Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

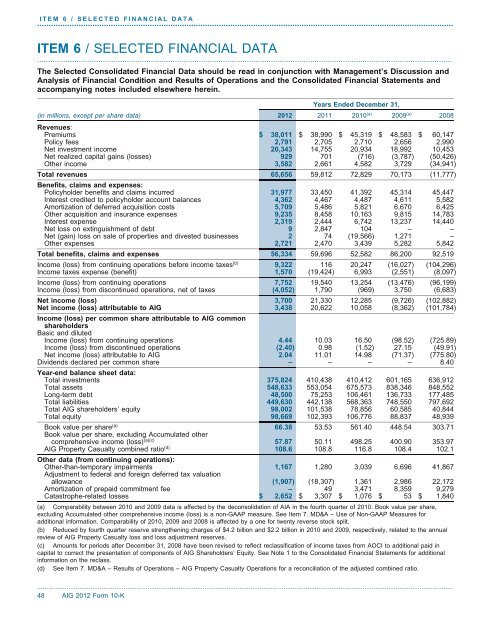

ITEM 6 / SELECTED FINANCIAL DATA.....................................................................................................................................................................................ITEM 6 / SELECTED FINANCIAL DATA..............................................................................................................................................................................................The Selected C<strong>on</strong>solidated Financial Data should be read in c<strong>on</strong>juncti<strong>on</strong> with Management’s Discussi<strong>on</strong> andAnalysis of Financial C<strong>on</strong>diti<strong>on</strong> and Results of Operati<strong>on</strong>s and the C<strong>on</strong>solidated Financial Statements andac<strong>com</strong>panying notes included elsewhere herein.Years Ended December 31,(in milli<strong>on</strong>s, except per share data) 2012 2011 2010 (a) 2009 (a) 2008Revenues:Premiums $ 38,011 $ 38,990 $ 45,319 $ 48,583 $ 60,147Policy fees 2,791 2,705 2,710 2,656 2,990Net investment in<strong>com</strong>e 20,343 14,755 20,934 18,992 10,453Net realized capital gains (losses) 929 701 (716) (3,787) (50,426)Other in<strong>com</strong>e 3,582 2,661 4,582 3,729 (34,941)Total revenues 65,656 59,812 72,829 70,173 (11,777)Benefits, claims and expenses:Policyholder benefits and claims incurred 31,977 33,450 41,392 45,314 45,447Interest credited to policyholder account balances 4,362 4,467 4,487 4,611 5,582Amortizati<strong>on</strong> of deferred acquisiti<strong>on</strong> costs 5,709 5,486 5,821 6,670 6,425Other acquisiti<strong>on</strong> and insurance expenses 9,235 8,458 10,163 9,815 14,783Interest expense 2,319 2,444 6,742 13,237 14,440Net loss <strong>on</strong> extinguishment of debt 9 2,847 104 – –Net (gain) loss <strong>on</strong> sale of properties and divested businesses 2 74 (19,566) 1,271 –Other expenses 2,721 2,470 3,439 5,282 5,842Total benefits, claims and expenses 56,334 59,696 52,582 86,200 92,519In<strong>com</strong>e (loss) from c<strong>on</strong>tinuing operati<strong>on</strong>s before in<strong>com</strong>e taxes (b) 9,322 116 20,247 (16,027) (104,296)In<strong>com</strong>e taxes expense (benefit) 1,570 (19,424) 6,993 (2,551) (8,097)In<strong>com</strong>e (loss) from c<strong>on</strong>tinuing operati<strong>on</strong>s 7,752 19,540 13,254 (13,476) (96,199)In<strong>com</strong>e (loss) from disc<strong>on</strong>tinued operati<strong>on</strong>s, net of taxes (4,052) 1,790 (969) 3,750 (6,683)Net in<strong>com</strong>e (loss) 3,700 21,330 12,285 (9,726) (102,882)Net in<strong>com</strong>e (loss) attributable to <strong>AIG</strong> 3,438 20,622 10,058 (8,362) (101,784)In<strong>com</strong>e (loss) per <strong>com</strong>m<strong>on</strong> share attributable to <strong>AIG</strong> <strong>com</strong>m<strong>on</strong>shareholdersBasic and dilutedIn<strong>com</strong>e (loss) from c<strong>on</strong>tinuing operati<strong>on</strong>s 4.44 10.03 16.50 (98.52) (725.89)In<strong>com</strong>e (loss) from