Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

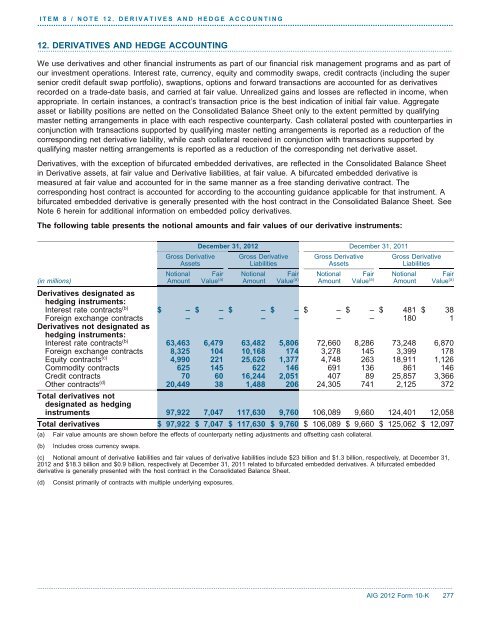

ITEM 8 / NOTE 12. DERIVATIVES AND HEDGE ACCOUNTING.....................................................................................................................................................................................12. DERIVATIVES AND HEDGE ACCOUNTING..............................................................................................................................................................................................We use derivatives and other financial instruments as part of our financial risk management programs and as part ofour investment operati<strong>on</strong>s. Interest rate, currency, equity and <strong>com</strong>modity swaps, credit c<strong>on</strong>tracts (including the supersenior credit default swap portfolio), swapti<strong>on</strong>s, opti<strong>on</strong>s and forward transacti<strong>on</strong>s are accounted for as derivativesrecorded <strong>on</strong> a trade-date basis, and carried at fair value. Unrealized gains and losses are reflected in in<strong>com</strong>e, whenappropriate. In certain instances, a c<strong>on</strong>tract’s transacti<strong>on</strong> price is the best indicati<strong>on</strong> of initial fair value. Aggregateasset or liability positi<strong>on</strong>s are netted <strong>on</strong> the C<strong>on</strong>solidated Balance Sheet <strong>on</strong>ly to the extent permitted by qualifyingmaster netting arrangements in place with each respective counterparty. Cash collateral posted with counterparties inc<strong>on</strong>juncti<strong>on</strong> with transacti<strong>on</strong>s supported by qualifying master netting arrangements is reported as a reducti<strong>on</strong> of thecorresp<strong>on</strong>ding net derivative liability, while cash collateral received in c<strong>on</strong>juncti<strong>on</strong> with transacti<strong>on</strong>s supported byqualifying master netting arrangements is reported as a reducti<strong>on</strong> of the corresp<strong>on</strong>ding net derivative asset.Derivatives, with the excepti<strong>on</strong> of bifurcated embedded derivatives, are reflected in the C<strong>on</strong>solidated Balance Sheetin Derivative assets, at fair value and Derivative liabilities, at fair value. A bifurcated embedded derivative ismeasured at fair value and accounted for in the same manner as a free standing derivative c<strong>on</strong>tract. Thecorresp<strong>on</strong>ding host c<strong>on</strong>tract is accounted for according to the accounting guidance applicable for that instrument. Abifurcated embedded derivative is generally presented with the host c<strong>on</strong>tract in the C<strong>on</strong>solidated Balance Sheet. SeeNote 6 herein for additi<strong>on</strong>al informati<strong>on</strong> <strong>on</strong> embedded policy derivatives.The following table presents the noti<strong>on</strong>al amounts and fair values of our derivative instruments:December 31, 2012 December 31, 2011Gross Derivative Gross Derivative Gross Derivative Gross DerivativeAssets Liabilities Assets LiabilitiesNoti<strong>on</strong>al Fair Noti<strong>on</strong>al Fair Noti<strong>on</strong>al Fair Noti<strong>on</strong>al Fair(in milli<strong>on</strong>s) Amount Value (a) Amount Value (a) Amount Value (a) Amount Value (a)Derivatives designated ashedging instruments:Interest rate c<strong>on</strong>tracts (b) $ – $ – $ – $ – $ – $ – $ 481 $ 38Foreign exchange c<strong>on</strong>tracts – – – – – – 180 1Derivatives not designated ashedging instruments:Interest rate c<strong>on</strong>tracts (b) 63,463 6,479 63,482 5,806 72,660 8,286 73,248 6,870Foreign exchange c<strong>on</strong>tracts 8,325 104 10,168 174 3,278 145 3,399 178Equity c<strong>on</strong>tracts (c) 4,990 221 25,626 1,377 4,748 263 18,911 1,126Commodity c<strong>on</strong>tracts 625 145 622 146 691 136 861 146Credit c<strong>on</strong>tracts 70 60 16,244 2,051 407 89 25,857 3,366Other c<strong>on</strong>tracts (d) 20,449 38 1,488 206 24,305 741 2,125 372Total derivatives notdesignated as hedginginstruments 97,922 7,047 117,630 9,760 106,089 9,660 124,401 12,058Total derivatives $ 97,922 $ 7,047 $ 117,630 $ 9,760 $ 106,089 $ 9,660 $ 125,062 $ 12,097(a) Fair value amounts are shown before the effects of counterparty netting adjustments and offsetting cash collateral.(b) Includes cross currency swaps.(c) Noti<strong>on</strong>al amount of derivative liabilities and fair values of derivative liabilities include $23 billi<strong>on</strong> and $1.3 billi<strong>on</strong>, respectively, at December 31,2012 and $18.3 billi<strong>on</strong> and $0.9 billi<strong>on</strong>, respectively at December 31, 2011 related to bifurcated embedded derivatives. A bifurcated embeddedderivative is generally presented with the host c<strong>on</strong>tract in the C<strong>on</strong>solidated Balance Sheet.(d) C<strong>on</strong>sist primarily of c<strong>on</strong>tracts with multiple underlying exposures...................................................................................................................................................................................................................................<strong>AIG</strong> 2012 Form 10-K 277