Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

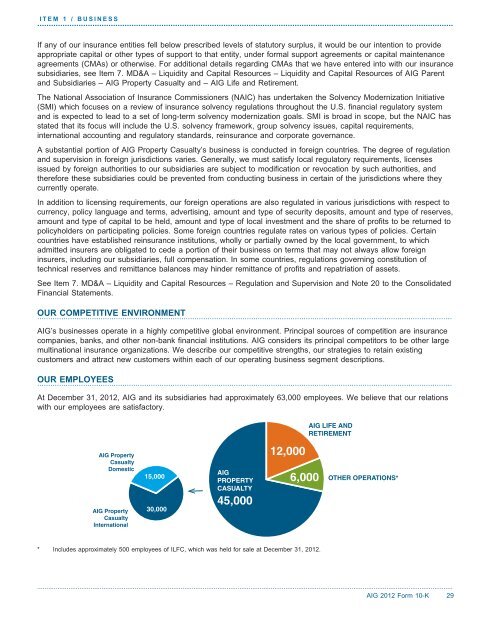

ITEM 1 / BUSINESS.....................................................................................................................................................................................If any of our insurance entities fell below prescribed levels of statutory surplus, it would be our intenti<strong>on</strong> to provideappropriate capital or other types of support to that entity, under formal support agreements or capital maintenanceagreements (CMAs) or otherwise. For additi<strong>on</strong>al details regarding CMAs that we have entered into with our insurancesubsidiaries, see Item 7. MD&A – Liquidity and Capital Resources – Liquidity and Capital Resources of <strong>AIG</strong> Parentand Subsidiaries – <strong>AIG</strong> Property Casualty and – <strong>AIG</strong> Life and Retirement.The Nati<strong>on</strong>al Associati<strong>on</strong> of Insurance Commissi<strong>on</strong>ers (NAIC) has undertaken the Solvency Modernizati<strong>on</strong> Initiative(SMI) which focuses <strong>on</strong> a review of insurance solvency regulati<strong>on</strong>s throughout the U.S. financial regulatory systemand is expected to lead to a set of l<strong>on</strong>g-term solvency modernizati<strong>on</strong> goals. SMI is broad in scope, but the NAIC hasstated that its focus will include the U.S. solvency framework, group solvency issues, capital requirements,internati<strong>on</strong>al accounting and regulatory standards, reinsurance and corporate governance.A substantial porti<strong>on</strong> of <strong>AIG</strong> Property Casualty’s business is c<strong>on</strong>ducted in foreign countries. The degree of regulati<strong>on</strong>and supervisi<strong>on</strong> in foreign jurisdicti<strong>on</strong>s varies. Generally, we must satisfy local regulatory requirements, licensesissued by foreign authorities to our subsidiaries are subject to modificati<strong>on</strong> or revocati<strong>on</strong> by such authorities, andtherefore these subsidiaries could be prevented from c<strong>on</strong>ducting business in certain of the jurisdicti<strong>on</strong>s where theycurrently operate.In additi<strong>on</strong> to licensing requirements, our foreign operati<strong>on</strong>s are also regulated in various jurisdicti<strong>on</strong>s with respect tocurrency, policy language and terms, advertising, amount and type of security deposits, amount and type of reserves,amount and type of capital to be held, amount and type of local investment and the share of profits to be returned topolicyholders <strong>on</strong> participating policies. Some foreign countries regulate rates <strong>on</strong> various types of policies. Certaincountries have established reinsurance instituti<strong>on</strong>s, wholly or partially owned by the local government, to whichadmitted insurers are obligated to cede a porti<strong>on</strong> of their business <strong>on</strong> terms that may not always allow foreigninsurers, including our subsidiaries, full <strong>com</strong>pensati<strong>on</strong>. In some countries, regulati<strong>on</strong>s governing c<strong>on</strong>stituti<strong>on</strong> oftechnical reserves and remittance balances may hinder remittance of profits and repatriati<strong>on</strong> of assets.See Item 7. MD&A – Liquidity and Capital Resources – Regulati<strong>on</strong> and Supervisi<strong>on</strong> and Note 20 to the C<strong>on</strong>solidatedFinancial Statements.OUR COMPETITIVE ENVIRONMENT..............................................................................................................................................................................................<strong>AIG</strong>’s businesses operate in a highly <strong>com</strong>petitive global envir<strong>on</strong>ment. Principal sources of <strong>com</strong>petiti<strong>on</strong> are insurance<strong>com</strong>panies, banks, and other n<strong>on</strong>-bank financial instituti<strong>on</strong>s. <strong>AIG</strong> c<strong>on</strong>siders its principal <strong>com</strong>petitors to be other largemultinati<strong>on</strong>al insurance organizati<strong>on</strong>s. We describe our <strong>com</strong>petitive strengths, our strategies to retain existingcustomers and attract new customers within each of our operating business segment descripti<strong>on</strong>s.OUR EMPLOYEES..............................................................................................................................................................................................At December 31, 2012, <strong>AIG</strong> and its subsidiaries had approximately 63,000 employees. We believe that our relati<strong>on</strong>swith our employees are satisfactory.<strong>AIG</strong> LIFE ANDRETIREMENT<strong>AIG</strong> PropertyCasualtyDomestic<strong>AIG</strong> PropertyCasualtyInternati<strong>on</strong>al15,00030,000<strong>AIG</strong>PROPERTYCASUALTY45,00012,0006,000* Includes approximately 500 employees of ILFC, which was held for sale at December 31, 2012.OTHER OPERATIONS*15FEB201315344305..................................................................................................................................................................................................................................<strong>AIG</strong> 2012 Form 10-K 29