Financial systems and development

Financial systems and development

Financial systems and development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

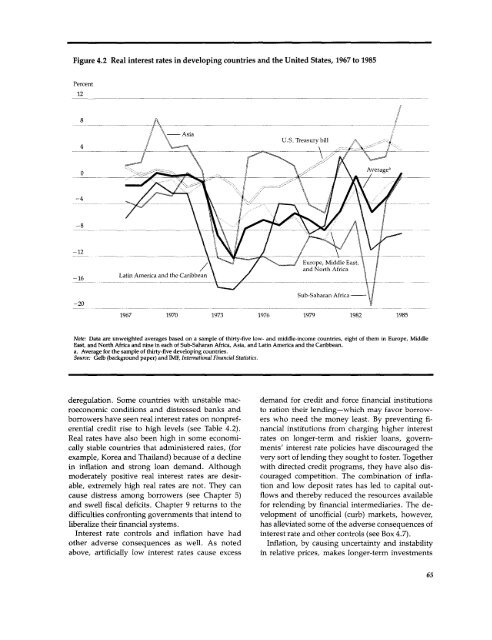

Figure 4.2 Real interest rates in developing countries <strong>and</strong> the United States, 1967 to 1985<br />

Percent<br />

12<br />

8-Asia<br />

hg X ~~~~~~~~~~~U.S.<br />

Treasury bill ,s ;<br />

4 _<br />

8 _________ __<br />

_X_ __ ___,_<br />

-- Oor~~~~~~~~~~~~~adNot fi<br />

- 1 6 Latin America <strong>and</strong> the Caribbean<br />

\ Middle East Average,Europe,<br />

Sub-Saharan Africa<br />

1967 1970 1973 1976 1979 1982 1985<br />

Note: Data are unweighted averages based on a sample of thirty-five low- <strong>and</strong> middle-income countries, eight of them in Europe, Middle<br />

East, <strong>and</strong> North Africa <strong>and</strong> nine in each of Sub-Saharan Africa, Asia, <strong>and</strong> Latin America <strong>and</strong> the Caribbean.<br />

a. Average for the sample of thirty-five developing countries.<br />

Source: Gelb (background paper) <strong>and</strong> IMF, International <strong>Financial</strong> Statistics.<br />

deregulation. Some countries with unstable mac- dem<strong>and</strong> for credit <strong>and</strong> force financial institutions<br />

roeconomic conditions <strong>and</strong> distressed banks <strong>and</strong> to ration their lending-which may favor borrowborrowers<br />

have seen real interest rates on nonpref- ers who need the money least. By preventing fierential<br />

credit rise to high levels (see Table 4.2). nancial institutions from charging higher interest<br />

Real rates have also been high in some economi- rates on longer-term <strong>and</strong> riskier loans, governcally<br />

stable countries that administered rates, (for ments' interest rate policies have discouraged the<br />

example, Korea <strong>and</strong> Thail<strong>and</strong>) because of a decline very sort of lending they sought to foster. Together<br />

in inflation <strong>and</strong> strong loan dem<strong>and</strong>. Although with directed credit programs, they have also dismoderately<br />

positive real interest rates are desir- couraged competition. The combination of inflaable,<br />

extremely high real rates are not. They can tion <strong>and</strong> low deposit rates has led to capital outcause<br />

distress among borrowers (see Chapter 5) flows <strong>and</strong> thereby reduced the resources available<br />

<strong>and</strong> swell fiscal deficits. Chapter 9 returns to the for relending by financial intermediaries. The dedifficulties<br />

confronting governments that intend to velopment of unofficial (curb) markets, however,<br />

liberalize their financial <strong>systems</strong>.<br />

has alleviated some of the adverse consequences of<br />

Interest rate controls <strong>and</strong> inflation have had interest rate <strong>and</strong> other controls (see Box 4.7).<br />

other adverse consequences as well. As noted Inflation, by causing uncertainty <strong>and</strong> instability<br />

above, artificially low interest rates cause excess in relative prices, makes longer-term investments<br />

65