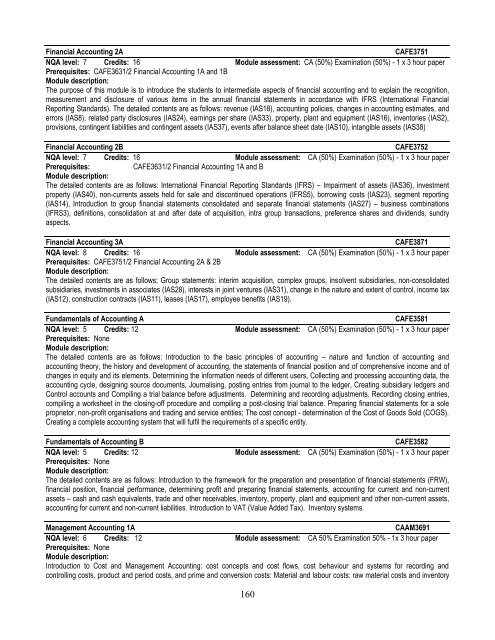

Financial Accounting 2ACAFE3751NQA level: 7 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: CAFE3631/2 Financial Accounting 1A and 1BModule description:The purpose of this module is to introduce the students to intermediate aspects of financial accounting and to explain the recognition,measurement and disclosure of various items in the annual financial statements in accordance with IFRS (International FinancialReporting Standards). The detailed contents are as follows: revenue (IAS18), accounting policies, changes in accounting estimates, anderrors (IAS8), related party disclosures (IAS24), earnings per share (IAS33), property, plant and equipment (IAS16), inventories (IAS2),provisions, contingent liabilities and contingent assets (IAS37), events after balance sheet date (IAS10), intangible assets (IAS38)Financial Accounting 2BCAFE3752NQA level: 7 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites:CAFE3631/2 Financial Accounting 1A and BModule description:The detailed contents are as follows: International Financial Reporting Standards (IFRS) – Impairment of assets (IAS36), investmentproperty (IAS40), non-currents assets held for sale and discontinued operations (IFRS5), borrowing costs (IAS23), segment reporting(IAS14), Introduction to group financial statements consolidated and separate financial statements (IAS27) – business combinations(IFRS3), definitions, consolidation at and after date of acquisition, intra group transactions, preference shares and dividends, sundryaspects.Financial Accounting 3ACAFE3871NQA level: 8 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: CAFE3751/2 Financial Accounting 2A & 2BModule description:The detailed contents are as follows; Group statements: interim acquisition, complex groups, insolvent subsidiaries, non-consolidatedsubsidiaries, investments in associates (IAS28), interests in joint ventures (IAS31), change in the nature and extent of control, income tax(IAS12), construction contracts (IAS11), leases (IAS17), employee benefits (IAS19).Fundamentals of Accounting ACAFE3581NQA level: 5 Credits: 12 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: NoneModule description:The detailed contents are as follows: Introduction to the basic principles of accounting – nature and function of accounting andaccounting theory, the history and development of accounting, the statements of financial position and of comprehensive income and ofchanges in equity and its elements. Determining the information needs of different users, Collecting and processing accounting data, theaccounting cycle, designing source documents, Journalising, posting entries from journal to the ledger, Creating subsidiary ledgers andControl accounts and Compiling a trial balance before adjustments. Determining and recording adjustments. Recording closing entries,compiling a worksheet in the closing-off procedure and compiling a post-closing trial balance. Preparing financial statements for a soleproprietor, non-profit organisations and trading and service entities; The cost concept - determination of the Cost of Goods Sold (COGS).Creating a complete accounting system that will fulfil the requirements of a specific entity.Fundamentals of Accounting BCAFE3582NQA level: 5 Credits: 12 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: NoneModule description:The detailed contents are as follows: Introduction to the framework for the preparation and presentation of financial statements (FRW),financial position, financial performance, determining profit and preparing financial statements, accounting for current and non-currentassets – cash and cash equivalents, trade and other receivables, inventory, property, plant and equipment and other non-current assets,accounting for current and non-current liabilities. Introduction to VAT (Value Added Tax). Inventory systems.Management Accounting 1ACAAM3691NQA level: 6 Credits: 12 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: NoneModule description:Introduction to Cost and Management Accounting: cost concepts and cost flows, cost behaviour and systems for recording andcontrolling costs, product and period costs, and prime and conversion costs: Material and labour costs: raw material costs and inventory160

