UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

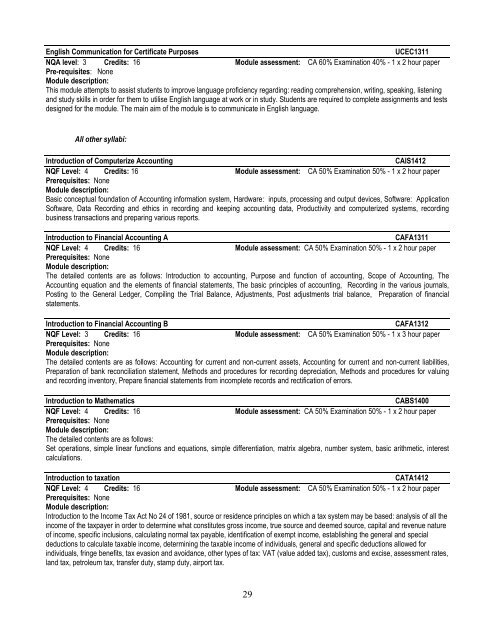

English Communication for Certificate PurposesUCEC1311NQA level: 3 Credits: 16 Module assessment: CA 60% Examination 40% - 1 x 2 hour paperPre-requisites: NoneModule description:This module attempts to assist students to improve language proficiency regarding: reading comprehension, writing, speaking, listeningand study skills in order for them to utilise English language at work or in study. Students are required to complete assignments and testsdesigned for the module. The main aim of the module is to communicate in English language.All other syllabi:Introduction of Computerize AccountingCAIS1412NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:Basic conceptual foundation of Accounting information system, Hardware: inputs, processing and output devices, Software: ApplicationSoftware, Data Recording and ethics in recording and keeping accounting data, Productivity and computerized systems, recordingbusiness transactions and preparing various reports.Introduction to Financial Accounting ACAFA1311NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:The detailed contents are as follows: Introduction to accounting, Purpose and function of accounting, Scope of Accounting, TheAccounting equation and the elements of financial statements, The basic principles of accounting, Recording in the various journals,Posting to the General Ledger, Compiling the Trial Balance, Adjustments, Post adjustments trial balance, Preparation of financialstatements.Introduction to Financial Accounting BCAFA1312NQF Level: 3 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 3 hour paperPrerequisites: NoneModule description:The detailed contents are as follows: Accounting for current and non-current assets, Accounting for current and non-current liabilities,Preparation of bank reconciliation statement, Methods and procedures for recording depreciation, Methods and procedures for valuingand recording inventory, Prepare financial statements from incomplete records and rectification of errors.Introduction to MathematicsCABS1400NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:The detailed contents are as follows:Set operations, simple linear functions and equations, simple differentiation, matrix algebra, number system, basic arithmetic, interestcalculations.Introduction to taxationCATA1412NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:Introduction to the Income Tax Act No 24 of 1981, source or residence principles on which a tax system may be based: analysis of all theincome of the taxpayer in order to determine what constitutes gross income, true source and deemed source, capital and revenue natureof income, specific inclusions, calculating normal tax payable, identification of exempt income, establishing the general and specialdeductions to calculate taxable income, determining the taxable income of individuals, general and specific deductions allowed forindividuals, fringe benefits, tax evasion and avoidance, other types of tax: VAT (value added tax), customs and excise, assessment rates,land tax, petroleum tax, transfer duty, stamp duty, airport tax.29