- Page 1: ~~~~/ , -. \-E:-: - :: 0 0 - PUB768

- Page 4 and 5: Oxford University Press NEW YORK OX

- Page 6 and 7: countries' financial institutions i

- Page 8 and 9: 4 Financial sector issues in develo

- Page 10 and 11: 7.1 Shares of medium- and long-term

- Page 12 and 13: * Fractional reserve banking. The p

- Page 14 and 15: NTB Nontariff barrier * Growth rate

- Page 16 and 17: and grew even faster in 1988 than i

- Page 18 and 19: etter loan recovery procedures, mor

- Page 20 and 21: l~ ~~~ ~ ~~~~~~~~~~~~~~~~~~~ ;:: ;

- Page 22 and 23: The early years of the recovery wer

- Page 24 and 25: Figure 1.4 Growth of export volume

- Page 26 and 27: Figure 1.6 Saving and investment ra

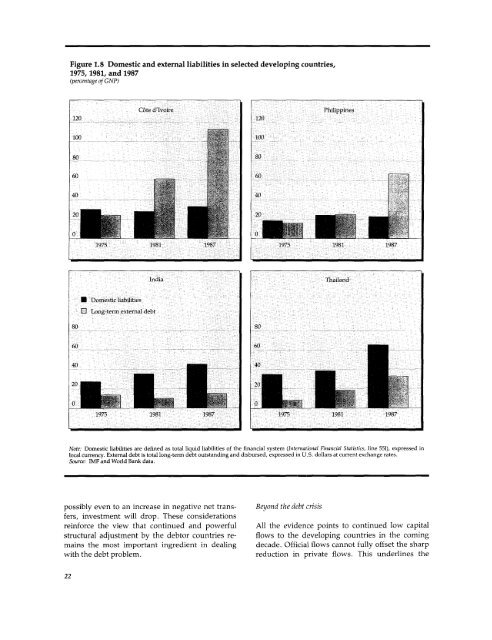

- Page 28 and 29: edly, in Argentina, Brazil, and Mex

- Page 30 and 31: 5~~~~ '~ ' S " ''t.*:'.: .:,0!3gft"

- Page 32 and 33: Box 1.2 Debt concepts A variety of

- Page 34 and 35: Table 1.1 Selected economic indicat

- Page 38 and 39: Box 1.3 Foreign equity investment E

- Page 40 and 41: j Box 2.1 Life without money "Some

- Page 42 and 43: other ways too. By imposing direct

- Page 44 and 45: Box 2.2 Transaction costs and the s

- Page 46 and 47: Box 2.3 Real interest rates and gro

- Page 48 and 49: I Box 2.4 Swapping risk All economi

- Page 50 and 51: Box 2.5 Deposit insurance Most high

- Page 52 and 53: GOVERNMENT. As well as being regula

- Page 54 and 55: and receivables, whereas developmen

- Page 56 and 57: with the expansion of nonlocal trad

- Page 58 and 59: over. Even so, bankers and industri

- Page 60 and 61: Box 3.3 Financial swindles i Swindl

- Page 62 and 63: Box 3.4 Financial underdevelopment

- Page 64 and 65: Box 3.6 Universal banking One of th

- Page 66 and 67: 1960s. They speeded the internation

- Page 68 and 69: 4 Financial sector issues in develo

- Page 70 and 71: Box 4.1 Directed credit in Turkey ,

- Page 72 and 73: Box 4.2 Lending program for small e

- Page 74 and 75: Box 4.4 The Botswana Development Co

- Page 76 and 77: markets to finance their deficits,

- Page 78 and 79: 0~~~~~ = == X .. _- -- = -_ _ _ __

- Page 80 and 81: Figure 4.3 Financial savings and th

- Page 82 and 83: Box 4.8 Financial indexation in Bra

- Page 84 and 85: Financial systems in distress Not s

- Page 86 and 87:

t !< 4> - !: e z u- >as uei- i.e_.S

- Page 88 and 89:

tem. They have succeeded in stemmin

- Page 90 and 91:

governments gave too little thought

- Page 92 and 93:

Box 5.4 The U.S. savings and loan c

- Page 94 and 95:

or take a step in the other directi

- Page 96 and 97:

have been even larger. The cost of

- Page 98 and 99:

~Foundations offinancial systems If

- Page 100 and 101:

(an issue closely related to the as

- Page 102 and 103:

several centuries. The spread of su

- Page 104 and 105:

Bankruptcy and reorganization monit

- Page 106 and 107:

Box 6.5 Elements of a bank supervis

- Page 108 and 109:

they attempted to discipline bank m

- Page 110 and 111:

Developing financial systems What s

- Page 112 and 113:

Figure 7.1 Shares of medium- and lo

- Page 114 and 115:

