Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

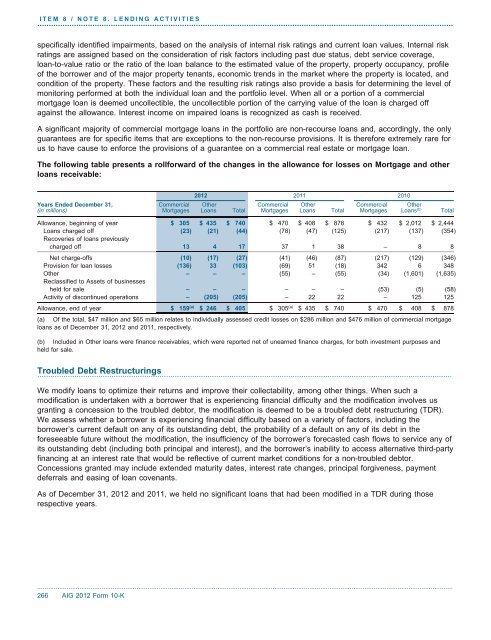

ITEM 8 / NOTE 8. LENDING ACTIVITIES.....................................................................................................................................................................................specifically identified impairments, based <strong>on</strong> the analysis of internal risk ratings and current loan values. Internal riskratings are assigned based <strong>on</strong> the c<strong>on</strong>siderati<strong>on</strong> of risk factors including past due status, debt service coverage,loan-to-value ratio or the ratio of the loan balance to the estimated value of the property, property occupancy, profileof the borrower and of the major property tenants, ec<strong>on</strong>omic trends in the market where the property is located, andc<strong>on</strong>diti<strong>on</strong> of the property. These factors and the resulting risk ratings also provide a basis for determining the level ofm<strong>on</strong>itoring performed at both the individual loan and the portfolio level. When all or a porti<strong>on</strong> of a <strong>com</strong>mercialmortgage loan is deemed uncollectible, the uncollectible porti<strong>on</strong> of the carrying value of the loan is charged offagainst the allowance. Interest in<strong>com</strong>e <strong>on</strong> impaired loans is recognized as cash is received.A significant majority of <strong>com</strong>mercial mortgage loans in the portfolio are n<strong>on</strong>-recourse loans and, accordingly, the <strong>on</strong>lyguarantees are for specific items that are excepti<strong>on</strong>s to the n<strong>on</strong>-recourse provisi<strong>on</strong>s. It is therefore extremely rare forus to have cause to enforce the provisi<strong>on</strong>s of a guarantee <strong>on</strong> a <strong>com</strong>mercial real estate or mortgage loan.The following table presents a rollforward of the changes in the allowance for losses <strong>on</strong> Mortgage and otherloans receivable:2012 2011 2010Years Ended December 31, Commercial Other Commercial Other Commercial Other(in milli<strong>on</strong>s) Mortgages Loans Total Mortgages Loans Total Mortgages Loans (b) TotalAllowance, beginning of year $ 305 $ 435 $ 740 $ 470 $ 408 $ 878 $ 432 $ 2,012 $ 2,444Loans charged off (23) (21) (44)(78) (47) (125) (217) (137) (354)Recoveries of loans previouslycharged off 13 4 1737 1 38 – 8 8Net charge-offs (10) (17) (27)(41) (46) (87) (217) (129) (346)Provisi<strong>on</strong> for loan losses (136) 33 (103)(69) 51 (18) 342 6 348Other – – –(55) – (55) (34) (1,601) (1,635)Reclassified to Assets of businessesheld for sale – – –– – – (53) (5) (58)Activity of disc<strong>on</strong>tinued operati<strong>on</strong>s – (205) (205)– 22 22 – 125 125Allowance, end of year $(a)159 $ 246 $ 405 $ 305 (a) $ 435 $ 740 $ 470 $ 408 $ 878(a) Of the total, $47 milli<strong>on</strong> and $65 milli<strong>on</strong> relates to individually assessed credit losses <strong>on</strong> $286 milli<strong>on</strong> and $476 milli<strong>on</strong> of <strong>com</strong>mercial mortgageloans as of December 31, 2012 and 2011, respectively.(b) Included in Other loans were finance receivables, which were reported net of unearned finance charges, for both investment purposes andheld for sale.Troubled Debt Restructurings..............................................................................................................................................................................................We modify loans to optimize their returns and improve their collectability, am<strong>on</strong>g other things. When such amodificati<strong>on</strong> is undertaken with a borrower that is experiencing financial difficulty and the modificati<strong>on</strong> involves usgranting a c<strong>on</strong>cessi<strong>on</strong> to the troubled debtor, the modificati<strong>on</strong> is deemed to be a troubled debt restructuring (TDR).We assess whether a borrower is experiencing financial difficulty based <strong>on</strong> a variety of factors, including theborrower’s current default <strong>on</strong> any of its outstanding debt, the probability of a default <strong>on</strong> any of its debt in theforeseeable future without the modificati<strong>on</strong>, the insufficiency of the borrower’s forecasted cash flows to service any ofits outstanding debt (including both principal and interest), and the borrower’s inability to access alternative third-partyfinancing at an interest rate that would be reflective of current market c<strong>on</strong>diti<strong>on</strong>s for a n<strong>on</strong>-troubled debtor.C<strong>on</strong>cessi<strong>on</strong>s granted may include extended maturity dates, interest rate changes, principal forgiveness, paymentdeferrals and easing of loan covenants.As of December 31, 2012 and 2011, we held no significant loans that had been modified in a TDR during thoserespective years...................................................................................................................................................................................................................................266 <strong>AIG</strong> 2012 Form 10-K