Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

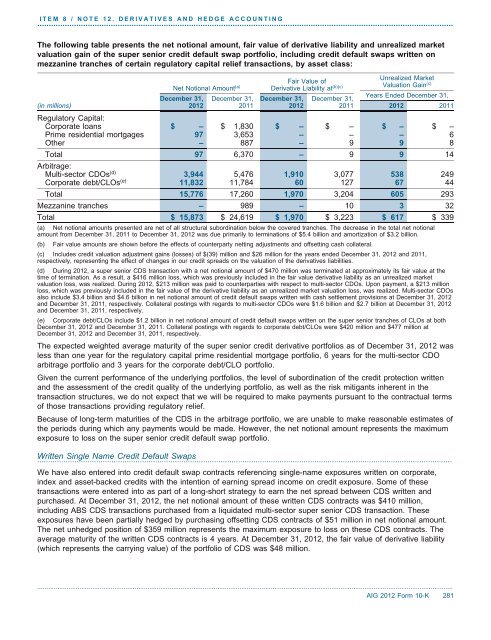

ITEM 8 / NOTE 12. DERIVATIVES AND HEDGE ACCOUNTING.....................................................................................................................................................................................The following table presents the net noti<strong>on</strong>al amount, fair value of derivative liability and unrealized marketvaluati<strong>on</strong> gain of the super senior credit default swap portfolio, including credit default swaps written <strong>on</strong>mezzanine tranches of certain regulatory capital relief transacti<strong>on</strong>s, by asset class:Fair Value ofUnrealized MarketValuati<strong>on</strong> GainNet Noti<strong>on</strong>al Amount (a) Derivative Liability at (b)(c) (c)December 31, December 31, December 31, December 31,Years Ended December 31,(in milli<strong>on</strong>s) 2012 2011 2012 2011 2012 2011Regulatory Capital:Corporate loans $ – $ 1,830 $ – $ – $ – $ –Prime residential mortgages 97 3,653 – – –6Other – 887 – 9 98Total 97 6,370 – 9 914Arbitrage:Multi-sector CDOs (d) 3,944 5,476 1,910 3,077 538 249Corporate debt/CLOs (e) 11,832 11,784 60 127 6744Total 15,776 17,260 1,970 3,204 605 293Mezzanine tranches – 989 – 10 332Total $ 15,873 $ 24,619 $ 1,970 $ 3,223 $ 617 $ 339(a) Net noti<strong>on</strong>al amounts presented are net of all structural subordinati<strong>on</strong> below the covered tranches. The decrease in the total net noti<strong>on</strong>alamount from December 31, 2011 to December 31, 2012 was due primarily to terminati<strong>on</strong>s of $5.4 billi<strong>on</strong> and amortizati<strong>on</strong> of $3.2 billi<strong>on</strong>.(b) Fair value amounts are shown before the effects of counterparty netting adjustments and offsetting cash collateral.(c) Includes credit valuati<strong>on</strong> adjustment gains (losses) of $(39) milli<strong>on</strong> and $26 milli<strong>on</strong> for the years ended December 31, 2012 and 2011,respectively, representing the effect of changes in our credit spreads <strong>on</strong> the valuati<strong>on</strong> of the derivatives liabilities.(d) During 2012, a super senior CDS transacti<strong>on</strong> with a net noti<strong>on</strong>al amount of $470 milli<strong>on</strong> was terminated at approximately its fair value at thetime of terminati<strong>on</strong>. As a result, a $416 milli<strong>on</strong> loss, which was previously included in the fair value derivative liability as an unrealized marketvaluati<strong>on</strong> loss, was realized. During 2012, $213 milli<strong>on</strong> was paid to counterparties with respect to multi-sector CDOs. Up<strong>on</strong> payment, a $213 milli<strong>on</strong>loss, which was previously included in the fair value of the derivative liability as an unrealized market valuati<strong>on</strong> loss, was realized. Multi-sector CDOsalso include $3.4 billi<strong>on</strong> and $4.6 billi<strong>on</strong> in net noti<strong>on</strong>al amount of credit default swaps written with cash settlement provisi<strong>on</strong>s at December 31, 2012and December 31, 2011, respectively. Collateral postings with regards to multi-sector CDOs were $1.6 billi<strong>on</strong> and $2.7 billi<strong>on</strong> at December 31, 2012and December 31, 2011, respectively.(e) Corporate debt/CLOs include $1.2 billi<strong>on</strong> in net noti<strong>on</strong>al amount of credit default swaps written <strong>on</strong> the super senior tranches of CLOs at bothDecember 31, 2012 and December 31, 2011. Collateral postings with regards to corporate debt/CLOs were $420 milli<strong>on</strong> and $477 milli<strong>on</strong> atDecember 31, 2012 and December 31, 2011, respectively.The expected weighted average maturity of the super senior credit derivative portfolios as of December 31, 2012 wasless than <strong>on</strong>e year for the regulatory capital prime residential mortgage portfolio, 6 years for the multi-sector CDOarbitrage portfolio and 3 years for the corporate debt/CLO portfolio.Given the current performance of the underlying portfolios, the level of subordinati<strong>on</strong> of the credit protecti<strong>on</strong> writtenand the assessment of the credit quality of the underlying portfolio, as well as the risk mitigants inherent in thetransacti<strong>on</strong> structures, we do not expect that we will be required to make payments pursuant to the c<strong>on</strong>tractual termsof those transacti<strong>on</strong>s providing regulatory relief.Because of l<strong>on</strong>g-term maturities of the CDS in the arbitrage portfolio, we are unable to make reas<strong>on</strong>able estimates ofthe periods during which any payments would be made. However, the net noti<strong>on</strong>al amount represents the maximumexposure to loss <strong>on</strong> the super senior credit default swap portfolio.Written Single Name Credit Default Swaps..............................................................................................................................................................................................We have also entered into credit default swap c<strong>on</strong>tracts referencing single-name exposures written <strong>on</strong> corporate,index and asset-backed credits with the intenti<strong>on</strong> of earning spread in<strong>com</strong>e <strong>on</strong> credit exposure. Some of thesetransacti<strong>on</strong>s were entered into as part of a l<strong>on</strong>g-short strategy to earn the net spread between CDS written andpurchased. At December 31, 2012, the net noti<strong>on</strong>al amount of these written CDS c<strong>on</strong>tracts was $410 milli<strong>on</strong>,including ABS CDS transacti<strong>on</strong>s purchased from a liquidated multi-sector super senior CDS transacti<strong>on</strong>. Theseexposures have been partially hedged by purchasing offsetting CDS c<strong>on</strong>tracts of $51 milli<strong>on</strong> in net noti<strong>on</strong>al amount.The net unhedged positi<strong>on</strong> of $359 milli<strong>on</strong> represents the maximum exposure to loss <strong>on</strong> these CDS c<strong>on</strong>tracts. Theaverage maturity of the written CDS c<strong>on</strong>tracts is 4 years. At December 31, 2012, the fair value of derivative liability(which represents the carrying value) of the portfolio of CDS was $48 milli<strong>on</strong>...................................................................................................................................................................................................................................<strong>AIG</strong> 2012 Form 10-K 281