Financial systems and development

Financial systems and development

Financial systems and development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

strides in recent years in establishing <strong>and</strong> invigo- requires all limited liability companies of a certain<br />

rating equity markets. Such markets now exist in size to make the same financial disclosures as pubmore<br />

than forty countries. Indeed, the market cap- licly listed firms. In the past, dem<strong>and</strong> for securities<br />

italization of stock exchanges (that is, the total has been inhibited by the lack of investor confivalue<br />

of listed shares) is a greater proportion of dence. In the future, much of the dem<strong>and</strong> is likely<br />

GNP in Jordan <strong>and</strong> Malaysia than in France <strong>and</strong> to come from institutional investors.<br />

Germany, <strong>and</strong> India's stock exchanges list more A primary reason for the underdeveloped state<br />

companies than the stock markets of any other of capital markets in many developing countries is<br />

country except the United States (see Table 7.1). In the absence of an appropriate legal, regulatory,<br />

many countries, however, equity markets remain <strong>and</strong> tax framework. In some countries new shares<br />

small. Only a few countries have active corporate have to be issued at par value, which makes them<br />

bond markets; they include Canada, India, Korea, unattractive to companies if the market value of<br />

<strong>and</strong> the United States.<br />

their shares has appreciated significantly. In other<br />

The supply of equities has been limited by the countries the tax-free status of time deposits or<br />

reluctance of owners of private companies to dilute government <strong>and</strong> public enterprise bonds lessens<br />

their ownership <strong>and</strong> control by issuing stock or to the appeal of private corporate instruments. Far<br />

comply with requirements to disclose information more important in developing countries, however,<br />

about their operations. The availability of less ex- is lax enforcement of corporate income taxes. This<br />

pensive debt finance has also discouraged equity makes it possible for closely held corporations to<br />

issues. Some countries-for example, Korea-have avoid taxes by showing very low accounting<br />

provided considerable tax incentives to encourage profits; publicly traded corporations cannot hide<br />

corporations to go public. In Jordan, any firm seek- their profits without hurting investor confidence.<br />

ing limited liability must offer a substantial per- A common problem in securities markets, especentage<br />

of its shares to the general public. Chile cially early in their <strong>development</strong>, is the danger of a<br />

speculative boom followed by a sharp decline.<br />

Such crises have affected markets in Brazil, Hong<br />

Kong, Korea, Mexico, the Philippines, Singapore,<br />

<strong>and</strong> Thail<strong>and</strong>. Large increases <strong>and</strong> declines in<br />

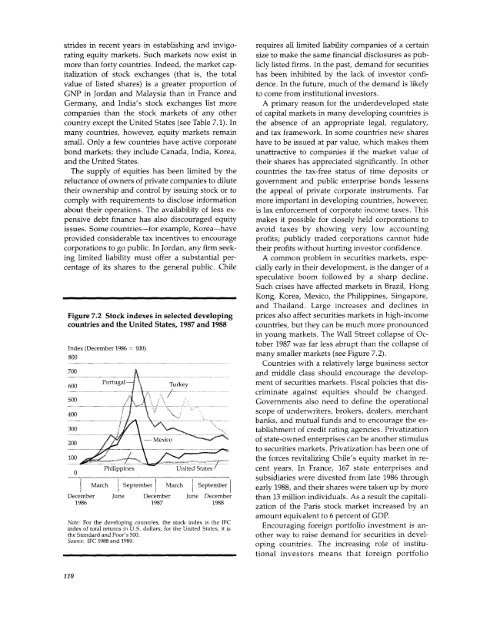

Figure 7.2 Stock indexes in selected developing prices also affect securities markets in high-income<br />

countries <strong>and</strong> the United States, 1987 <strong>and</strong> 1988 countries, but they can be much more pronounced<br />

in young markets. The Wall Street collapse of Oc-<br />

Index (December 1986 = 100)<br />

tober 1987 was far less abrupt than the collapse of<br />

800 many smaller markets (see Figure 7.2).<br />

Countries with a relatively large business sector<br />

700 <strong>and</strong> middle class should encourage the develop-<br />

600 Portugal Turkey ment of securities markets. Fiscal policies that dis-<br />

___- -- / -- criminate against equities should be changed.<br />

500 ___ Governments also need to define the operational<br />

400 i } \ X X ; ' 2 scope of underwriters, brokers, dealers, merchant<br />

----------<br />

_-- - -- ¢-t-- banks, <strong>and</strong> mutual funds <strong>and</strong> to encourage the es-<br />

300 tablishment of credit rating agencies. Privatization<br />

200 Mexico<br />

/----t---- i ..<br />

of state-owned enterprises can be another stimulus<br />

to securities markets. Privatization has been one of<br />

100 ' the forces revitalizing Chile's equity market in re-<br />

0 Philippines UnitedStates cent years. In France, 167 state enterprises <strong>and</strong><br />

I<br />

0<br />

March September March September<br />

subsidiaries were divested from late 1986 through<br />

early 1988, <strong>and</strong> their shares were taken up by more<br />

December June December June December<br />

1986 1987 1988<br />

than 13 million individuals. As a result the capitalization<br />

of the Paris stock market increased by an<br />

amount equivalent to 6 percent of GDP.<br />

Note: For the developing countries, the stock index is the IFC Enouraging fori portf i s ns<br />

index of total returns in U.S. dollars; for the United States, it is Encouraging foreign portfolio investment is anthe<br />

St<strong>and</strong>ard <strong>and</strong> Poor's 500.<br />

other way to raise dem<strong>and</strong> for securities in devel-<br />

Sou(rce: IFC 1988 <strong>and</strong> 1989.wa<br />

oping countries. The increasing role of institutional<br />

investors means that foreign portfolio<br />

110