Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Bring on tomorrow - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

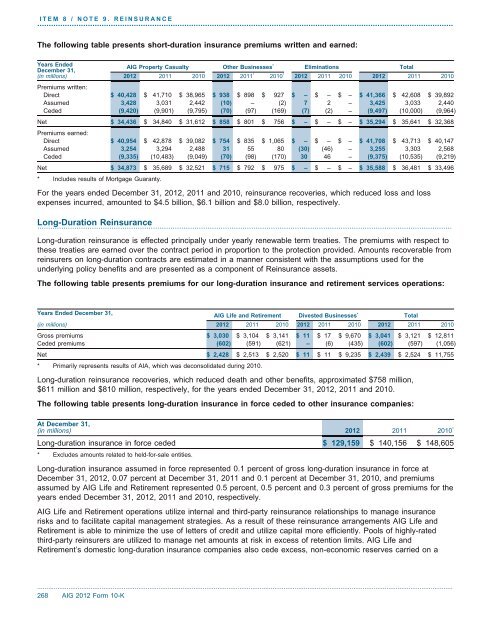

ITEM 8 / NOTE 9. REINSURANCE.....................................................................................................................................................................................The following table presents short-durati<strong>on</strong> insurance premiums written and earned:Years Ended<strong>AIG</strong> Property Casualty Other Businesses * Eliminati<strong>on</strong>s TotalDecember 31,(in milli<strong>on</strong>s) 2012 2011 2010 2012 2011 * 2010 * 2012 2011 2010 2012 2011 2010Premiums written:Direct $ 40,428 $ 41,710 $ 38,965 $ 938 $ 898 $ 927 $ – $ – $ – $ 41,366 $ 42,608 $ 39,892Assumed 3,428 3,031 2,442 (10) – (2) 7 2 – 3,425 3,033 2,440Ceded (9,420) (9,901) (9,795) (70) (97) (169) (7) (2) – (9,497) (10,000) (9,964)Net $ 34,436 $ 34,840 $ 31,612 $ 858 $ 801 $ 756 $ – $ – $ – $ 35,294 $ 35,641 $ 32,368Premiums earned:Direct $ 40,954 $ 42,878 $ 39,082 $ 754 $ 835 $ 1,065 $ – $ – $ – $ 41,708 $ 43,713 $ 40,147Assumed 3,254 3,294 2,488 31 55 80 (30) (46) – 3,255 3,303 2,568Ceded (9,335) (10,483) (9,049) (70) (98) (170) 30 46 – (9,375) (10,535) (9,219)Net $ 34,873 $ 35,689 $ 32,521 $ 715 $ 792 $ 975 $ – $ – $ – $ 35,588 $ 36,481 $ 33,496* Includes results of Mortgage Guaranty.For the years ended December 31, 2012, 2011 and 2010, reinsurance recoveries, which reduced loss and lossexpenses incurred, amounted to $4.5 billi<strong>on</strong>, $6.1 billi<strong>on</strong> and $8.0 billi<strong>on</strong>, respectively.L<strong>on</strong>g-Durati<strong>on</strong> Reinsurance..............................................................................................................................................................................................L<strong>on</strong>g-durati<strong>on</strong> reinsurance is effected principally under yearly renewable term treaties. The premiums with respect tothese treaties are earned over the c<strong>on</strong>tract period in proporti<strong>on</strong> to the protecti<strong>on</strong> provided. Amounts recoverable fromreinsurers <strong>on</strong> l<strong>on</strong>g-durati<strong>on</strong> c<strong>on</strong>tracts are estimated in a manner c<strong>on</strong>sistent with the assumpti<strong>on</strong>s used for theunderlying policy benefits and are presented as a <strong>com</strong>p<strong>on</strong>ent of Reinsurance assets.The following table presents premiums for our l<strong>on</strong>g-durati<strong>on</strong> insurance and retirement services operati<strong>on</strong>s:Years Ended December 31,<strong>AIG</strong> Life and Retirement Divested Businesses * Total(in milli<strong>on</strong>s) 2012 2011 2010 2012 2011 2010 2012 2011 2010Gross premiums $ 3,030 $ 3,104 $ 3,141 $ 11 $ 17 $ 9,670 $ 3,041 $ 3,121 $ 12,811Ceded premiums (602) (591) (621) – (6) (435) (602) (597) (1,056)Net $ 2,428 $ 2,513 $ 2,520 $ 11 $ 11 $ 9,235 $ 2,439 $ 2,524 $ 11,755* Primarily represents results of AIA, which was dec<strong>on</strong>solidated during 2010.L<strong>on</strong>g-durati<strong>on</strong> reinsurance recoveries, which reduced death and other benefits, approximated $758 milli<strong>on</strong>,$611 milli<strong>on</strong> and $810 milli<strong>on</strong>, respectively, for the years ended December 31, 2012, 2011 and 2010.The following table presents l<strong>on</strong>g-durati<strong>on</strong> insurance in force ceded to other insurance <strong>com</strong>panies:At December 31,(in milli<strong>on</strong>s) 2012 2011 2010 *L<strong>on</strong>g-durati<strong>on</strong> insurance in force ceded $ 129,159 $ 140,156 $ 148,605* Excludes amounts related to held-for-sale entities.L<strong>on</strong>g-durati<strong>on</strong> insurance assumed in force represented 0.1 percent of gross l<strong>on</strong>g-durati<strong>on</strong> insurance in force atDecember 31, 2012, 0.07 percent at December 31, 2011 and 0.1 percent at December 31, 2010, and premiumsassumed by <strong>AIG</strong> Life and Retirement represented 0.5 percent, 0.5 percent and 0.3 percent of gross premiums for theyears ended December 31, 2012, 2011 and 2010, respectively.<strong>AIG</strong> Life and Retirement operati<strong>on</strong>s utilize internal and third-party reinsurance relati<strong>on</strong>ships to manage insurancerisks and to facilitate capital management strategies. As a result of these reinsurance arrangements <strong>AIG</strong> Life andRetirement is able to minimize the use of letters of credit and utilize capital more efficiently. Pools of highly-ratedthird-party reinsurers are utilized to manage net amounts at risk in excess of retenti<strong>on</strong> limits. <strong>AIG</strong> Life andRetirement’s domestic l<strong>on</strong>g-durati<strong>on</strong> insurance <strong>com</strong>panies also cede excess, n<strong>on</strong>-ec<strong>on</strong>omic reserves carried <strong>on</strong> a..................................................................................................................................................................................................................................268 <strong>AIG</strong> 2012 Form 10-K