í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

í´ì¸ M&Aì ë²ì ìì - Sullivan & Cromwell

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

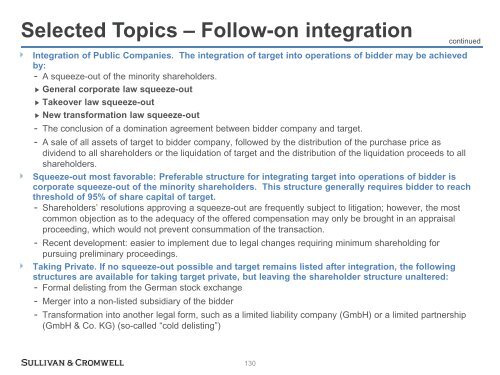

Selected Topics – Follow-on integration<br />

continued<br />

Integration of Public Companies. The integration of target into operations of bidder may be achieved<br />

by:<br />

- A squeeze-out of the minority shareholders.<br />

▶ General corporate law squeeze-out<br />

▶ Takeover law squeeze-out<br />

▶ New transformation law squeeze-out<br />

- The conclusion of a domination agreement between bidder company and target.<br />

- A sale of all assets of target to bidder company, followed by the distribution of the purchase price as<br />

dividend to all shareholders or the liquidation of target and the distribution of the liquidation proceeds to all<br />

shareholders.<br />

Squeeze-out most favorable: Preferable structure for integrating target into operations of bidder is<br />

corporate squeeze-out of the minority shareholders. This structure generally requires bidder to reach<br />

threshold of 95% of share capital of target.<br />

- Shareholders‘ resolutions approving a squeeze-out are frequently subject to litigation; however, the most<br />

common objection as to the adequacy of the offered compensation may only be brought in an appraisal<br />

proceeding, which would not prevent consummation of the transaction.<br />

- Recent development: easier to implement due to legal changes requiring minimum shareholding for<br />

pursuing preliminary proceedings.<br />

Taking Private. If no squeeze-out possible and target remains listed after integration, the following<br />

structures are available for taking target private, but leaving the shareholder structure unaltered:<br />

- Formal delisting from the German stock exchange<br />

- Merger into a non-listed subsidiary of the bidder<br />

- Transformation into another legal form, such as a limited liability company (GmbH) or a limited partnership<br />

(GmbH & Co. KG) (so-called ―cold delisting‖)<br />

130