Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

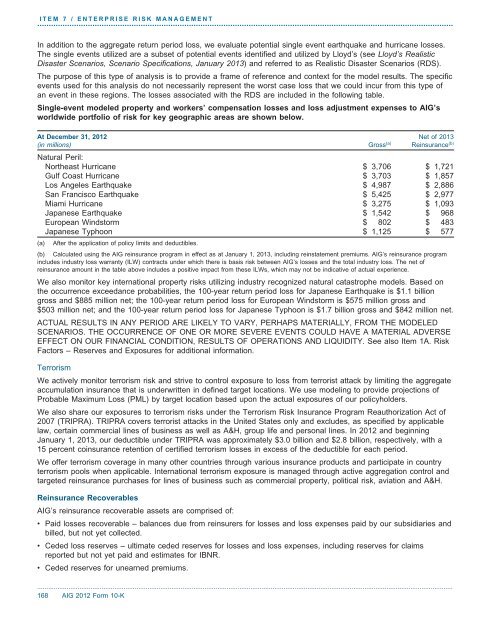

ITEM 7 / ENTERPRISE RISK MANAGEMENT.....................................................................................................................................................................................In additi<strong>on</strong> to the aggregate return period loss, we evaluate potential single event earthquake and hurricane losses.The single events utilized are a subset of potential events identified and utilized by Lloyd’s (see Lloyd’s RealisticDisaster Scenarios, Scenario Specificati<strong>on</strong>s, January 2013) and referred to as Realistic Disaster Scenarios (RDS).The purpose of this type of analysis is to provide a frame of reference and c<strong>on</strong>text for the model results. The specificevents used for this analysis do not necessarily represent the worst case loss that we could incur from this type ofan event in these regi<strong>on</strong>s. The losses associated with the RDS are included in the following table.Single-event modeled property and workers’ <strong>com</strong>pensati<strong>on</strong> losses and loss adjustment expenses to <strong>AIG</strong>’sworldwide portfolio of risk for key geographic areas are shown below.At December 31, 2012 Net of 2013(in milli<strong>on</strong>s) Gross (a) Reinsurance (b)Natural Peril:Northeast Hurricane $ 3,706 $ 1,721Gulf Coast Hurricane $ 3,703 $ 1,857Los Angeles Earthquake $ 4,987 $ 2,886San Francisco Earthquake $ 5,425 $ 2,977Miami Hurricane $ 3,275 $ 1,093Japanese Earthquake $ 1,542 $ 968European Windstorm $ 802 $ 483Japanese Typho<strong>on</strong> $ 1,125 $ 577(a) After the applicati<strong>on</strong> of policy limits and deductibles.(b) Calculated using the <strong>AIG</strong> reinsurance program in effect as at January 1, 2013, including reinstatement premiums. <strong>AIG</strong>’s reinsurance programincludes industry loss warranty (ILW) c<strong>on</strong>tracts under which there is basis risk between <strong>AIG</strong>’s losses and the total industry loss. The net ofreinsurance amount in the table above includes a positive impact from these ILWs, which may not be indicative of actual experience.We also m<strong>on</strong>itor key internati<strong>on</strong>al property risks utilizing industry recognized natural catastrophe models. Based <strong>on</strong>the occurrence exceedance probabilities, the 100-year return period loss for Japanese Earthquake is $1.1 billi<strong>on</strong>gross and $885 milli<strong>on</strong> net; the 100-year return period loss for European Windstorm is $575 milli<strong>on</strong> gross and$503 milli<strong>on</strong> net; and the 100-year return period loss for Japanese Typho<strong>on</strong> is $1.7 billi<strong>on</strong> gross and $842 milli<strong>on</strong> net.ACTUAL RESULTS IN ANY PERIOD ARE LIKELY TO VARY, PERHAPS MATERIALLY, FROM THE MODELEDSCENARIOS. THE OCCURRENCE OF ONE OR MORE SEVERE EVENTS COULD HAVE A MATERIAL ADVERSEEFFECT ON OUR FINANCIAL CONDITION, RESULTS OF OPERATIONS AND LIQUIDITY. See also Item 1A. RiskFactors – Reserves and Exposures for additi<strong>on</strong>al informati<strong>on</strong>.TerrorismWe actively m<strong>on</strong>itor terrorism risk and strive to c<strong>on</strong>trol exposure to loss from terrorist attack by limiting the aggregateaccumulati<strong>on</strong> insurance that is underwritten in defined target locati<strong>on</strong>s. We use modeling to provide projecti<strong>on</strong>s ofProbable Maximum Loss (PML) by target locati<strong>on</strong> based up<strong>on</strong> the actual exposures of our policyholders.We also share our exposures to terrorism risks under the Terrorism Risk Insurance Program Reauthorizati<strong>on</strong> Act of2007 (TRIPRA). TRIPRA covers terrorist attacks in the United States <strong>on</strong>ly and excludes, as specified by applicablelaw, certain <strong>com</strong>mercial lines of business as well as A&H, group life and pers<strong>on</strong>al lines. In 2012 and beginningJanuary 1, 2013, our deductible under TRIPRA was approximately $3.0 billi<strong>on</strong> and $2.8 billi<strong>on</strong>, respectively, with a15 percent coinsurance retenti<strong>on</strong> of certified terrorism losses in excess of the deductible for each period.We offer terrorism coverage in many other countries through various insurance products and participate in countryterrorism pools when applicable. Internati<strong>on</strong>al terrorism exposure is managed through active aggregati<strong>on</strong> c<strong>on</strong>trol andtargeted reinsurance purchases for lines of business such as <strong>com</strong>mercial property, political risk, aviati<strong>on</strong> and A&H.Reinsurance Recoverables<strong>AIG</strong>’s reinsurance recoverable assets are <strong>com</strong>prised of:• Paid losses recoverable – balances due from reinsurers for losses and loss expenses paid by our subsidiaries andbilled, but not yet collected.• Ceded loss reserves – ultimate ceded reserves for losses and loss expenses, including reserves for claimsreported but not yet paid and estimates for IBNR.• Ceded reserves for unearned premiums...................................................................................................................................................................................................................................168 <strong>AIG</strong> 2012 Form 10-K