Financial systems and development

Financial systems and development

Financial systems and development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The task of financial reform<br />

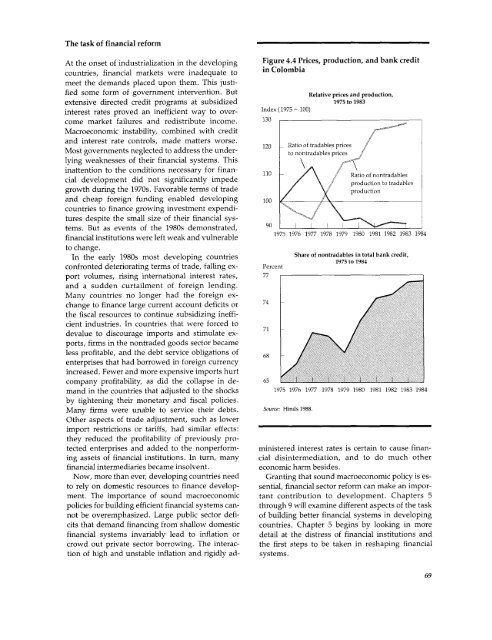

At the onset of industrialization in the developing Figure 4.4 Prices, production, <strong>and</strong> bank credit<br />

countries, financial markets were inadequate to in Colombia<br />

meet the dem<strong>and</strong>s placed upon them. This justified<br />

some form of government intervention. But<br />

Relative prices <strong>and</strong> production,<br />

extensive directed credit programs at subsidized 1975 to 1983<br />

interest rates proved an inefficient way to over- Index (1975 100)<br />

come market failures <strong>and</strong> redistribute income. 130<br />

Macroeconomic instability, combined with credit<br />

<strong>and</strong> interest rate controls, made matters worse. 1d<br />

Most governments neglected to address the under- to nontradables prices<br />

lying weaknesses of their financial <strong>systems</strong>. This<br />

inattention to the conditions necessary for finan- 110 A Ratio of nontradables<br />

cial <strong>development</strong> did not significantly impede pRotio o tradables<br />

growth during the 1970s. Favorable terms of trade / production<br />

<strong>and</strong> cheap foreign funding enabled developing 100<br />

countries to finance growing investment expendi-<br />

N<br />

tures despite the small size of their financial <strong>systems</strong>.<br />

But as events of the 1980s demonstrated, 90 I<br />

financial institutions were left weak <strong>and</strong> vulnerable 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984<br />

to change.<br />

In the early 1980s most developing countries Share of nontradables in total bank credit,<br />

confronted deteriorating terms of trade, falling ex- Percent 1975 to 1984<br />

port volumes, rising international interest rates, 77<br />

<strong>and</strong> a sudden curtailment of foreign lending.<br />

Many countries no longer had the foreign exchange<br />

to finance large current account deficits or 74<br />

the fiscal resources to continue subsidizing inefficient<br />

industries. In countries that were forced to<br />

devalue to discourage imports <strong>and</strong> stimulate exports,<br />

71<br />

firms in the nontraded goods sector became<br />

less profitable, <strong>and</strong> the debt service obligations of 68<br />

enterprises that had borrowed in foreign currency<br />

increased. Fewer <strong>and</strong> more expensive imports hurt<br />

company profitability, as did the collapse in de- 65 I 1<br />

m<strong>and</strong> in the countries that adjusted to the shocks 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984<br />

by tightening their monetary <strong>and</strong> fiscal policies.<br />

Many firms were unable to service their debts. Source: Hinds 1988.<br />

Other aspects of trade adjustment, such as lower<br />

import restrictions or tariffs, had similar effects:<br />

they reduced the profitability of previously protected<br />

enterprises <strong>and</strong> added to the nonperform- ministered interest rates is certain to cause finaning<br />

assets of financial institutions. In turn, many cial disintermediation, <strong>and</strong> to do much other<br />

financial intermediaries became insolvent.<br />

economic harm besides.<br />

Now, more than ever, developing countries need Granting that sound macroeconomic policy is esto<br />

rely on domestic resources to finance develop- sential, financial sector reform can make an imporment.<br />

The importance of sound macroeconomic tant contribution to <strong>development</strong>. Chapters 5<br />

policies for building efficient financial <strong>systems</strong> can- through 9 will examine different aspects of the task<br />

not be overemphasized. Large public sector defi- of building better financial <strong>systems</strong> in developing<br />

cits that dem<strong>and</strong> financing from shallow domestic countries. Chapter 5 begins by looking in more<br />

financial <strong>systems</strong> invariably lead to inflation or detail at the distress of financial institutions <strong>and</strong><br />

crowd out private sector borrowing. The interac- the first steps to be taken in reshaping financial<br />

tion of high <strong>and</strong> unstable inflation <strong>and</strong> rigidly ad- <strong>systems</strong>.<br />

69