Financial systems and development

Financial systems and development

Financial systems and development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

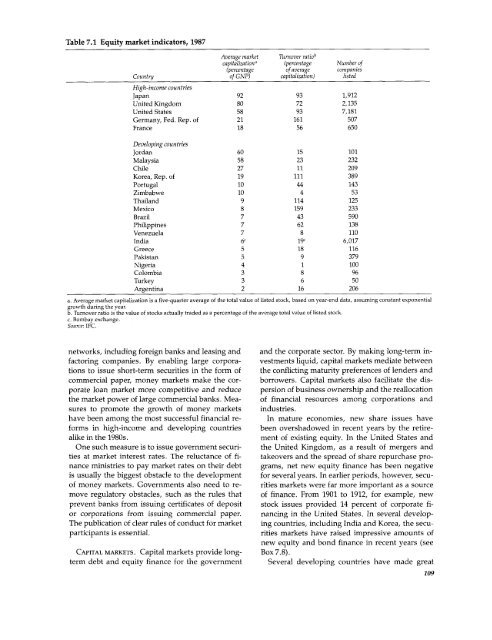

Table 7.1 Equity market indicators, 1987<br />

Average market Turnover ratiob<br />

capitalization, (percentage Number of<br />

(percentage of average companies<br />

Country of GNP) capitalization) listed<br />

High-income countries<br />

Japan 92 93 1,912<br />

United Kingdom 80 72 2,135<br />

United States 58 93 7,181<br />

Germany, Fed. Rep. of 21 161 507<br />

France 18 56 650<br />

Developitig countries<br />

Jordan 60 15 101<br />

Malaysia 58 23 232<br />

Chile 27 11 209<br />

Korea, Rep. of 19 111 389<br />

Portugal 10 44 143<br />

Zimbabwe 10 4 53<br />

Thail<strong>and</strong> 9 114 125<br />

Mexico 8 159 233<br />

Brazil 7 43 590<br />

Philippines 7 62 138<br />

Venezuela 7 8 110<br />

India 6' 19' 6,017<br />

Greece 5 18 116<br />

Pakistan 5 9 379<br />

Nigeria 4 1 100<br />

Colombia 3 8 96<br />

Turkey 3 6 50<br />

Argentina 2 16 206<br />

a. Average market capitalization is a five-quarter average of the total value of listed stock, based on year-end data, assuming constant exponential<br />

growth during the year.<br />

b. Turnover ratio is the value of stocks actually traded as a percentage of the average total value of listed stock.<br />

c. Bombay exchange.<br />

Source: IFC.<br />

networks, including foreign banks <strong>and</strong> leasing <strong>and</strong> <strong>and</strong> the corporate sector. By making long-term infactoring<br />

companies. By enabling large corpora- vestments liquid, capital markets mediate between<br />

tions to issue short-term securities in the form of the conflicting maturity preferences of lenders <strong>and</strong><br />

commercial paper, money markets make the cor- borrowers. Capital markets also facilitate the disporate<br />

loan market more competitive <strong>and</strong> reduce persion of business ownership <strong>and</strong> the reallocation<br />

the market power of large commercial banks. Mea- of financial resources among corporations <strong>and</strong><br />

sures to promote the growth of money markets industries.<br />

have been among the most successful financial re- In mature economies, new share issues have<br />

forms in high-income <strong>and</strong> developing countries been overshadowed in recent years by the retirealike<br />

in the 1980s.<br />

ment of existing equity. In the United States <strong>and</strong><br />

One such measure is to issue government securi- the United Kingdom, as a result of mergers <strong>and</strong><br />

ties at market interest rates. The reluctance of fi- takeovers <strong>and</strong> the spread of share repurchase pronance<br />

ministries to pay market rates on their debt grams, net new equity finance has been negative<br />

is usually the biggest obstacle to the <strong>development</strong> for several years. In earlier periods, however, secuof<br />

money markets. Governments also need to re- rities markets were far more important as a source<br />

move regulatory obstacles, such as the rules that of finance. From 1901 to 1912, for example, new<br />

prevent banks from issuing certificates of deposit stock issues provided 14 percent of corporate fior<br />

corporations from issuing commercial paper. nancing in the United States. In several develop-<br />

The publication of clear rules of conduct for market ing countries, including India <strong>and</strong> Korea, the secuparticipants<br />

is essential.<br />

rities markets have raised impressive amounts of<br />

new equity <strong>and</strong> bond finance in recent years (see<br />

CAPITAL MARKETS. Capital markets provide long- Box 7.8).<br />

term debt <strong>and</strong> equity finance for the government Several developing countries have made great<br />

109