Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

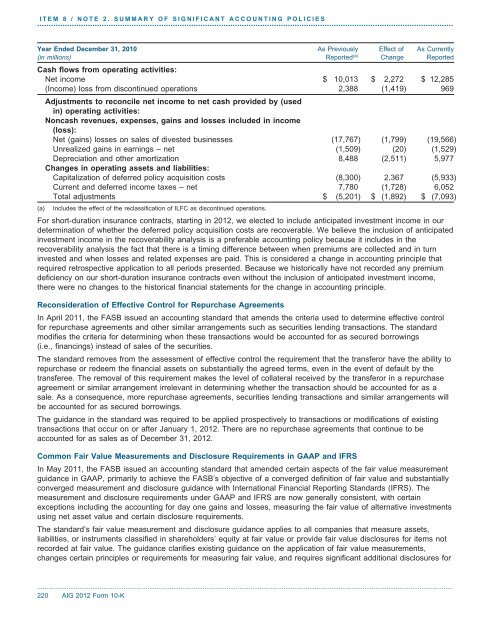

ITEM 8 / NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES.....................................................................................................................................................................................Year Ended December 31, 2010 As Previously Effect of As Currently(in milli<strong>on</strong>s) Reported (a) Change ReportedCash flows from operating activities:Net in<strong>com</strong>e $ 10,013 $ 2,272 $ 12,285(In<strong>com</strong>e) loss from disc<strong>on</strong>tinued operati<strong>on</strong>s 2,388 (1,419) 969Adjustments to rec<strong>on</strong>cile net in<strong>com</strong>e to net cash provided by (usedin) operating activities:N<strong>on</strong>cash revenues, expenses, gains and losses included in in<strong>com</strong>e(loss):Net (gains) losses <strong>on</strong> sales of divested businesses (17,767) (1,799) (19,566)Unrealized gains in earnings – net (1,509) (20) (1,529)Depreciati<strong>on</strong> and other amortizati<strong>on</strong> 8,488 (2,511) 5,977Changes in operating assets and liabilities:Capitalizati<strong>on</strong> of deferred policy acquisiti<strong>on</strong> costs (8,300) 2,367 (5,933)Current and deferred in<strong>com</strong>e taxes – net 7,780 (1,728) 6,052Total adjustments $ (5,201) $ (1,892) $ (7,093)(a) Includes the effect of the reclassificati<strong>on</strong> of ILFC as disc<strong>on</strong>tinued operati<strong>on</strong>s.For short-durati<strong>on</strong> insurance c<strong>on</strong>tracts, starting in 2012, we elected to include anticipated investment in<strong>com</strong>e in ourdeterminati<strong>on</strong> of whether the deferred policy acquisiti<strong>on</strong> costs are recoverable. We believe the inclusi<strong>on</strong> of anticipatedinvestment in<strong>com</strong>e in the recoverability analysis is a preferable accounting policy because it includes in therecoverability analysis the fact that there is a timing difference between when premiums are collected and in turninvested and when losses and related expenses are paid. This is c<strong>on</strong>sidered a change in accounting principle thatrequired retrospective applicati<strong>on</strong> to all periods presented. Because we historically have not recorded any premiumdeficiency <strong>on</strong> our short-durati<strong>on</strong> insurance c<strong>on</strong>tracts even without the inclusi<strong>on</strong> of anticipated investment in<strong>com</strong>e,there were no changes to the historical financial statements for the change in accounting principle.Rec<strong>on</strong>siderati<strong>on</strong> of Effective C<strong>on</strong>trol for Repurchase AgreementsIn April 2011, the FASB issued an accounting standard that amends the criteria used to determine effective c<strong>on</strong>trolfor repurchase agreements and other similar arrangements such as securities lending transacti<strong>on</strong>s. The standardmodifies the criteria for determining when these transacti<strong>on</strong>s would be accounted for as secured borrowings(i.e., financings) instead of sales of the securities.The standard removes from the assessment of effective c<strong>on</strong>trol the requirement that the transferor have the ability torepurchase or redeem the financial assets <strong>on</strong> substantially the agreed terms, even in the event of default by thetransferee. The removal of this requirement makes the level of collateral received by the transferor in a repurchaseagreement or similar arrangement irrelevant in determining whether the transacti<strong>on</strong> should be accounted for as asale. As a c<strong>on</strong>sequence, more repurchase agreements, securities lending transacti<strong>on</strong>s and similar arrangements willbe accounted for as secured borrowings.The guidance in the standard was required to be applied prospectively to transacti<strong>on</strong>s or modificati<strong>on</strong>s of existingtransacti<strong>on</strong>s that occur <strong>on</strong> or after January 1, 2012. There are no repurchase agreements that c<strong>on</strong>tinue to beaccounted for as sales as of December 31, 2012.Comm<strong>on</strong> Fair Value Measurements and Disclosure Requirements in GAAP and IFRSIn May 2011, the FASB issued an accounting standard that amended certain aspects of the fair value measurementguidance in GAAP, primarily to achieve the FASB’s objective of a c<strong>on</strong>verged definiti<strong>on</strong> of fair value and substantiallyc<strong>on</strong>verged measurement and disclosure guidance with Internati<strong>on</strong>al Financial Reporting Standards (IFRS). Themeasurement and disclosure requirements under GAAP and IFRS are now generally c<strong>on</strong>sistent, with certainexcepti<strong>on</strong>s including the accounting for day <strong>on</strong>e gains and losses, measuring the fair value of alternative investmentsusing net asset value and certain disclosure requirements.The standard’s fair value measurement and disclosure guidance applies to all <strong>com</strong>panies that measure assets,liabilities, or instruments classified in shareholders’ equity at fair value or provide fair value disclosures for items notrecorded at fair value. The guidance clarifies existing guidance <strong>on</strong> the applicati<strong>on</strong> of fair value measurements,changes certain principles or requirements for measuring fair value, and requires significant additi<strong>on</strong>al disclosures for..................................................................................................................................................................................................................................220 <strong>AIG</strong> 2012 Form 10-K