management, inventory levels, purchasing and storage of inventory, selective inventory control techniques; Payroll accounting andmethods of compensation, individual and group incentive plans, fringe benefits, learning curves and cost estimation; Accounting foroverhead costs: identification and coding of overheads, collection, allocation, apportionment and absorption of overheads, cost driversand overhead costs, production, administration and marketing overheads. Activity based costing: activity based costing defined,comparison between traditional and activity based costing systems, activities and transactions as cost drivers, strengths and weaknessesof activity based cost system. Job order costing: Contract costing: main features of contracts and types of contracts, cost calculation forcontracts, methods of determining profit for incomplete contracts, contract cost accounts.Biology SyllabiAnimal Form and FunctionSBLG3611NQF Level: 5 Credits: 16 Module Assessment: CA 40% Examination 60% - 1 x 3 hour paperPrerequisite: SBLG3411 Introduction to Biology, SBLG3512 Diversity of LifeModule description:This module intends to provide the student with a thorough understanding of the structures and functions of different body organs andsystems in various animal species. It will cover the following topics: Structure, types and general characteristics and functions of epithelialtissues, cell-to-cell contact , structure and function of soft and specialized connective tissues, structure and functions of skeletal, smoothand cardiac muscles, structure and functions of neurons, types of neurons, neuralgia and their functions. Mechanisms of homeostasis,positive feedback, information flow. Communication lines of vertebrate nervous systems, sodium-potassium pumps, chemical synapsesand neurotransmitters. The invertebrate nervous system, the nerve net and function, the nerve cord. Functional divisions of vertebratenervous systems, brain cavities and canals, blood – brain – barrier, the limbic system. Mechanoreceptors, thermo-receptors, painreceptors, chemo-receptors, osmo-receptors, photoreceptors. Senses of taste and smell, sense of balance. The structure and function ofvertebrate eye and ear. The structure and functions of the endocrine glands. Prostaglandins-types and functions. Feedback control ofhormonal secretions. Role of hormones in arthropod metamorphosis. Integumentary system, vertebrate skin and structure and itsfunctions. Bone structure and functions, skeletal joints, skeletal muscular system. The vertebrate and invertebrate circulatory systems,links with lymphatic system, functions of blood, blood volume and composition, the heart and dorsal vessel-structure and functions, bloodpressure, cardiovascular disorders, the defense system – barrier to infection, specific and non-specific responses, inflammation, controlof immune response, cell-mediated and antibody mediated responses, immunoglobulins and lymphocytes. Gas exchange, factorsinfluencing gas exchange, gas transport pigments, vertebrate lungs and structures, breathing mechanisms, respiratory cycle, oxygen andcarbon dioxide transport, chemoreceptors (carotid bodies and aortic bodies), respiratory systems of mammals, fish, birds andarthropods. Reproduction in vertebrates and invertebrates. Temperature regulation.Cell Molecular Biology, Microbiology and Genetics for EducatorsSMBE3771NQF Level: 7 Credits: 16 Module Assessment: CA 40% Exam 60% - 1 x 3 hour paperPrerequisite: SBLG3612 Plant Form and Function, SBLG3611 Animal Form and Function, SMBL3652 Human BiologyModule description:This is a broad based module that will start with an introduction to the chemical basis of cellular processes, an overview of mitosis andmeiosis, Mendelian & non-Mendelian Genetics: monohybrid crosses, dihydrid cross, test crosses, chromosomal theory of inheritance, sexdetermination & sex-linked genes, basic genetic linkage and chromosome mapping, and the genetic code; structure and function ofeukaryotic chromosomes and mutations as the basis for genetic variations and their effects and natural selection. Macromolecules :proteins, carbohydrates fatty acids and nucleic acids and their roles in cellular organization; the structure of DNA and genome sizes andcomplexity; DNA replication; Eukaryotic transcription and RNA processing; principles of microbiology, importance of microorganisms,microbial cell structure, physiological diversity of microorganisms, prokaryotic diversity, microscopy and cell morphology, microbial cellmembranes and cell walls, surface structures and inclusions, endospores, microbial motility and bacterial taxis, staining techniques,microbial nutrition and metabolism, culture media, laboratory culture of microorganisms, enriSCHEnt and isolation, isolation of purecultures, bacterial cell division, growth of bacterial populations, measuring microbial growth, environmental effects on microbial growth,control of microbial growth, Identification of bacteria; Microbial genetics and genetic engineering: conjugation, transformation andtransduction; Mutations, causes and uses of mutations; DNA Isolation; molecular cloning, genetic recombination, detection of variation inproteins and DNA. Genetically Modified Organisms: examples, risks and benefits.Chemistry for Life SciencesSCHM3532NQF Level: 5 Credits: 16 Module Assessment: CA 50% Examination 50% - 1 x 3 hour paperPrerequisite: Faculty entry requirementsModule description:This module is designed for students that have insufficient background in chemistry and for non-chemistry majors .It is an introduction totopics in general and organic chemistry, and biochemistry. The following will be covered:161