UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

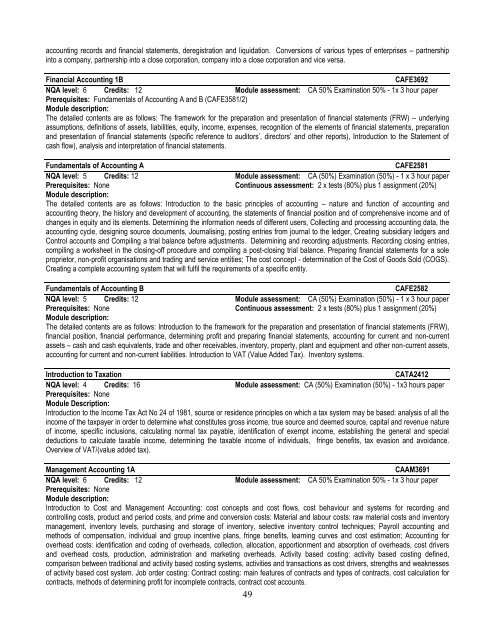

accounting records and financial statements, deregistration and liquidation. Conversions of various types of enterprises – partnershipinto a company, partnership into a close corporation, company into a close corporation and vice versa.Financial Accounting 1BCAFE3692NQA level: 6 Credits: 12 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: Fundamentals of Accounting A and B (CAFE3581/2)Module description:The detailed contents are as follows: The framework for the preparation and presentation of financial statements (FRW) – underlyingassumptions, definitions of assets, liabilities, equity, income, expenses, recognition of the elements of financial statements, preparationand presentation of financial statements (specific reference to auditors’, directors’ and other reports), Introduction to the Statement ofcash flow), analysis and interpretation of financial statements.Fundamentals of Accounting ACAFE2581NQA level: 5 Credits: 12 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: None Continuous assessment: 2 x tests (80%) plus 1 assignment (20%)Module description:The detailed contents are as follows: Introduction to the basic principles of accounting – nature and function of accounting andaccounting theory, the history and development of accounting, the statements of financial position and of comprehensive income and ofchanges in equity and its elements. Determining the information needs of different users, Collecting and processing accounting data, theaccounting cycle, designing source documents, Journalising, posting entries from journal to the ledger, Creating subsidiary ledgers andControl accounts and Compiling a trial balance before adjustments. Determining and recording adjustments. Recording closing entries,compiling a worksheet in the closing-off procedure and compiling a post-closing trial balance. Preparing financial statements for a soleproprietor, non-profit organisations and trading and service entities; The cost concept - determination of the Cost of Goods Sold (COGS).Creating a complete accounting system that will fulfil the requirements of a specific entity.Fundamentals of Accounting BCAFE2582NQA level: 5 Credits: 12 Module assessment: CA (50%) Examination (50%) - 1 x 3 hour paperPrerequisites: None Continuous assessment: 2 x tests (80%) plus 1 assignment (20%)Module description:The detailed contents are as follows: Introduction to the framework for the preparation and presentation of financial statements (FRW),financial position, financial performance, determining profit and preparing financial statements, accounting for current and non-currentassets – cash and cash equivalents, trade and other receivables, inventory, property, plant and equipment and other non-current assets,accounting for current and non-current liabilities. Introduction to VAT (Value Added Tax). Inventory systems.Introduction to TaxationCATA2412NQA level: 4 Credits: 16 Module assessment: CA (50%) Examination (50%) - 1x3 hours paperPrerequisites: NoneModule Description:Introduction to the Income Tax Act No 24 of 1981, source or residence principles on which a tax system may be based: analysis of all theincome of the taxpayer in order to determine what constitutes gross income, true source and deemed source, capital and revenue natureof income, specific inclusions, calculating normal tax payable, identification of exempt income, establishing the general and specialdeductions to calculate taxable income, determining the taxable income of individuals, fringe benefits, tax evasion and avoidance.Overview of VAT/(value added tax).Management Accounting 1ACAAM3691NQA level: 6 Credits: 12 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: NoneModule description:Introduction to Cost and Management Accounting: cost concepts and cost flows, cost behaviour and systems for recording andcontrolling costs, product and period costs, and prime and conversion costs: Material and labour costs: raw material costs and inventorymanagement, inventory levels, purchasing and storage of inventory, selective inventory control techniques; Payroll accounting andmethods of compensation, individual and group incentive plans, fringe benefits, learning curves and cost estimation; Accounting foroverhead costs: identification and coding of overheads, collection, allocation, apportionment and absorption of overheads, cost driversand overhead costs, production, administration and marketing overheads. Activity based costing: activity based costing defined,comparison between traditional and activity based costing systems, activities and transactions as cost drivers, strengths and weaknessesof activity based cost system. Job order costing: Contract costing: main features of contracts and types of contracts, cost calculation forcontracts, methods of determining profit for incomplete contracts, contract cost accounts.49