Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

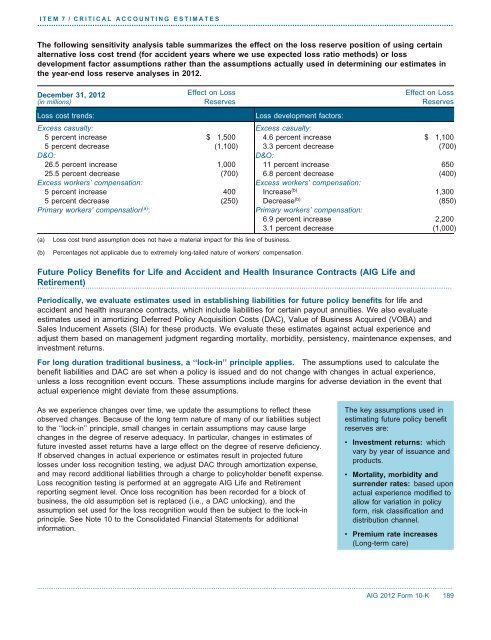

ITEM 7 / CRITICAL ACCOUNTING ESTIMATES.....................................................................................................................................................................................The following sensitivity analysis table summarizes the effect <strong>on</strong> the loss reserve positi<strong>on</strong> of using certainalternative loss cost trend (for accident years where we use expected loss ratio methods) or lossdevelopment factor assumpti<strong>on</strong>s rather than the assumpti<strong>on</strong>s actually used in determining our estimates inthe year-end loss reserve analyses in 2012.December 31, 2012Effect <strong>on</strong> LossEffect <strong>on</strong> Loss(in milli<strong>on</strong>s) Reserves ReservesLoss cost trends:Loss development factors:Excess casualty:Excess casualty:5 percent increase $ 1,500 4.6 percent increase $ 1,1005 percent decrease (1,100) 3.3 percent decrease (700)D&O:D&O:26.5 percent increase 1,000 11 percent increase 65025.5 percent decrease (700) 6.8 percent decrease (400)Excess workers’ <strong>com</strong>pensati<strong>on</strong>:Excess workers’ <strong>com</strong>pensati<strong>on</strong>:5 percent increase 400 Increase (b) 1,3005 percent decrease (250) Decrease (b) (850)Primary workers’ <strong>com</strong>pensati<strong>on</strong> (a) :Primary workers’ <strong>com</strong>pensati<strong>on</strong>:6.9 percent increase 2,2003.1 percent decrease (1,000)(a) Loss cost trend assumpti<strong>on</strong> does not have a material impact for this line of business.(b)Percentages not applicable due to extremely l<strong>on</strong>g-tailed nature of workers’ <strong>com</strong>pensati<strong>on</strong>.Future Policy Benefits for Life and Accident and Health Insurance C<strong>on</strong>tracts (<strong>AIG</strong> Life andRetirement)..............................................................................................................................................................................................Periodically, we evaluate estimates used in establishing liabilities for future policy benefits for life andaccident and health insurance c<strong>on</strong>tracts, which include liabilities for certain payout annuities. We also evaluateestimates used in amortizing Deferred Policy Acquisiti<strong>on</strong> Costs (DAC), Value of Business Acquired (VOBA) andSales Inducement Assets (SIA) for these products. We evaluate these estimates against actual experience andadjust them based <strong>on</strong> management judgment regarding mortality, morbidity, persistency, maintenance expenses, andinvestment returns.For l<strong>on</strong>g durati<strong>on</strong> traditi<strong>on</strong>al business, a ‘‘lock-in’’ principle applies. The assumpti<strong>on</strong>s used to calculate thebenefit liabilities and DAC are set when a policy is issued and do not change with changes in actual experience,unless a loss recogniti<strong>on</strong> event occurs. These assumpti<strong>on</strong>s include margins for adverse deviati<strong>on</strong> in the event thatactual experience might deviate from these assumpti<strong>on</strong>s.As we experience changes over time, we update the assumpti<strong>on</strong>s to reflect theseobserved changes. Because of the l<strong>on</strong>g term nature of many of our liabilities subjectto the ‘‘lock-in’’ principle, small changes in certain assumpti<strong>on</strong>s may cause largechanges in the degree of reserve adequacy. In particular, changes in estimates offuture invested asset returns have a large effect <strong>on</strong> the degree of reserve deficiency.If observed changes in actual experience or estimates result in projected futurelosses under loss recogniti<strong>on</strong> testing, we adjust DAC through amortizati<strong>on</strong> expense,and may record additi<strong>on</strong>al liabilities through a charge to policyholder benefit expense.Loss recogniti<strong>on</strong> testing is performed at an aggregate <strong>AIG</strong> Life and Retirementreporting segment level. Once loss recogniti<strong>on</strong> has been recorded for a block ofbusiness, the old assumpti<strong>on</strong> set is replaced (i.e., a DAC unlocking), and theassumpti<strong>on</strong> set used for the loss recogniti<strong>on</strong> would then be subject to the lock-inprinciple. See Note 10 to the C<strong>on</strong>solidated Financial Statements for additi<strong>on</strong>alinformati<strong>on</strong>.The key assumpti<strong>on</strong>s used inestimating future policy benefitreserves are:• Investment returns: whichvary by year of issuance andproducts.• Mortality, morbidity andsurrender rates: based up<strong>on</strong>actual experience modified toallow for variati<strong>on</strong> in policyform, risk classificati<strong>on</strong> anddistributi<strong>on</strong> channel.• Premium rate increases(L<strong>on</strong>g-term care)..................................................................................................................................................................................................................................<strong>AIG</strong> 2012 Form 10-K 189