Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

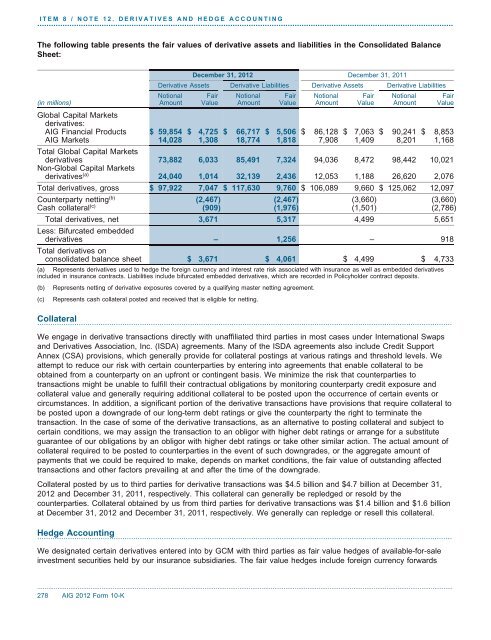

ITEM 8 / NOTE 12. DERIVATIVES AND HEDGE ACCOUNTING.....................................................................................................................................................................................The following table presents the fair values of derivative assets and liabilities in the C<strong>on</strong>solidated BalanceSheet:December 31, 2012 December 31, 2011Derivative Assets Derivative Liabilities Derivative Assets Derivative LiabilitiesNoti<strong>on</strong>al Fair Noti<strong>on</strong>al Fair Noti<strong>on</strong>al Fair Noti<strong>on</strong>al Fair(in milli<strong>on</strong>s) Amount Value Amount Value Amount Value Amount ValueGlobal Capital Marketsderivatives:<strong>AIG</strong> Financial Products $ 59,854 $ 4,725 $ 66,717 $ 5,506 $ 86,128 $ 7,063 $ 90,241 $ 8,853<strong>AIG</strong> Markets 14,028 1,308 18,774 1,818 7,908 1,409 8,201 1,168Total Global Capital Marketsderivatives 73,882 6,033 85,491 7,324 94,036 8,472 98,442 10,021N<strong>on</strong>-Global Capital Marketsderivatives (a) 24,040 1,014 32,139 2,436 12,053 1,188 26,620 2,076Total derivatives, gross $ 97,922 7,047 $ 117,630 9,760 $ 106,089 9,660 $ 125,062 12,097Counterparty netting (b) (2,467) (2,467)(3,660) (3,660)Cash collateral (c) (909) (1,976)(1,501) (2,786)Total derivatives, net 3,671 5,3174,499 5,651Less: Bifurcated embeddedderivatives – 1,256– 918Total derivatives <strong>on</strong>c<strong>on</strong>solidated balance sheet $ 3,671 $ 4,061$ 4,499 $ 4,733(a) Represents derivatives used to hedge the foreign currency and interest rate risk associated with insurance as well as embedded derivativesincluded in insurance c<strong>on</strong>tracts. Liabilities include bifurcated embedded derivatives, which are recorded in Policyholder c<strong>on</strong>tract deposits.(b) Represents netting of derivative exposures covered by a qualifying master netting agreement.(c) Represents cash collateral posted and received that is eligible for netting.Collateral..............................................................................................................................................................................................We engage in derivative transacti<strong>on</strong>s directly with unaffiliated third parties in most cases under Internati<strong>on</strong>al Swapsand Derivatives Associati<strong>on</strong>, Inc. (ISDA) agreements. Many of the ISDA agreements also include Credit SupportAnnex (CSA) provisi<strong>on</strong>s, which generally provide for collateral postings at various ratings and threshold levels. Weattempt to reduce our risk with certain counterparties by entering into agreements that enable collateral to beobtained from a counterparty <strong>on</strong> an upfr<strong>on</strong>t or c<strong>on</strong>tingent basis. We minimize the risk that counterparties totransacti<strong>on</strong>s might be unable to fulfill their c<strong>on</strong>tractual obligati<strong>on</strong>s by m<strong>on</strong>itoring counterparty credit exposure andcollateral value and generally requiring additi<strong>on</strong>al collateral to be posted up<strong>on</strong> the occurrence of certain events orcircumstances. In additi<strong>on</strong>, a significant porti<strong>on</strong> of the derivative transacti<strong>on</strong>s have provisi<strong>on</strong>s that require collateral tobe posted up<strong>on</strong> a downgrade of our l<strong>on</strong>g-term debt ratings or give the counterparty the right to terminate thetransacti<strong>on</strong>. In the case of some of the derivative transacti<strong>on</strong>s, as an alternative to posting collateral and subject tocertain c<strong>on</strong>diti<strong>on</strong>s, we may assign the transacti<strong>on</strong> to an obligor with higher debt ratings or arrange for a substituteguarantee of our obligati<strong>on</strong>s by an obligor with higher debt ratings or take other similar acti<strong>on</strong>. The actual amount ofcollateral required to be posted to counterparties in the event of such downgrades, or the aggregate amount ofpayments that we could be required to make, depends <strong>on</strong> market c<strong>on</strong>diti<strong>on</strong>s, the fair value of outstanding affectedtransacti<strong>on</strong>s and other factors prevailing at and after the time of the downgrade.Collateral posted by us to third parties for derivative transacti<strong>on</strong>s was $4.5 billi<strong>on</strong> and $4.7 billi<strong>on</strong> at December 31,2012 and December 31, 2011, respectively. This collateral can generally be repledged or resold by thecounterparties. Collateral obtained by us from third parties for derivative transacti<strong>on</strong>s was $1.4 billi<strong>on</strong> and $1.6 billi<strong>on</strong>at December 31, 2012 and December 31, 2011, respectively. We generally can repledge or resell this collateral.Hedge Accounting..............................................................................................................................................................................................We designated certain derivatives entered into by GCM with third parties as fair value hedges of available-for-saleinvestment securities held by our insurance subsidiaries. The fair value hedges include foreign currency forwards..................................................................................................................................................................................................................................278 <strong>AIG</strong> 2012 Form 10-K