ordinary meeting of council to be held on tuesday, 18 july 2006

ordinary meeting of council to be held on tuesday, 18 july 2006

ordinary meeting of council to be held on tuesday, 18 july 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

March <strong>2006</strong><br />

Ku-ring-gai Council<br />

Investment Policy<br />

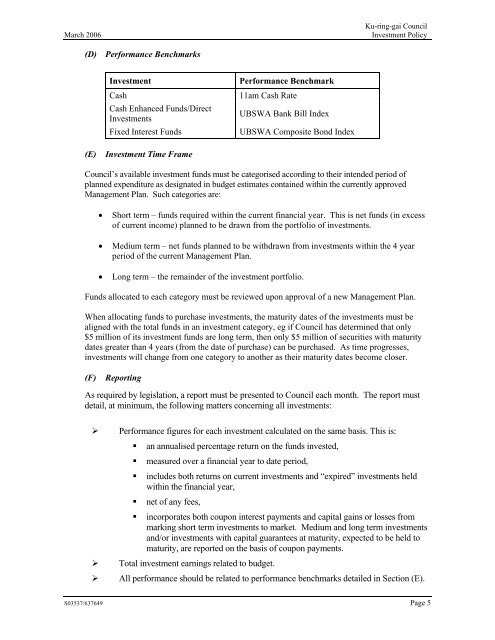

(D) Performance Benchmarks<br />

Investment<br />

Cash<br />

Cash Enhanced Funds/Direct<br />

Investments<br />

Fixed Interest Funds<br />

Performance Benchmark<br />

11am Cash Rate<br />

UBSWA Bank Bill Index<br />

UBSWA Composite B<strong>on</strong>d Index<br />

(E)<br />

Investment Time Frame<br />

Council’s available investment funds must <str<strong>on</strong>g>be</str<strong>on</strong>g> categorised according <str<strong>on</strong>g>to</str<strong>on</strong>g> their intended period <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

planned expenditure as designated in budget estimates c<strong>on</strong>tained within the currently approved<br />

Management Plan. Such categories are:<br />

• Short term – funds required within the current financial year. This is net funds (in excess<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> current income) planned <str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>be</str<strong>on</strong>g> drawn from the portfolio <str<strong>on</strong>g>of</str<strong>on</strong>g> investments.<br />

• Medium term – net funds planned <str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>be</str<strong>on</strong>g> withdrawn from investments within the 4 year<br />

period <str<strong>on</strong>g>of</str<strong>on</strong>g> the current Management Plan.<br />

• L<strong>on</strong>g term – the remainder <str<strong>on</strong>g>of</str<strong>on</strong>g> the investment portfolio.<br />

Funds allocated <str<strong>on</strong>g>to</str<strong>on</strong>g> each category must <str<strong>on</strong>g>be</str<strong>on</strong>g> reviewed up<strong>on</strong> approval <str<strong>on</strong>g>of</str<strong>on</strong>g> a new Management Plan.<br />

When allocating funds <str<strong>on</strong>g>to</str<strong>on</strong>g> purchase investments, the maturity dates <str<strong>on</strong>g>of</str<strong>on</strong>g> the investments must <str<strong>on</strong>g>be</str<strong>on</strong>g><br />

aligned with the <str<strong>on</strong>g>to</str<strong>on</strong>g>tal funds in an investment category, eg if Council has determined that <strong>on</strong>ly<br />

$5 milli<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> its investment funds are l<strong>on</strong>g term, then <strong>on</strong>ly $5 milli<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> securities with maturity<br />

dates greater than 4 years (from the date <str<strong>on</strong>g>of</str<strong>on</strong>g> purchase) can <str<strong>on</strong>g>be</str<strong>on</strong>g> purchased. As time progresses,<br />

investments will change from <strong>on</strong>e category <str<strong>on</strong>g>to</str<strong>on</strong>g> another as their maturity dates <str<strong>on</strong>g>be</str<strong>on</strong>g>come closer.<br />

(F)<br />

Reporting<br />

As required by legislati<strong>on</strong>, a report must <str<strong>on</strong>g>be</str<strong>on</strong>g> presented <str<strong>on</strong>g>to</str<strong>on</strong>g> Council each m<strong>on</strong>th. The report must<br />

detail, at minimum, the following matters c<strong>on</strong>cerning all investments:<br />

‣ Performance figures for each investment calculated <strong>on</strong> the same basis. This is:<br />

• an annualised percentage return <strong>on</strong> the funds invested,<br />

• measured over a financial year <str<strong>on</strong>g>to</str<strong>on</strong>g> date period,<br />

• includes both returns <strong>on</strong> current investments and “expired” investments <str<strong>on</strong>g>held</str<strong>on</strong>g><br />

within the financial year,<br />

• net <str<strong>on</strong>g>of</str<strong>on</strong>g> any fees,<br />

• incorporates both coup<strong>on</strong> interest payments and capital gains or losses from<br />

marking short term investments <str<strong>on</strong>g>to</str<strong>on</strong>g> market. Medium and l<strong>on</strong>g term investments<br />

and/or investments with capital guarantees at maturity, expected <str<strong>on</strong>g>to</str<strong>on</strong>g> <str<strong>on</strong>g>be</str<strong>on</strong>g> <str<strong>on</strong>g>held</str<strong>on</strong>g> <str<strong>on</strong>g>to</str<strong>on</strong>g><br />

maturity, are reported <strong>on</strong> the basis <str<strong>on</strong>g>of</str<strong>on</strong>g> coup<strong>on</strong> payments.<br />

‣ Total investment earnings related <str<strong>on</strong>g>to</str<strong>on</strong>g> budget.<br />

‣ All performance should <str<strong>on</strong>g>be</str<strong>on</strong>g> related <str<strong>on</strong>g>to</str<strong>on</strong>g> performance <str<strong>on</strong>g>be</str<strong>on</strong>g>nchmarks detailed in Secti<strong>on</strong> (E).<br />

S03537/637649 Page 5