Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

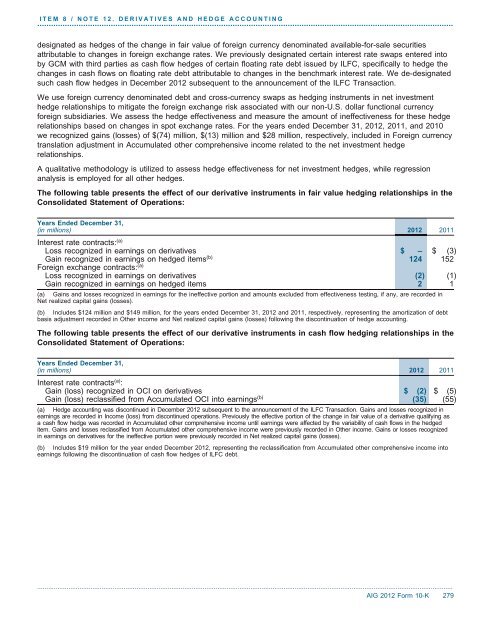

ITEM 8 / NOTE 12. DERIVATIVES AND HEDGE ACCOUNTING.....................................................................................................................................................................................designated as hedges of the change in fair value of foreign currency denominated available-for-sale securitiesattributable to changes in foreign exchange rates. We previously designated certain interest rate swaps entered intoby GCM with third parties as cash flow hedges of certain floating rate debt issued by ILFC, specifically to hedge thechanges in cash flows <strong>on</strong> floating rate debt attributable to changes in the benchmark interest rate. We de-designatedsuch cash flow hedges in December 2012 subsequent to the announcement of the ILFC Transacti<strong>on</strong>.We use foreign currency denominated debt and cross-currency swaps as hedging instruments in net investmenthedge relati<strong>on</strong>ships to mitigate the foreign exchange risk associated with our n<strong>on</strong>-U.S. dollar functi<strong>on</strong>al currencyforeign subsidiaries. We assess the hedge effectiveness and measure the amount of ineffectiveness for these hedgerelati<strong>on</strong>ships based <strong>on</strong> changes in spot exchange rates. For the years ended December 31, 2012, 2011, and 2010we recognized gains (losses) of $(74) milli<strong>on</strong>, $(13) milli<strong>on</strong> and $28 milli<strong>on</strong>, respectively, included in Foreign currencytranslati<strong>on</strong> adjustment in Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e related to the net investment hedgerelati<strong>on</strong>ships.A qualitative methodology is utilized to assess hedge effectiveness for net investment hedges, while regressi<strong>on</strong>analysis is employed for all other hedges.The following table presents the effect of our derivative instruments in fair value hedging relati<strong>on</strong>ships in theC<strong>on</strong>solidated Statement of Operati<strong>on</strong>s:Years Ended December 31,(in milli<strong>on</strong>s) 2012 2011Interest rate c<strong>on</strong>tracts: (a)Loss recognized in earnings <strong>on</strong> derivatives $ – $ (3)Gain recognized in earnings <strong>on</strong> hedged items (b) 124 152Foreign exchange c<strong>on</strong>tracts: (a)Loss recognized in earnings <strong>on</strong> derivatives (2) (1)Gain recognized in earnings <strong>on</strong> hedged items 2 1(a) Gains and losses recognized in earnings for the ineffective porti<strong>on</strong> and amounts excluded from effectiveness testing, if any, are recorded inNet realized capital gains (losses).(b) Includes $124 milli<strong>on</strong> and $149 milli<strong>on</strong>, for the years ended December 31, 2012 and 2011, respectively, representing the amortizati<strong>on</strong> of debtbasis adjustment recorded in Other in<strong>com</strong>e and Net realized capital gains (losses) following the disc<strong>on</strong>tinuati<strong>on</strong> of hedge accounting.The following table presents the effect of our derivative instruments in cash flow hedging relati<strong>on</strong>ships in theC<strong>on</strong>solidated Statement of Operati<strong>on</strong>s:Years Ended December 31,(in milli<strong>on</strong>s) 2012 2011Interest rate c<strong>on</strong>tracts (a) :Gain (loss) recognized in OCI <strong>on</strong> derivatives $ (2) $ (5)Gain (loss) reclassified from Accumulated OCI into earnings (b) (35) (55)(a) Hedge accounting was disc<strong>on</strong>tinued in December 2012 subsequent to the announcement of the ILFC Transacti<strong>on</strong>. Gains and losses recognized inearnings are recorded in In<strong>com</strong>e (loss) from disc<strong>on</strong>tinued operati<strong>on</strong>s. Previously the effective porti<strong>on</strong> of the change in fair value of a derivative qualifying asa cash flow hedge was recorded in Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e until earnings were affected by the variability of cash flows in the hedgeditem. Gains and losses reclassified from Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e were previously recorded in Other in<strong>com</strong>e. Gains or losses recognizedin earnings <strong>on</strong> derivatives for the ineffective porti<strong>on</strong> were previously recorded in Net realized capital gains (losses).(b) Includes $19 milli<strong>on</strong> for the year ended December 2012, representing the reclassificati<strong>on</strong> from Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e intoearnings following the disc<strong>on</strong>tinuati<strong>on</strong> of cash flow hedges of ILFC debt...................................................................................................................................................................................................................................<strong>AIG</strong> 2012 Form 10-K 279