UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

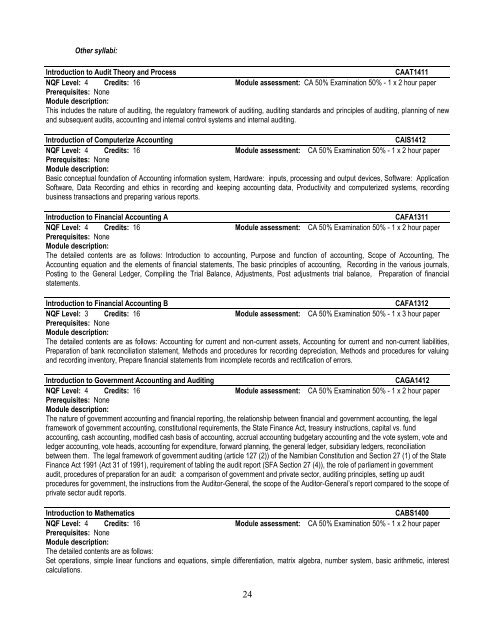

Other syllabi:Introduction to Audit Theory and ProcessCAAT1411NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:This includes the nature of auditing, the regulatory framework of auditing, auditing standards and principles of auditing, planning of newand subsequent audits, accounting and internal control systems and internal auditing.Introduction of Computerize AccountingCAIS1412NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:Basic conceptual foundation of Accounting information system, Hardware: inputs, processing and output devices, Software: ApplicationSoftware, Data Recording and ethics in recording and keeping accounting data, Productivity and computerized systems, recordingbusiness transactions and preparing various reports.Introduction to Financial Accounting ACAFA1311NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:The detailed contents are as follows: Introduction to accounting, Purpose and function of accounting, Scope of Accounting, TheAccounting equation and the elements of financial statements, The basic principles of accounting, Recording in the various journals,Posting to the General Ledger, Compiling the Trial Balance, Adjustments, Post adjustments trial balance, Preparation of financialstatements.Introduction to Financial Accounting BCAFA1312NQF Level: 3 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 3 hour paperPrerequisites: NoneModule description:The detailed contents are as follows: Accounting for current and non-current assets, Accounting for current and non-current liabilities,Preparation of bank reconciliation statement, Methods and procedures for recording depreciation, Methods and procedures for valuingand recording inventory, Prepare financial statements from incomplete records and rectification of errors.Introduction to Government Accounting and AuditingCAGA1412NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:The nature of government accounting and financial reporting, the relationship between financial and government accounting, the legalframework of government accounting, constitutional requirements, the State Finance Act, treasury instructions, capital vs. fundaccounting, cash accounting, modified cash basis of accounting, accrual accounting budgetary accounting and the vote system, vote andledger accounting, vote heads, accounting for expenditure, forward planning, the general ledger, subsidiary ledgers, reconciliationbetween them. The legal framework of government auditing (article 127 (2)) of the Namibian Constitution and Section 27 (1) of the StateFinance Act 1991 (Act 31 of 1991), requirement of tabling the audit report (SFA Section 27 (4)), the role of parliament in governmentaudit, procedures of preparation for an audit: a comparison of government and private sector, auditing principles, setting up auditprocedures for government, the instructions from the Auditor-General, the scope of the Auditor-General’s report compared to the scope ofprivate sector audit reports.Introduction to MathematicsCABS1400NQF Level: 4 Credits: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPrerequisites: NoneModule description:The detailed contents are as follows:Set operations, simple linear functions and equations, simple differentiation, matrix algebra, number system, basic arithmetic, interestcalculations.24