Economic Report of the President

Report - The American Presidency Project

Report - The American Presidency Project

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

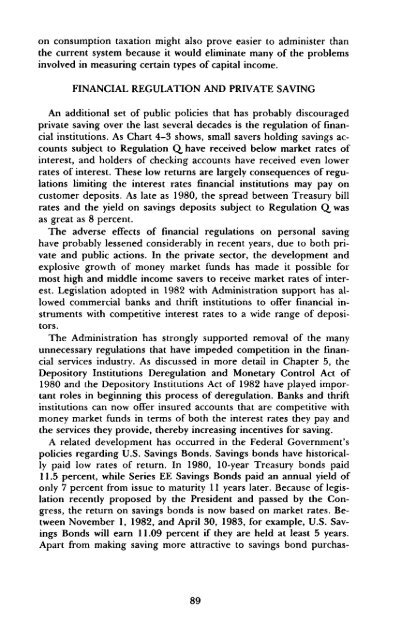

on consumption taxation might also prove easier to administer than<strong>the</strong> current system because it would eliminate many <strong>of</strong> <strong>the</strong> problemsinvolved in measuring certain types <strong>of</strong> capital income.FINANCIAL REGULATION AND PRIVATE SAVINGAn additional set <strong>of</strong> public policies that has probably discouragedprivate saving over <strong>the</strong> last several decades is <strong>the</strong> regulation <strong>of</strong> financialinstitutions. As Chart 4-3 shows, small savers holding savings accountssubject to Regulation Q,have received below market rates <strong>of</strong>interest, and holders <strong>of</strong> checking accounts have received even lowerrates <strong>of</strong> interest. These low returns are largely consequences <strong>of</strong> regulationslimiting <strong>the</strong> interest rates financial institutions may pay oncustomer deposits. As late as 1980, <strong>the</strong> spread between Treasury billrates and <strong>the</strong> yield on savings deposits subject to Regulation Q wasas great as 8 percent.The adverse effects <strong>of</strong> financial regulations on personal savinghave probably lessened considerably in recent years, due to both privateand public actions. In <strong>the</strong> private sector, <strong>the</strong> development andexplosive growth <strong>of</strong> money market funds has made it possible formost high and middle income savers to receive market rates <strong>of</strong> interest.Legislation adopted in 1982 with Administration support has allowedcommercial banks and thrift institutions to <strong>of</strong>fer financial instrumentswith competitive interest rates to a wide range <strong>of</strong> depositors.The Administration has strongly supported removal <strong>of</strong> <strong>the</strong> manyunnecessary regulations that have impeded competition in <strong>the</strong> financialservices industry. As discussed in more detail in Chapter 5, <strong>the</strong>Depository Institutions Deregulation and Monetary Control Act <strong>of</strong>1980 and <strong>the</strong> Depository Institutions Act <strong>of</strong> 1982 have played importantroles in beginning this process <strong>of</strong> deregulation. Banks and thriftinstitutions can now <strong>of</strong>fer insured accounts that are competitive withmoney market funds in terms <strong>of</strong> both <strong>the</strong> interest rates <strong>the</strong>y pay and<strong>the</strong> services <strong>the</strong>y provide, <strong>the</strong>reby increasing incentives for saving.A related development has occurred in <strong>the</strong> Federal Government'spolicies regarding U.S. Savings Bonds. Savings bonds have historicallypaid low rates <strong>of</strong> return. In 1980, 10-year Treasury bonds paid11.5 percent, while Series EE Savings Bonds paid an annual yield <strong>of</strong>only 7 percent from issue to maturity 11 years later. Because <strong>of</strong> legislationrecently proposed by <strong>the</strong> <strong>President</strong> and passed by <strong>the</strong> Congress,<strong>the</strong> return on savings bonds is now based on market rates. BetweenNovember 1, 1982, and April 30, 1983, for example, U.S. SavingsBonds will earn 11.09 percent if <strong>the</strong>y are held at least 5 years.Apart from making saving more attractive to savings bond purchas-89