Financial systems and development

Financial systems and development

Financial systems and development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

will not be necessary because defaulting borrowers ing implicit or explicit deposit guarantees <strong>and</strong> by<br />

will start to repay or because banks will make ade- regularly granting assistance to troubled banks<br />

quate provisions for their bad loans. But, as Box <strong>and</strong> firms, governments have suppressed the mar-<br />

5.5 argues, the likelihood of spontaneous recovery ket forces that otherwise would have eliminated or<br />

is low. Other considerations-the budgetary costs reorganized unprofitable firms <strong>and</strong> allocated the<br />

of restructuring, issues of fairness in allocating the associated losses. Until governments take the furlosses,<br />

the embarrassment of bad loans made to ther step of performing the market's losspublic<br />

enterprises or political allies, or fear of bank allocating function, losses will continue. As losses<br />

runs-also lead governments to ignore the prob- mount, so do the costs of supporting the losslem<br />

as long as they can.<br />

making institutions. The continuing costs of peri-<br />

If there is no crisis, should governments inter- odic support will eventually outweigh the onevene<br />

merely to relieve financial distress? One rea- time cost of restructuring.<br />

son most may have to is that earlier interventions Governments can either take the next step, by<br />

have made a market solution unlikely. By provid- performing the market's loss-allocating function,<br />

Box 5.5<br />

Can banks "muddle through"?<br />

Governments have often refrained from intervening in A "wait <strong>and</strong> see" approach is likely to prove costly.<br />

the financial sector in the hope that ailing banks will To recapitalize themselves, banks with large losses<br />

recover spontaneously. Rather than obliging the banks (losses greater than their capital) must increase earnto<br />

make provisions for their losses (which might force ings substantially. If efforts to increase earnings lead<br />

those with losses larger than capital into bankruptcy), bankers to engage in overly risky behavior, however,<br />

many governments have permitted them to operate new losses will make spontaneous recovery even less<br />

with impaired capital positions. For banks to recover feasible.<br />

unaided, at least one of two things must happen:<br />

enough defaulting borrowers must resume servicing<br />

their debts or banks must earn enough to restore capital<br />

adequacy.<br />

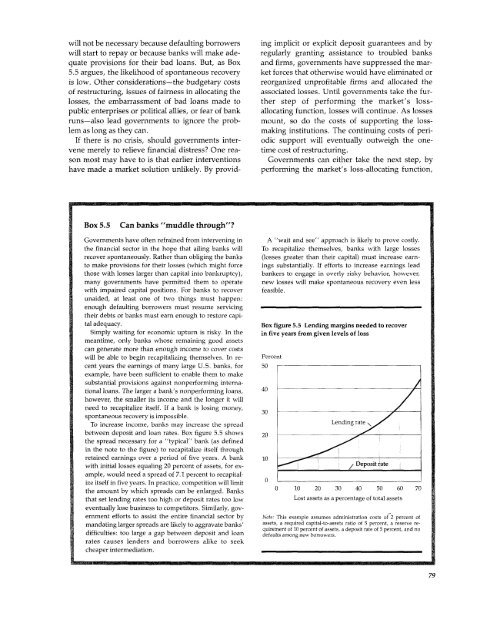

Box figure 5.5 Lending margins needed to recover<br />

Simply waiting for economic upturn is risky. In the in five years from given levels of loss<br />

meantime, only banks whose remaining good assets<br />

can generate more than enough income to cover costs<br />

will be able to begin recapitalizing themselves. In re- Percent<br />

cent years the earnings of many large U.S. banks, for 50<br />

example, have been sufficient to enable them to make<br />

substantial provisions against nonperforming international<br />

loans. The larger a bank's nonperforming loans, 40 -<br />

however, the smaller its income <strong>and</strong> the longer it will<br />

need to recapitalize itself. If a bank is losing money, 30<br />

spontaneous recovery is impossible.<br />

To increase income, banks may increase the spread<br />

Lending rate\<br />

between deposit <strong>and</strong> loan rates. Box figure 5.5 shows 20<br />

the spread necessary for a "typical" bank (as defined<br />

in the note to the figure) to recapitalize itself through<br />

retained earnings over a period of five years. A bank 10 -<br />

with initial losses equaling 20 percent of assets, for ex-<br />

/ Deposit rate<br />

ample, would need a spread of 7.1 percent to recapitalize<br />

itself in five years. In practice, competition will limit 0<br />

the amount by which spreads can be enlarged. Banks 0 10 20 30 40 50 60 70<br />

that set lending rates too high or deposit rates too low<br />

Lost assets as a percentage of total assets<br />

eventually lose business to competitors. Similarly, government<br />

efforts to assist the entire financial sector by Note: This example assumes administration costs of 2 percent of<br />

m<strong>and</strong>ating larger spreads are likely to aggravate banks' assets, a required capital-to-assets ratio of 5 percent, a reserve requirernent<br />

of 10 percent of assets, a deposit rate of 5 percent, <strong>and</strong> no<br />

difficulties: too large a gap between deposit <strong>and</strong> loan defaults among new borrowers.<br />

rates causes lenders <strong>and</strong> borrowers alike to seek<br />

cheaper intermediation.<br />

79