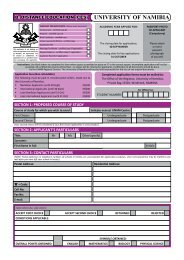

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

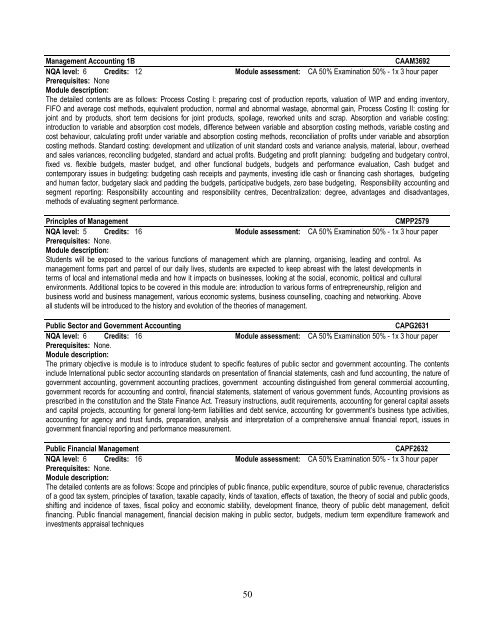

Management Accounting 1BCAAM3692NQA level: 6 Credits: 12 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: NoneModule description:The detailed contents are as follows: Process Costing I: preparing cost of production reports, valuation of WIP and ending inventory,FIFO and average cost methods, equivalent production, normal and abnormal wastage, abnormal gain, Process Costing II: costing forjoint and by products, short term decisions for joint products, spoilage, reworked units and scrap. Absorption and variable costing:introduction to variable and absorption cost models, difference between variable and absorption costing methods, variable costing andcost behaviour, calculating profit under variable and absorption costing methods, reconciliation of profits under variable and absorptioncosting methods. Standard costing: development and utilization of unit standard costs and variance analysis, material, labour, overheadand sales variances, reconciling budgeted, standard and actual profits. Budgeting and profit planning: budgeting and budgetary control,fixed vs. flexible budgets, master budget, and other functional budgets, budgets and performance evaluation, Cash budget andcontemporary issues in budgeting: budgeting cash receipts and payments, investing idle cash or financing cash shortages, budgetingand human factor, budgetary slack and padding the budgets, participative budgets, zero base budgeting, Responsibility accounting andsegment reporting: Responsibility accounting and responsibility centres, Decentralization: degree, advantages and disadvantages,methods of evaluating segment performance.Principles of ManagementCMPP2579NQA level: 5 Credits: 16 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: None.Module description:Students will be exposed to the various functions of management which are planning, organising, leading and control. Asmanagement forms part and parcel of our daily lives, students are expected to keep abreast with the latest developments interms of local and international media and how it impacts on businesses, looking at the social, economic, political and culturalenvironments. Additional topics to be covered in this module are: introduction to various forms of entrepreneurship, religion andbusiness world and business management, various economic systems, business counselling, coaching and networking. Aboveall students will be introduced to the history and evolution of the theories of management.Public Sector and Government AccountingCAPG2631NQA level: 6 Credits: 16 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: None.Module description:The primary objective is module is to introduce student to specific features of public sector and government accounting. The contentsinclude International public sector accounting standards on presentation of financial statements, cash and fund accounting, the nature ofgovernment accounting, government accounting practices, government accounting distinguished from general commercial accounting,government records for accounting and control, financial statements, statement of various government funds, Accounting provisions asprescribed in the constitution and the State Finance Act. Treasury instructions, audit requirements, accounting for general capital assetsand capital projects, accounting for general long-term liabilities and debt service, accounting for government’s business type activities,accounting for agency and trust funds, preparation, analysis and interpretation of a comprehensive annual financial report, issues ingovernment financial reporting and performance measurement.Public Financial ManagementCAPF2632NQA level: 6 Credits: 16 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: None.Module description:The detailed contents are as follows: Scope and principles of public finance, public expenditure, source of public revenue, characteristicsof a good tax system, principles of taxation, taxable capacity, kinds of taxation, effects of taxation, the theory of social and public goods,shifting and incidence of taxes, fiscal policy and economic stability, development finance, theory of public debt management, deficitfinancing. Public financial management, financial decision making in public sector, budgets, medium term expenditure framework andinvestments appraisal techniques50