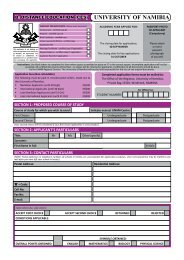

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

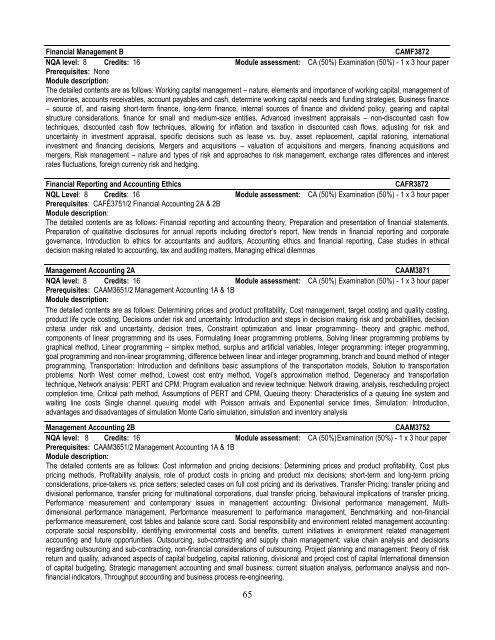

Financial Management BCAMF3872NQA level: 8 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: NoneModule description:The detailed contents are as follows: Working capital management – nature, elements and importance of working capital, management ofinventories, accounts receivables, account payables and cash, determine working capital needs and funding strategies, Business finance– source of, and raising short-term finance, long-term finance, internal sources of finance and dividend policy, gearing and capitalstructure considerations, finance for small and medium-size entities, Advanced investment appraisals – non-discounted cash flowtechniques, discounted cash flow techniques, allowing for inflation and taxation in discounted cash flows, adjusting for risk anduncertainty in investment appraisal, specific decisions such as lease vs. buy, asset replacement, capital rationing, internationalinvestment and financing decisions, Mergers and acquisitions – valuation of acquisitions and mergers, financing acquisitions andmergers, Risk management – nature and types of risk and approaches to risk management, exchange rates differences and interestrates fluctuations, foreign currency risk and hedging.Financial Reporting and Accounting EthicsCAFR3872NQL Level: 8 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: CAFÉ3751/2 Financial Accounting 2A & 2BModule description:The detailed contents are as follows: Financial reporting and accounting theory, Preparation and presentation of financial statements,Preparation of qualitative disclosures for annual reports including director’s report, New trends in financial reporting and corporategovernance, Introduction to ethics for accountants and auditors, Accounting ethics and financial reporting, Case studies in ethicaldecision making related to accounting, tax and auditing matters, Managing ethical dilemmasManagement Accounting 2ACAAM3871NQA level: 8 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: CAAM3651/2 Management Accounting 1A & 1BModule description:The detailed contents are as follows: Determining prices and product profitability, Cost management, target costing and quality costing,product life cycle costing, Decisions under risk and uncertainty: Introduction and steps in decision making risk and probabilities, decisioncriteria under risk and uncertainty, decision trees, Constraint optimization and linear programming- theory and graphic method,components of linear programming and its uses, Formulating linear programming problems, Solving linear programming problems bygraphical method, Linear programming – simplex method, surplus and artificial variables, Integer programming: integer programming,goal programming and non-linear programming, difference between linear and integer programming, branch and bound method of integerprogramming, Transportation: Introduction and definitions basic assumptions of the transportation models, Solution to transportationproblems: North West corner method, Lowest cost entry method, Vogel’s approximation method, Degeneracy and transportationtechnique, Network analysis: PERT and CPM: Program evaluation and review technique: Network drawing, analysis, rescheduling projectcompletion time, Critical path method, Assumptions of PERT and CPM, Queuing theory: Characteristics of a queuing line system andwaiting line costs Single channel queuing model with Poisson arrivals and Exponential service times, Simulation: Introduction,advantages and disadvantages of simulation Monte Carlo simulation, simulation and inventory analysisManagement Accounting 2BCAAM3752NQA level: 8 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: CAAM3651/2 Management Accounting 1A & 1BModule description:The detailed contents are as follows: Cost information and pricing decisions: Determining prices and product profitability, Cost pluspricing methods, Profitability analysis, role of product costs in pricing and product mix decisions; short-term and long-term pricingconsiderations, price-takers vs. price setters; selected cases on full cost pricing and its derivatives. Transfer Pricing: transfer pricing anddivisional performance, transfer pricing for multinational corporations, dual transfer pricing, behavioural implications of transfer pricing.Performance measurement and contemporary issues in management accounting: Divisional performance management, Multidimensionalperformance management, Performance measurement to performance management, Benchmarking and non-financialperformance measurement, cost tables and balance score card. Social responsibility and environment related management accounting:corporate social responsibility, identifying environmental costs and benefits, current initiatives in environment related managementaccounting and future opportunities. Outsourcing, sub-contracting and supply chain management: value chain analysis and decisionsregarding outsourcing and sub-contracting, non-financial considerations of outsourcing. Project planning and management: theory of riskreturn and quality, advanced aspects of capital budgeting, capital rationing, divisional and project cost of capital International dimensionof capital budgeting, Strategic management accounting and small business: current situation analysis, performance analysis and nonfinancialindicators. Throughput accounting and business process re-engineering.65