Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

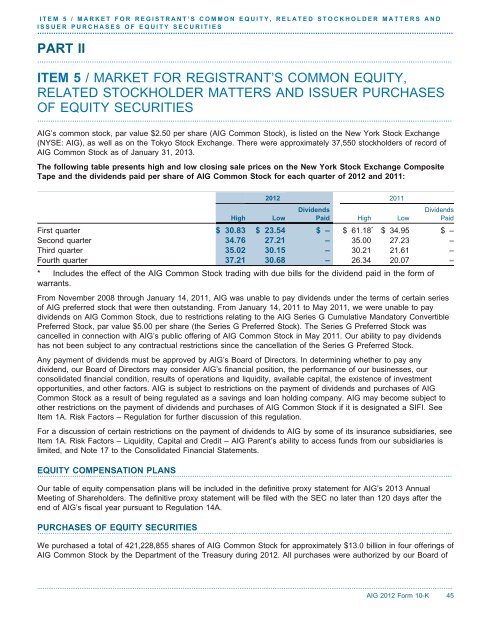

ITEM 5 / MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS ANDISSUER PURCHASES OF EQUITY SECURITIES.....................................................................................................................................................................................PART II..............................................................................................................................................................................................ITEM 5 / MARKET FOR REGISTRANT’S COMMON EQUITY,RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASESOF EQUITY SECURITIES..............................................................................................................................................................................................<strong>AIG</strong>’s <strong>com</strong>m<strong>on</strong> stock, par value $2.50 per share (<strong>AIG</strong> Comm<strong>on</strong> Stock), is listed <strong>on</strong> the New York Stock Exchange(NYSE: <strong>AIG</strong>), as well as <strong>on</strong> the Tokyo Stock Exchange. There were approximately 37,550 stockholders of record of<strong>AIG</strong> Comm<strong>on</strong> Stock as of January 31, 2013.The following table presents high and low closing sale prices <strong>on</strong> the New York Stock Exchange CompositeTape and the dividends paid per share of <strong>AIG</strong> Comm<strong>on</strong> Stock for each quarter of 2012 and 2011:2012 2011DividendsDividendsHigh Low Paid High Low PaidFirst quarter $ 30.83 $ 23.54 $ – $ 61.18 * $ 34.95 $ –Sec<strong>on</strong>d quarter 34.76 27.21 – 35.00 27.23 –Third quarter 35.02 30.15 – 30.21 21.61 –Fourth quarter 37.21 30.68 – 26.34 20.07 –* Includes the effect of the <strong>AIG</strong> Comm<strong>on</strong> Stock trading with due bills for the dividend paid in the form ofwarrants.From November 2008 through January 14, 2011, <strong>AIG</strong> was unable to pay dividends under the terms of certain seriesof <strong>AIG</strong> preferred stock that were then outstanding. From January 14, 2011 to May 2011, we were unable to paydividends <strong>on</strong> <strong>AIG</strong> Comm<strong>on</strong> Stock, due to restricti<strong>on</strong>s relating to the <strong>AIG</strong> Series G Cumulative Mandatory C<strong>on</strong>vertiblePreferred Stock, par value $5.00 per share (the Series G Preferred Stock). The Series G Preferred Stock wascancelled in c<strong>on</strong>necti<strong>on</strong> with <strong>AIG</strong>’s public offering of <strong>AIG</strong> Comm<strong>on</strong> Stock in May 2011. Our ability to pay dividendshas not been subject to any c<strong>on</strong>tractual restricti<strong>on</strong>s since the cancellati<strong>on</strong> of the Series G Preferred Stock.Any payment of dividends must be approved by <strong>AIG</strong>’s Board of Directors. In determining whether to pay anydividend, our Board of Directors may c<strong>on</strong>sider <strong>AIG</strong>’s financial positi<strong>on</strong>, the performance of our businesses, ourc<strong>on</strong>solidated financial c<strong>on</strong>diti<strong>on</strong>, results of operati<strong>on</strong>s and liquidity, available capital, the existence of investmentopportunities, and other factors. <strong>AIG</strong> is subject to restricti<strong>on</strong>s <strong>on</strong> the payment of dividends and purchases of <strong>AIG</strong>Comm<strong>on</strong> Stock as a result of being regulated as a savings and loan holding <strong>com</strong>pany. <strong>AIG</strong> may be<strong>com</strong>e subject toother restricti<strong>on</strong>s <strong>on</strong> the payment of dividends and purchases of <strong>AIG</strong> Comm<strong>on</strong> Stock if it is designated a SIFI. SeeItem 1A. Risk Factors – Regulati<strong>on</strong> for further discussi<strong>on</strong> of this regulati<strong>on</strong>.For a discussi<strong>on</strong> of certain restricti<strong>on</strong>s <strong>on</strong> the payment of dividends to <strong>AIG</strong> by some of its insurance subsidiaries, seeItem 1A. Risk Factors – Liquidity, Capital and Credit – <strong>AIG</strong> Parent’s ability to access funds from our subsidiaries islimited, and Note 17 to the C<strong>on</strong>solidated Financial Statements.EQUITY COMPENSATION PLANS..............................................................................................................................................................................................Our table of equity <strong>com</strong>pensati<strong>on</strong> plans will be included in the definitive proxy statement for <strong>AIG</strong>’s 2013 AnnualMeeting of Shareholders. The definitive proxy statement will be filed with the SEC no later than 120 days after theend of <strong>AIG</strong>’s fiscal year pursuant to Regulati<strong>on</strong> 14A.PURCHASES OF EQUITY SECURITIES..............................................................................................................................................................................................We purchased a total of 421,228,855 shares of <strong>AIG</strong> Comm<strong>on</strong> Stock for approximately $13.0 billi<strong>on</strong> in four offerings of<strong>AIG</strong> Comm<strong>on</strong> Stock by the Department of the Treasury during 2012. All purchases were authorized by our Board of..................................................................................................................................................................................................................................<strong>AIG</strong> 2012 Form 10-K 45