UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

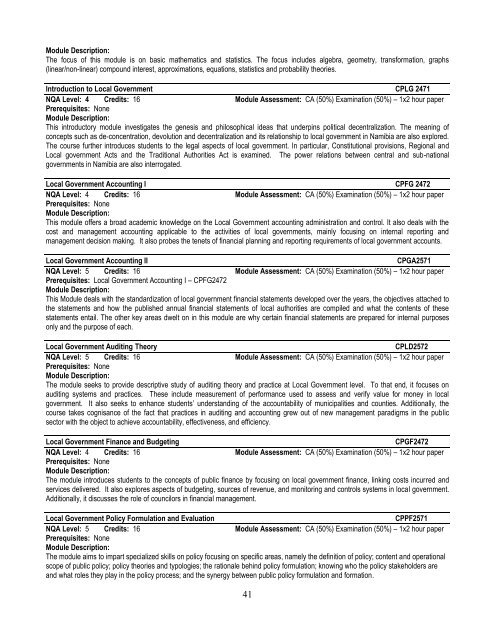

Module Description:The focus of this module is on basic mathematics and statistics. The focus includes algebra, geometry, transformation, graphs(linear/non-linear) compound interest, approximations, equations, statistics and probability theories.Introduction to Local Government CPLG 2471NQA Level: 4 Credits: 16 Module Assessment: CA (50%) Examination (50%) – 1x2 hour paperPrerequisites: NoneModule Description:This introductory module investigates the genesis and philosophical ideas that underpins political decentralization. The meaning ofconcepts such as de-concentration, devolution and decentralization and its relationship to local government in Namibia are also explored.The course further introduces students to the legal aspects of local government. In particular, Constitutional provisions, Regional andLocal government Acts and the Traditional Authorities Act is examined. The power relations between central and sub-nationalgovernments in Namibia are also interrogated.Local Government Accounting I CPFG 2472NQA Level: 4 Credits: 16 Module Assessment: CA (50%) Examination (50%) – 1x2 hour paperPrerequisites: NoneModule Description:This module offers a broad academic knowledge on the Local Government accounting administration and control. It also deals with thecost and management accounting applicable to the activities of local governments, mainly focusing on internal reporting andmanagement decision making. It also probes the tenets of financial planning and reporting requirements of local government accounts.Local Government Accounting IICPGA2571NQA Level: 5 Credits: 16 Module Assessment: CA (50%) Examination (50%) – 1x2 hour paperPrerequisites: Local Government Accounting I – CPFG2472Module Description:This Module deals with the standardization of local government financial statements developed over the years, the objectives attached tothe statements and how the published annual financial statements of local authorities are compiled and what the contents of thesestatements entail. The other key areas dwelt on in this module are why certain financial statements are prepared for internal purposesonly and the purpose of each.Local Government Auditing TheoryCPLD2572NQA Level: 5 Credits: 16 Module Assessment: CA (50%) Examination (50%) – 1x2 hour paperPrerequisites: NoneModule Description:The module seeks to provide descriptive study of auditing theory and practice at Local Government level. To that end, it focuses onauditing systems and practices. These include measurement of performance used to assess and verify value for money in localgovernment. It also seeks to enhance students’ understanding of the accountability of municipalities and counties. Additionally, thecourse takes cognisance of the fact that practices in auditing and accounting grew out of new management paradigms in the publicsector with the object to achieve accountability, effectiveness, and efficiency.Local Government Finance and BudgetingCPGF2472NQA Level: 4 Credits: 16 Module Assessment: CA (50%) Examination (50%) – 1x2 hour paperPrerequisites: NoneModule Description:The module introduces students to the concepts of public finance by focusing on local government finance, linking costs incurred andservices delivered. It also explores aspects of budgeting, sources of revenue, and monitoring and controls systems in local government.Additionally, it discusses the role of councilors in financial management.Local Government Policy Formulation and EvaluationCPPF2571NQA Level: 5 Credits: 16 Module Assessment: CA (50%) Examination (50%) – 1x2 hour paperPrerequisites: NoneModule Description:The module aims to impart specialized skills on policy focusing on specific areas, namely the definition of policy; content and operationalscope of public policy; policy theories and typologies; the rationale behind policy formulation; knowing who the policy stakeholders areand what roles they play in the policy process; and the synergy between public policy formulation and formation.41