í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

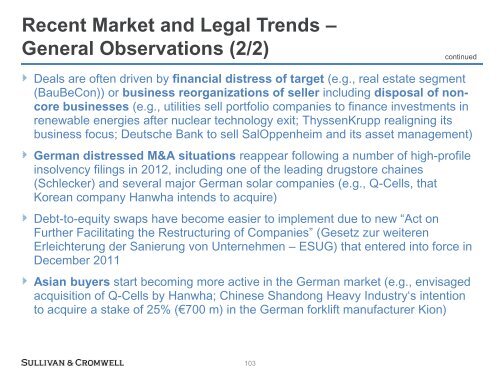

Recent Market and Legal Trends –<br />

General Observations (2/2)<br />

continued<br />

Deals are often driven by financial distress of target (e.g., real estate segment<br />

(BauBeCon)) or business reorganizations of seller including disposal of noncore<br />

businesses (e.g., utilities sell portfolio companies to finance investments in<br />

renewable energies after nuclear technology exit; ThyssenKrupp realigning its<br />

business focus; Deutsche Bank to sell SalOppenheim and its asset management)<br />

German distressed M&A situations reappear following a number of high-profile<br />

insolvency filings in 2012, including one of the leading drugstore chaines<br />

(Schlecker) and several major German solar companies (e.g., Q-Cells, that<br />

Korean company Hanwha intends to acquire)<br />

Debt-to-equity swaps have become easier to implement due to new ―Act on<br />

Further Facilitating the Restructuring of Companies‖ (Gesetz zur weiteren<br />

Erleichterung der Sanierung von Unternehmen – ESUG) that entered into force in<br />

December 2011<br />

Asian buyers start becoming more active in the German market (e.g., envisaged<br />

acquisition of Q-Cells by Hanwha; Chinese Shandong Heavy Industry‗s intention<br />

to acquire a stake of 25% (€700 m) in the German forklift manufacturer Kion)<br />

103