시기와 필요서류 해외

- Page 127 and 128:

신고 처리 및 후속 조치 신

- Page 129 and 130:

4. 계약 조항 중 주의할 부

- Page 131 and 132:

분쟁해결 조항 국제 중재

- Page 133 and 134:

진술과 보장 조항 영미법

- Page 135 and 136:

PMI 준비시 고려할 사항 장

- Page 137 and 138:

Partner Profile 김경연 변호사

- Page 139 and 140:

September 26, 2012 | Seoul 해외 M

- Page 141 and 142:

Investing in France: Selected Legal

- Page 143 and 144:

South Korean Investments in France

- Page 145 and 146:

1. Providing Equity Without Taking

- Page 147 and 148:

1. Providing Equity Without Taking

- Page 149 and 150:

1. Providing Equity Without Taking

- Page 151 and 152:

1. Providing Equity Without Taking

- Page 153 and 154: 1. Providing Equity Without Taking

- Page 155 and 156: 2. Acquiring Control

- Page 157 and 158: 2.1 Regulated Business Sectors A.

- Page 159 and 160: 2.1 Regulated Business Sectors cont

- Page 161 and 162: 2.2 Merger Regulation (i) 프랑스

- Page 163 and 164: 2.3 Labor Law Issues 프랑스 기

- Page 165 and 166: 2.3 Labor Law Issues continued IRPs

- Page 167 and 168: 2.4 Public Companies a) Access to I

- Page 169 and 170: 2.4 Public Companies a) Access to i

- Page 171 and 172: 2.4 Public Companies b) Disclosure

- Page 173 and 174: 2.4 Public Companies c) Mandatory T

- Page 175 and 176: 2.4 Public Companies continued d) K

- Page 177 and 178: 2.4 Public Companies d) Key Rules o

- Page 179 and 180: Appendix A - S&C Paris Office CHAMB

- Page 181 and 182: Appendix B ‒ Biography of Dominiq

- Page 183 and 184: Investing in Germany: Recent Trends

- Page 185 and 186: Amount of Transactions Transaction

- Page 187 and 188: Recent Market and Legal Trends - Ge

- Page 189 and 190: Recent Market and Legal Trends - Ge

- Page 191 and 192: Recent Market and Legal Trends - In

- Page 193 and 194: Recent Market and Legal Trends - Ge

- Page 195 and 196: 2.1Private M&A

- Page 197 and 198: Selected Topics - Selected Topics i

- Page 199 and 200: Selected Topics - Selected Topics i

- Page 201 and 202: Recent Market and Legal Trends - Ge

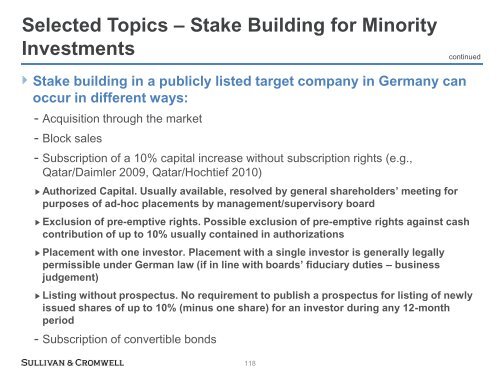

- Page 203: Selected Topics - Stake Building fo

- Page 207 and 208: Selected Topics - Stake Building Sh

- Page 209 and 210: Selected Topics - Specific Features

- Page 211 and 212: Selected Topics - Specific Features

- Page 213 and 214: Selected Topics - Specific Features

- Page 215 and 216: Selected Topics - Follow-on integra

- Page 217 and 218: 2.3 Joint Aspects

- Page 219 and 220: Joint Aspects - Regulatory Restrict

- Page 221 and 222: Joint Aspects - Regulatory Restrict

- Page 223 and 224: Joint Aspects - Corporate Restricti

- Page 225 and 226: Joint Aspects - Labour Law/Due Dili

- Page 227 and 228: Joint Aspects - Antitrust - Practic

- Page 229 and 230: Outlook (1/2) Macroeconomic Situati

- Page 231 and 232: Appendices Appendix A - S&C Frankfu

- Page 233 and 234: Appendix B - Biography of Carsten B

- Page 235 and 236: Appendix B - Biography of Carsten B