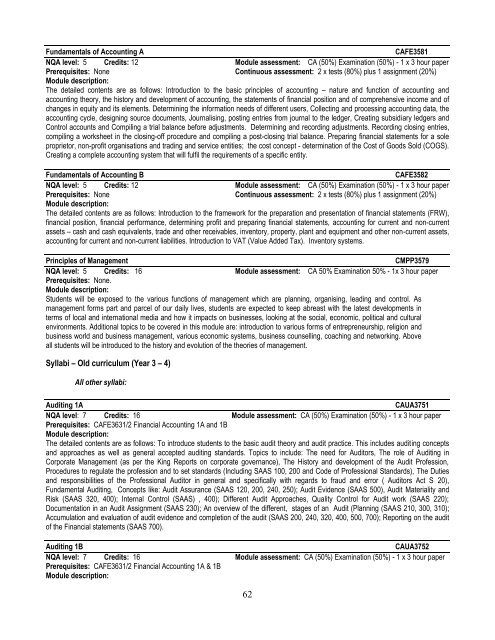

Fundamentals of Accounting ACAFE3581NQA level: 5 Credits: 12 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: None Continuous assessment: 2 x tests (80%) plus 1 assignment (20%)Module description:The detailed contents are as follows: Introduction to the basic principles of accounting – nature and function of accounting andaccounting theory, the history and development of accounting, the statements of financial position and of comprehensive income and ofchanges in equity and its elements. Determining the information needs of different users, Collecting and processing accounting data, theaccounting cycle, designing source documents, Journalising, posting entries from journal to the ledger, Creating subsidiary ledgers andControl accounts and Compiling a trial balance before adjustments. Determining and recording adjustments. Recording closing entries,compiling a worksheet in the closing-off procedure and compiling a post-closing trial balance. Preparing financial statements for a soleproprietor, non-profit organisations and trading and service entities; the cost concept - determination of the Cost of Goods Sold (COGS).Creating a complete accounting system that will fulfil the requirements of a specific entity.Fundamentals of Accounting BCAFE3582NQA level: 5 Credits: 12 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: None Continuous assessment: 2 x tests (80%) plus 1 assignment (20%)Module description:The detailed contents are as follows: Introduction to the framework for the preparation and presentation of financial statements (FRW),financial position, financial performance, determining profit and preparing financial statements, accounting for current and non-currentassets – cash and cash equivalents, trade and other receivables, inventory, property, plant and equipment and other non-current assets,accounting for current and non-current liabilities. Introduction to VAT (Value Added Tax). Inventory systems.Principles of ManagementCMPP3579NQA level: 5 Credits: 16 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: None.Module description:Students will be exposed to the various functions of management which are planning, organising, leading and control. Asmanagement forms part and parcel of our daily lives, students are expected to keep abreast with the latest developments interms of local and international media and how it impacts on businesses, looking at the social, economic, political and culturalenvironments. Additional topics to be covered in this module are: introduction to various forms of entrepreneurship, religion andbusiness world and business management, various economic systems, business counselling, coaching and networking. Aboveall students will be introduced to the history and evolution of the theories of management.Syllabi – Old curriculum (Year 3 – 4)All other syllabi:Auditing 1ACAUA3751NQA level: 7 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: CAFE3631/2 Financial Accounting 1A and 1BModule description:The detailed contents are as follows: To introduce students to the basic audit theory and audit practice. This includes auditing conceptsand approaches as well as general accepted auditing standards. Topics to include: The need for Auditors, The role of Auditing inCorporate Management (as per the King Reports on corporate governance), The History and development of the Audit Profession,Procedures to regulate the profession and to set standards (Including SAAS 100, 200 and Code of Professional Standards), The Dutiesand responsibilities of the Professional Auditor in general and specifically with regards to fraud and error ( Auditors Act S 20),Fundamental Auditing, Concepts like: Audit Assurance (SAAS 120, 200, 240, 250); Audit Evidence (SAAS 500), Audit Materiality andRisk (SAAS 320, 400); Internal Control (SAAS) , 400); Different Audit Approaches, Quality Control for Audit work (SAAS 220);Documentation in an Audit Assignment (SAAS 230); An overview of the different, stages of an Audit (Planning (SAAS 210, 300, 310);Accumulation and evaluation of audit evidence and completion of the audit (SAAS 200, 240, 320, 400, 500, 700); Reporting on the auditof the Financial statements (SAAS 700).Auditing 1BCAUA3752NQA level: 7 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: CAFE3631/2 Financial Accounting 1A & 1BModule description:62