disc<strong>on</strong>tinued operati<strong>on</strong>s (2.40) 0.98 (1.52) 27.15 (49.91)Net in<strong>com</strong>e (loss) attributable to <strong>AIG</strong> 2.04 11.01 14.98 (71.37) (775.80)Dividends declared per <strong>com</strong>m<strong>on</strong> share –– – – 8.40Year-end balance sheet data:Total investments 375,824 410,438 410,412 601,165 636,912Total assets 548,633 553,054 675,573 838,346 848,552L<strong>on</strong>g-term debt 48,500 75,253 106,461 136,733 177,485Total liabilities 449,630 442,138 568,363 748,550 797,692Total <strong>AIG</strong> shareholders’ equity 98,002 101,538 78,856 60,585 40,844Total equity 98,669 102,393 106,776 88,837 48,939Book value per share (a) 66.38 53.53 561.40 448.54 303.71Book value per share, excluding Accumulated other<strong>com</strong>prehensive in<strong>com</strong>e (loss) (a)(c) 57.87 50.11 498.25 400.90 353.97<strong>AIG</strong> Property Casualty <strong>com</strong>bined ratio (d) 108.6 108.8 116.8 108.4 102.1Other data (from c<strong>on</strong>tinuing operati<strong>on</strong>s):Other-than-temporary impairments 1,167 1,280 3,039 6,696 41,867Adjustment to federal and foreign deferred tax valuati<strong>on</strong>allowance (1,907) (18,307) 1,361 2,986 22,172Amortizati<strong>on</strong> of prepaid <strong>com</strong>mitment fee – 49 3,471 8,359 9,279Catastrophe-related losses $ 2,652 $ 3,307 $ 1,076 $ 53 $ 1,840(a) Comparability between 2010 and 2009 data is affected by the dec<strong>on</strong>solidati<strong>on</strong> of AIA in the fourth quarter of 2010. Book value per share,excluding Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e (loss) is a n<strong>on</strong>-GAAP measure. See Item 7. MD&A – Use of N<strong>on</strong>-GAAP Measures foradditi<strong>on</strong>al informati<strong>on</strong>. Comparability of 2010, 2009 and 2008 is affected by a <strong>on</strong>e for twenty reverse stock split.(b) Reduced by fourth quarter reserve strengthening charges of $4.2 billi<strong>on</strong> and $2.2 billi<strong>on</strong> in 2010 and 2009, respectively, related to the annualreview of <strong>AIG</strong> Property Casualty loss and loss adjustment reserves.(c) Amounts for periods after December 31, 2008 have been revised to reflect reclassificati<strong>on</strong> of in<strong>com</strong>e taxes from AOCI to additi<strong>on</strong>al paid incapital to correct the presentati<strong>on</strong> of <strong>com</strong>p<strong>on</strong>ents of <strong>AIG</strong> Shareholders’ Equity. See Note 1 to the C<strong>on</strong>solidated Financial Statements for additi<strong>on</strong>alinformati<strong>on</strong> <strong>on</strong> the reclass.(d) See Item 7. MD&A – Results of Operati<strong>on</strong>s – <strong>AIG</strong> Property Casualty Operati<strong>on</strong>s for a rec<strong>on</strong>ciliati<strong>on</strong> of the adjusted <strong>com</strong>bined ratio...................................................................................................................................................................................................................................48 <strong>AIG</strong> 2012 Form 10-K