the MEA - ASU NSW

the MEA - ASU NSW

the MEA - ASU NSW

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

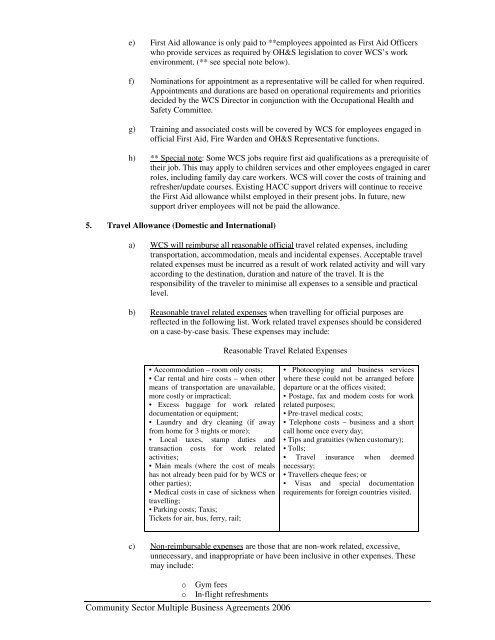

e) First Aid allowance is only paid to **employees appointed as First Aid Officerswho provide services as required by OH&S legislation to cover WCS’s workenvironment. (** see special note below).f) Nominations for appointment as a representative will be called for when required.Appointments and durations are based on operational requirements and prioritiesdecided by <strong>the</strong> WCS Director in conjunction with <strong>the</strong> Occupational Health andSafety Committee.g) Training and associated costs will be covered by WCS for employees engaged inofficial First Aid, Fire Warden and OH&S Representative functions.h) ** Special note: Some WCS jobs require first aid qualifications as a prerequisite of<strong>the</strong>ir job. This may apply to children services and o<strong>the</strong>r employees engaged in carerroles, including family day care workers. WCS will cover <strong>the</strong> costs of training andrefresher/update courses. Existing HACC support drivers will continue to receive<strong>the</strong> First Aid allowance whilst employed in <strong>the</strong>ir present jobs. In future, newsupport driver employees will not be paid <strong>the</strong> allowance.5. Travel Allowance (Domestic and International)a) WCS will reimburse all reasonable official travel related expenses, includingtransportation, accommodation, meals and incidental expenses. Acceptable travelrelated expenses must be incurred as a result of work related activity and will varyaccording to <strong>the</strong> destination, duration and nature of <strong>the</strong> travel. It is <strong>the</strong>responsibility of <strong>the</strong> traveler to minimise all expenses to a sensible and practicallevel.b) Reasonable travel related expenses when travelling for official purposes arereflected in <strong>the</strong> following list. Work related travel expenses should be consideredon a case-by-case basis. These expenses may include:Reasonable Travel Related Expenses• Accommodation – room only costs;• Car rental and hire costs – when o<strong>the</strong>rmeans of transportation are unavailable,more costly or impractical;• Excess baggage for work relateddocumentation or equipment;• Laundry and dry cleaning (if awayfrom home for 3 nights or more);• Local taxes, stamp duties andtransaction costs for work relatedactivities;• Main meals (where <strong>the</strong> cost of mealshas not already been paid for by WCS oro<strong>the</strong>r parties);• Medical costs in case of sickness whentravelling;• Parking costs; Taxis;Tickets for air, bus, ferry, rail;• Photocopying and business serviceswhere <strong>the</strong>se could not be arranged beforedeparture or at <strong>the</strong> offices visited;• Postage, fax and modem costs for workrelated purposes;• Pre-travel medical costs;• Telephone costs – business and a shortcall home once every day;• Tips and gratuities (when customary);• Tolls;• Travel insurance when deemednecessary;• Travellers cheque fees; or• Visas and special documentationrequirements for foreign countries visited.c) Non-reimbursable expenses are those that are non-work related, excessive,unnecessary, and inappropriate or have been inclusive in o<strong>the</strong>r expenses. Thesemay include:o Gym feeso In-flight refreshmentsCommunity Sector Multiple Business Agreements 2006