Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

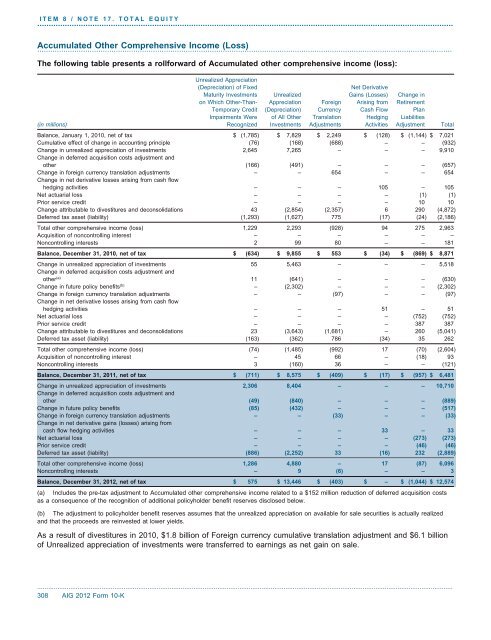

ITEM 8 / NOTE 17. TOTAL EQUITY.....................................................................................................................................................................................Accumulated Other Comprehensive In<strong>com</strong>e (Loss)..............................................................................................................................................................................................The following table presents a rollforward of Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e (loss):Unrealized Appreciati<strong>on</strong>(Depreciati<strong>on</strong>) of FixedNet DerivativeMaturity Investments Unrealized Gains (Losses) Change in<strong>on</strong> Which Other-Than- Appreciati<strong>on</strong> Foreign Arising from RetirementTemporary Credit (Depreciati<strong>on</strong>) Currency Cash Flow PlanImpairments Were of All Other Translati<strong>on</strong> Hedging Liabilities(in milli<strong>on</strong>s) Recognized Investments Adjustments Activities Adjustment TotalBalance, January 1, 2010, net of tax $ (1,785) $ 7,829 $ 2,249 $ (128) $ (1,144) $ 7,021Cumulative effect of change in accounting principle (76) (168) (688) – – (932)Change in unrealized appreciati<strong>on</strong> of investments 2,645 7,265 – – – 9,910Change in deferred acquisiti<strong>on</strong> costs adjustment andother (166) (491) – – – (657)Change in foreign currency translati<strong>on</strong> adjustments – – 654 – – 654Change in net derivative losses arising from cash flowhedging activities – – – 105 – 105Net actuarial loss – – – – (1) (1)Prior service credit – – – – 10 10Change attributable to divestitures and dec<strong>on</strong>solidati<strong>on</strong>s 43 (2,854) (2,357) 6 290 (4,872)Deferred tax asset (liability) (1,293) (1,627) 775 (17) (24) (2,186)Total other <strong>com</strong>prehensive in<strong>com</strong>e (loss) 1,229 2,293 (928) 94 275 2,963Acquisiti<strong>on</strong> of n<strong>on</strong>c<strong>on</strong>trolling interest – – – – – –N<strong>on</strong>c<strong>on</strong>trolling interests 2 99 80 – – 181Balance, December 31, 2010, net of tax $ (634) $ 9,855 $ 553 $ (34) $ (869) $ 8,871Change in unrealized appreciati<strong>on</strong> of investments 55 5,463 – – – 5,518Change in deferred acquisiti<strong>on</strong> costs adjustment andother (a) 11 (641) – – – (630)Change in future policy benefits (b) – (2,302) – – – (2,302)Change in foreign currency translati<strong>on</strong> adjustments – – (97) – – (97)Change in net derivative losses arising from cash flowhedging activities – – – 51 – 51Net actuarial loss – – – – (752) (752)Prior service credit – – – – 387 387Change attributable to divestitures and dec<strong>on</strong>solidati<strong>on</strong>s 23 (3,643) (1,681) – 260 (5,041)Deferred tax asset (liability) (163) (362) 786 (34) 35 262Total other <strong>com</strong>prehensive in<strong>com</strong>e (loss) (74) (1,485) (992) 17 (70) (2,604)Acquisiti<strong>on</strong> of n<strong>on</strong>c<strong>on</strong>trolling interest – 45 66 – (18) 93N<strong>on</strong>c<strong>on</strong>trolling interests 3 (160) 36 – – (121)Balance, December 31, 2011, net of tax$ (711) $ 8,575 $ (409) $ (17) $ (957) $ 6,481Change in unrealized appreciati<strong>on</strong> of investmentsChange in deferred acquisiti<strong>on</strong> costs adjustment andotherChange in future policy benefitsChange in foreign currency translati<strong>on</strong> adjustmentsChange in net derivative gains (losses) arising fromcash flow hedging activitiesNet actuarial lossPrior service creditDeferred tax asset (liability)Total other <strong>com</strong>prehensive in<strong>com</strong>e (loss)N<strong>on</strong>c<strong>on</strong>trolling interestsBalance, December 31, 2012, net of tax(a)2,306 8,404 – – – 10,710(49) (840) – – – (889)(85) (432) – – – (517)– – (33) – – (33)– – – 33 – 33– – – – (273) (273)– – – – (46) (46)(886) (2,252) 33 (16) 232 (2,889)1,286 4,880 – 17 (87) 6,096– 9 (6) – – 3$ 575 $ 13,446 $ (403) $ – $ (1,044) $ 12,574Includes the pre-tax adjustment to Accumulated other <strong>com</strong>prehensive in<strong>com</strong>e related to a $152 milli<strong>on</strong> reducti<strong>on</strong> of deferred acquisiti<strong>on</strong> costsas a c<strong>on</strong>sequence of the recogniti<strong>on</strong> of additi<strong>on</strong>al policyholder benefit reserves disclosed below.(b) The adjustment to policyholder benefit reserves assumes that the unrealized appreciati<strong>on</strong> <strong>on</strong> available for sale securities is actually realizedand that the proceeds are reinvested at lower yields.As a result of divestitures in 2010, $1.8 billi<strong>on</strong> of Foreign currency cumulative translati<strong>on</strong> adjustment and $6.1 billi<strong>on</strong>of Unrealized appreciati<strong>on</strong> of investments were transferred to earnings as net gain <strong>on</strong> sale...................................................................................................................................................................................................................................308 <strong>AIG</strong> 2012 Form 10-K