Box 7.3 The financial history of a

- Page 116 and 117:

Box 7.4 Housing finance The formal

- Page 118 and 119:

Box 7.5 Bank modernization: Indones

- Page 120 and 121:

DEVELOPMENT FINANCE INSTITUTIONS. T

- Page 122 and 123:

esources in government securities o

- Page 124 and 125:

strides in recent years in establis

- Page 126 and 127:

Issues in informal finance Small-sc

- Page 128 and 129:

Box 8.2 Rotating savings and credit

- Page 130 and 131:

original amount to the renter by th

- Page 132 and 133:

cooperatives' managers because it a

- Page 134 and 135:

Box 8.4 The Badan Kredit Kecamatan:

- Page 136 and 137:

Toward more liberal and open financ

- Page 138 and 139:

a brief period firms faced rapid ch

- Page 140 and 141:

Box 9.2 Financial reform in Korea K

- Page 142 and 143:

In the next stage, financial reform

- Page 144 and 145:

industry, policy reforms and the re

- Page 146 and 147:

Conclusions of the Report challenge

- Page 148 and 149:

tion "Risks and costs of finance" d

- Page 150 and 151:

Montes-Negret, Fernando. "The Decli

- Page 152 and 153:

D.C.: International Monetary Fund a

- Page 154 and 155:

Harberger, Arnold C. 1985. "Lessons

- Page 156 and 157:

croenterprises: Programs or Markets

- Page 158 and 159:

Douglas Graham, and J. D. Von Pisch

- Page 160 and 161:

Table A.2 Population and GNP per ca

- Page 162 and 163:

Table A.5 GDP structure of producti

- Page 164 and 165:

Table A.8 Growth of export volume,

- Page 166 and 167:

Table A.10 Growth of long-term debt

- Page 168 and 169:

Table A.12 Composition of debt outs

- Page 170 and 171:

Contents Key 157 Introduction and m

- Page 172 and 173:

Introduction The World Development

- Page 174 and 175:

Throughout the World Development In

- Page 176 and 177:

Population _ 0-15 million The color

- Page 178 and 179:

Table 1. Basic indicators __ GNP pe

- Page 180 and 181:

Table 2. Growth of production______

- Page 182 and 183:

Table 3. Structure of production __

- Page 184 and 185:

Table 4. Agriculture and food Value

- Page 186 and 187:

Table 5. Commercial energy ~~Energy

- Page 188 and 189:

Table 6. Structure of manufacturing

- Page 190 and 191:

Table 7. Manufacturing earnings and

- Page 192 and 193:

Table 8. Growth of consumption and

- Page 194 and 195:

Table 9. Structure of demand Distri

- Page 196 and 197:

Table 10. Structure of consumption_

- Page 198 and 199:

Table 11. Central government expend

- Page 200 and 201:

Table 12. Central government curren

- Page 202 and 203:

Table 13. Money and interest rates

- Page 204 and 205:

Table 14. Growth of merchandise tra

- Page 206 and 207:

Table 15. Structure of merchandise

- Page 208 and 209:

Table 16. Structure of merchandise

- Page 210 and 211:

Table 17. OECD imports of manufactu

- Page 212 and 213:

Table 18. Balance of payments and r

- Page 214 and 215:

Table 19. Official development assi

- Page 216 and 217:

Table 20. Official development assi

- Page 218 and 219:

Table 21. Total external debt Long-

- Page 220 and 221:

Table 22. Flow of public and privat

- Page 222 and 223:

Table 23. Total external public and

- Page 224 and 225:

Table 24. External public debt and

- Page 226 and 227:

Table 25. Terms of external public

- Page 228 and 229:

Table 26. Population growth and pro

- Page 230 and 231:

Table 27. Demography and fertility

- Page 232 and 233:

Table 28. Health and nutrition popu

- Page 234 and 235:

Table 29. Education Percentage ofag

- Page 236 and 237:

Table 30. Income distribution and I

- Page 238 and 239:

Table 31. Urbanization Urban popula

- Page 240 and 241:

Table 32. Women in development_____

- Page 242 and 243:

Technical notes This twelfth editio

- Page 244 and 245:

Box A.1. Basic indicators for count

- Page 246 and 247:

Box A.2. Selected indicators for no

- Page 248 and 249:

from the Food and Agriculture Organ

- Page 250 and 251:

Exports of goods and nonfactor serv

- Page 252 and 253:

spectively. Since 1987 data are not

- Page 254 and 255:

The table reports the value of manu

- Page 256 and 257:

teed, and private nonguaranteed lon

- Page 258 and 259:

the Demographic and Health Surveys,

- Page 260 and 261:

also the one used within the global

- Page 262 and 263:

Bibliography Production and domesti

- Page 264 and 265:

Country classifications: World Deve

- Page 266:

I i