Income-Generating Activities - Action Against Hunger

Income-Generating Activities - Action Against Hunger

Income-Generating Activities - Action Against Hunger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Field handbook • Scientific and Technical Department<br />

According to the survey, meat is not an impulsive purchase meat product. Among<br />

the questions asked the common reply was the following one: “I always decide before<br />

coming to store”, in 99% of cases, and only 1% of interviewees take a decision in the<br />

store.<br />

The frequency of meat purchase is important in analysis, to find out the demand.<br />

Most people buy meat quite frequently, 14% of them –everyday, 55% - once or twice in<br />

a week. Only 1% buys rarely – once or twice in a year.<br />

Consumer preference structure analysis included (a) preference among domestically<br />

produced and imported meat and (b) purchasing place. The domestically produced,<br />

local meat has the prevalent share of preferences comprising about 73% of<br />

responses. This is explained by customers’ preference for buying fresh meat.<br />

According to the meat consumers, freshness and price are the most important factors<br />

conditioning the purchasing decision.<br />

The meat is purchased according to priority in: market, nearby store, specialized<br />

store, and supermarket. This is again explained by the customer preference for buying<br />

fresh meat.<br />

Concerning sausage type, the highest percentage had: “no preference/doesn’t matter”<br />

(57%) and “I buy beef” (30%), while in the direct question about buying lamb/mutton<br />

sausage, 47% of interviewees think that they will not buy lamb/mutton sausage. 29%<br />

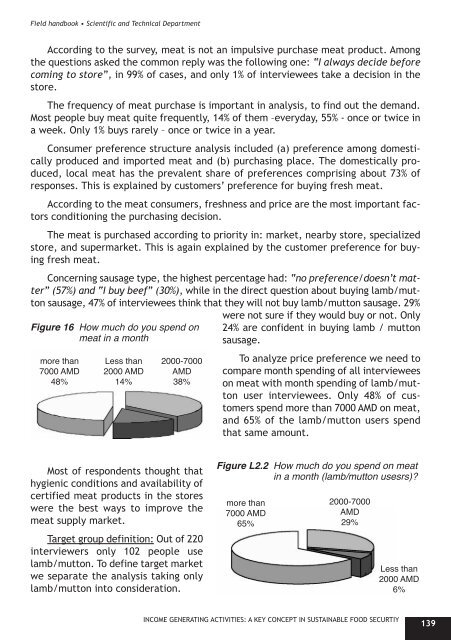

Figure 16 How much do you spend on<br />

meat in a month<br />

more than<br />

7000 AMD<br />

48%<br />

Less than<br />

2000 AMD<br />

14%<br />

2000-7000<br />

AMD<br />

38%<br />

were not sure if they would buy or not. Only<br />

24% are confident in buying lamb / mutton<br />

sausage.<br />

To analyze price preference we need to<br />

compare month spending of all interviewees<br />

on meat with month spending of lamb/mutton<br />

user interviewees. Only 48% of customers<br />

spend more than 7000 AMD on meat,<br />

and 65% of the lamb/mutton users spend<br />

that same amount.<br />

Most of respondents thought that<br />

hygienic conditions and availability of<br />

certified meat products in the stores<br />

were the best ways to improve the<br />

meat supply market.<br />

Target group definition: Out of 220<br />

interviewers only 102 people use<br />

lamb/mutton. To define target market<br />

we separate the analysis taking only<br />

lamb/mutton into consideration.<br />

Figure L2.2 How much do you spend on meat<br />

in a month (lamb/mutton usesrs)<br />

more than<br />

7000 AMD<br />

65%<br />

2000-7000<br />

AMD<br />

29%<br />

Less than<br />

2000 AMD<br />

6%<br />

INCOME GENERATING ACTIVITIES: A KEY CONCEPT IN SUSTAINABLE FOOD SECURTIY<br />

139