Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

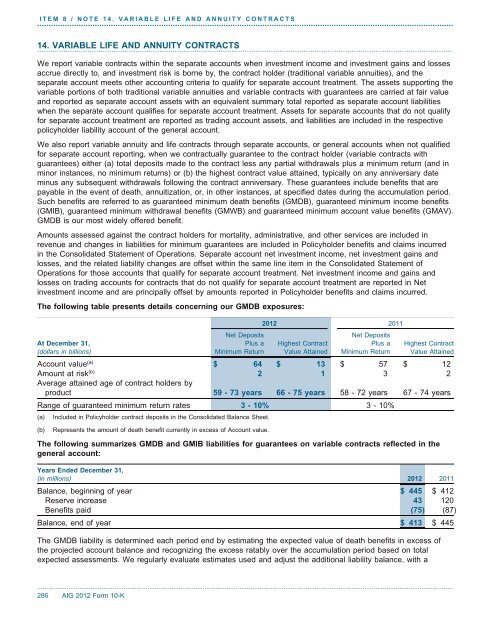

ITEM 8 / NOTE 14. VARIABLE LIFE AND ANNUITY CONTRACTS.....................................................................................................................................................................................14. VARIABLE LIFE AND ANNUITY CONTRACTS..............................................................................................................................................................................................We report variable c<strong>on</strong>tracts within the separate accounts when investment in<strong>com</strong>e and investment gains and lossesaccrue directly to, and investment risk is borne by, the c<strong>on</strong>tract holder (traditi<strong>on</strong>al variable annuities), and theseparate account meets other accounting criteria to qualify for separate account treatment. The assets supporting thevariable porti<strong>on</strong>s of both traditi<strong>on</strong>al variable annuities and variable c<strong>on</strong>tracts with guarantees are carried at fair valueand reported as separate account assets with an equivalent summary total reported as separate account liabilitieswhen the separate account qualifies for separate account treatment. Assets for separate accounts that do not qualifyfor separate account treatment are reported as trading account assets, and liabilities are included in the respectivepolicyholder liability account of the general account.We also report variable annuity and life c<strong>on</strong>tracts through separate accounts, or general accounts when not qualifiedfor separate account reporting, when we c<strong>on</strong>tractually guarantee to the c<strong>on</strong>tract holder (variable c<strong>on</strong>tracts withguarantees) either (a) total deposits made to the c<strong>on</strong>tract less any partial withdrawals plus a minimum return (and inminor instances, no minimum returns) or (b) the highest c<strong>on</strong>tract value attained, typically <strong>on</strong> any anniversary dateminus any subsequent withdrawals following the c<strong>on</strong>tract anniversary. These guarantees include benefits that arepayable in the event of death, annuitizati<strong>on</strong>, or, in other instances, at specified dates during the accumulati<strong>on</strong> period.Such benefits are referred to as guaranteed minimum death benefits (GMDB), guaranteed minimum in<strong>com</strong>e benefits(GMIB), guaranteed minimum withdrawal benefits (GMWB) and guaranteed minimum account value benefits (GMAV).GMDB is our most widely offered benefit.Amounts assessed against the c<strong>on</strong>tract holders for mortality, administrative, and other services are included inrevenue and changes in liabilities for minimum guarantees are included in Policyholder benefits and claims incurredin the C<strong>on</strong>solidated Statement of Operati<strong>on</strong>s. Separate account net investment in<strong>com</strong>e, net investment gains andlosses, and the related liability changes are offset within the same line item in the C<strong>on</strong>solidated Statement ofOperati<strong>on</strong>s for those accounts that qualify for separate account treatment. Net investment in<strong>com</strong>e and gains andlosses <strong>on</strong> trading accounts for c<strong>on</strong>tracts that do not qualify for separate account treatment are reported in Netinvestment in<strong>com</strong>e and are principally offset by amounts reported in Policyholder benefits and claims incurred.The following table presents details c<strong>on</strong>cerning our GMDB exposures:2012 2011Net DepositsNet DepositsAt December 31, Plus a Highest C<strong>on</strong>tract Plus a Highest C<strong>on</strong>tract(dollars in billi<strong>on</strong>s) Minimum Return Value Attained Minimum Return Value AttainedAccount value (a) $ 64 $ 13 $ 57 $ 12Amount at risk (b) 2 13 2Average attained age of c<strong>on</strong>tract holders byproduct 59 - 73 years 66 - 75 years 58 - 72 years 67 - 74 yearsRange of guaranteed minimum return rates 3 - 10%3 - 10%(a) Included in Policyholder c<strong>on</strong>tract deposits in the C<strong>on</strong>solidated Balance Sheet.(b) Represents the amount of death benefit currently in excess of Account value.The following summarizes GMDB and GMIB liabilities for guarantees <strong>on</strong> variable c<strong>on</strong>tracts reflected in thegeneral account:Years Ended December 31,(in milli<strong>on</strong>s) 2012 2011Balance, beginning of year $ 445 $ 412Reserve increase 43 120Benefits paid (75) (87)Balance, end of year $ 413 $ 445The GMDB liability is determined each period end by estimating the expected value of death benefits in excess ofthe projected account balance and recognizing the excess ratably over the accumulati<strong>on</strong> period based <strong>on</strong> totalexpected assessments. We regularly evaluate estimates used and adjust the additi<strong>on</strong>al liability balance, with a..................................................................................................................................................................................................................................286 <strong>AIG</strong> 2012 Form 10-K