The detailed contents are as follows: This course introduces students to the performance of the audit process. Topics include:Fundamental Identification and Formulation of Audit Objectives, Tests of Control General principals & In an elementary computerizeddata processing system (SAAS 400), The use of an overall audit plan, The audit of the income/Expense cycle, The audit of thePurchase/payments cycle, The Audit of the Inventory Cycle, The Audit of the Sources of Finance, The Audit of the Provision of Finance.Auditing 2CAUA3871NQA level: 8 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: CAUA3751/2 Auditing 1A & BModule description:The detailed contents are as follows: This course introduces students to the environment of an audit practice, the advanced theory ofauditing and legal aspects of audit practice (covering all the Namibian Auditing Standards) and carrying out of the audits. Topics toinclude: Revision of most important Audit terminology (including Audit evidence which includes sampling procedures, Audit materialityand Audit risk), Detailed coverage of the audit process: Planning (including the overall audit plan and audit program (SAAS210),Analytical procedures in the planning of an audit (SAAS520), Related parties (SAAS550), Initial engagements: opening balances(SAAS510) and Using the work of another auditor (SAAS600), Performing of the Audit process: Fieldwork of the cycles(Revenue/receipts cycle (including the work of internal auditors (SAAS610) and Management representations (SAAS580), Purchasepayments together with Monetary unit sampling, Inventory (including Estimation sampling for variables and SAAS620 “Using the work ofan expert”), financial cycle (including SAAS540 “Audit of Accounting Estimates”) Students should be shown how to deal with moreadvanced auditing problems than was covered in the third year. Completion of the audit and reporting and reporting (Subsequent events(SAAS560), Going concern (SAAS570), Contingent liabilities, General review and evaluation (SAAS520). Reporting (SAAS700, 710) alsoreporting on other African Auditing Standards, Legislation of relevance to the auditor), The Public Accountants’ and Auditors’ Act 80 of1991 (Outline,, interpretation, application and administration of the public accountants’ and auditors act, Registration, Practice andOffences, Powers and duties of Auditors). Company Legislation conversions, Formation of companies, Share capital and shares, offeringof shares and the prospectus, administration, Directors, Remedies of Members, Auditors, Accounting and Disclosure, Take-over,Reorganizations and regulation of securities, Winding up and Judicial Management) Close corporation Legislation (Formation,Registration, Deregistration and Conversion of CC, Membership, Internal and external Relations, Accounting, Disclosure and the LegalRequirements Applicable to the Accounting Officer, Liability of Members and Others.Business Research MethodsCABR3752NQA level: 8 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: NoneModule description:This course introduces students to business research and report writing with a focus on the nature of research in business management,accounting and finance disciplines. The detailed contents are as follows: Introduction to research, research in business, the role andtypes of research, Problem identification and problem statements, literature review, Hypothesis construction, and writing researchproposal, Ethics in research, Measurement: Defining “measurement”, types of measurement (nominal, ordinal, interval, ratio),Measurement concerns (reliability, validity), Measuring Complex Variables, Research design, primary and secondary data sources, datacollection, questionnaire construction, Sampling theory and Procedures: Sampling basics, Non-probability samples, Probability samples,Multi-stage sampling, Factors affecting sample size, Margin of error (confidence intervals), Data analysis: the role of parametric and nonparametricstatistics, Types of statistics (descriptive, inferential), correlation and regression, Types of analysis (univariate, bivariate,multivariate) Hypothesis testing, Interpretation and presentation of research findings: written and oral presentations.Company Law and PracticeCACP3751NQA level: 7 Credit: 16 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisite: CACL3631/2 Commercial Law A & BModule description:The detailed contents are as follows: Acquisition of legal personality, types of companies, the inceptions of a company and its constitutivedocuments (memorandum and articles of association). Capacity and representation of a company (ultra vires doctrine, turquand ruleetc). Members and the register of the company. The share capital of a company, various classes and types of shares, voting rightsattached to shares, reduction of share capital. The transfer of shares, the transferability of shares, limitations in terms of articles ofshareholders agreements. Transmission of shares on death or insolvency. Offer of shares and the prospectus. Offers in the primarymarket and secondary markets. Liability for untruths in the prospectus and sanctions to be imposed in terms of company legislation.General meetings, annual general meetings, and convening of meetings. Directors, the legal position of director and the board ofdirectors. Annual financial statements. Majority rule and protections of minority interest. Reorganization, arrangement and compromises.Judicial management and liquidation of companies. Dissolution and de-registration of companies.63