UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

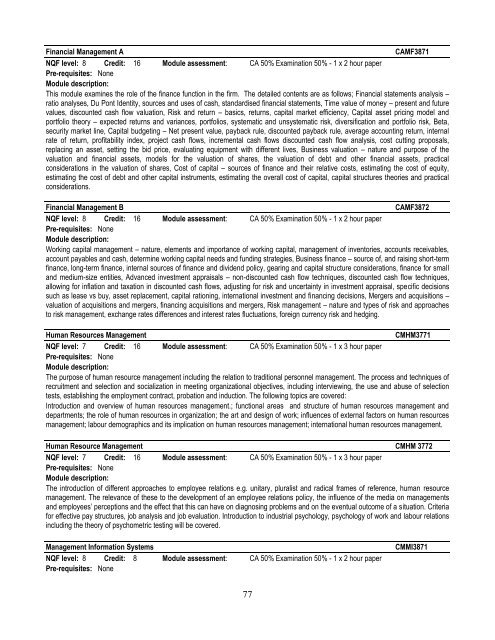

Financial Management ACAMF3871NQF level: 8 Credit: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPre-requisites: NoneModule description:This module examines the role of the finance function in the firm. The detailed contents are as follows; Financial statements analysis –ratio analyses, Du Pont Identity, sources and uses of cash, standardised financial statements, Time value of money – present and futurevalues, discounted cash flow valuation, Risk and return – basics, returns, capital market efficiency, Capital asset pricing model andportfolio theory – expected returns and variances, portfolios, systematic and unsystematic risk, diversification and portfolio risk, Beta,security market line, Capital budgeting – Net present value, payback rule, discounted payback rule, average accounting return, internalrate of return, profitability index, project cash flows, incremental cash flows discounted cash flow analysis, cost cutting proposals,replacing an asset, setting the bid price, evaluating equipment with different lives, Business valuation – nature and purpose of thevaluation and financial assets, models for the valuation of shares, the valuation of debt and other financial assets, practicalconsiderations in the valuation of shares, Cost of capital – sources of finance and their relative costs, estimating the cost of equity,estimating the cost of debt and other capital instruments, estimating the overall cost of capital, capital structures theories and practicalconsiderations.Financial Management BCAMF3872NQF level: 8 Credit: 16 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPre-requisites: NoneModule description:Working capital management – nature, elements and importance of working capital, management of inventories, accounts receivables,account payables and cash, determine working capital needs and funding strategies, Business finance – source of, and raising short-termfinance, long-term finance, internal sources of finance and dividend policy, gearing and capital structure considerations, finance for smalland medium-size entities, Advanced investment appraisals – non-discounted cash flow techniques, discounted cash flow techniques,allowing for inflation and taxation in discounted cash flows, adjusting for risk and uncertainty in investment appraisal, specific decisionssuch as lease vs buy, asset replacement, capital rationing, international investment and financing decisions, Mergers and acquisitions –valuation of acquisitions and mergers, financing acquisitions and mergers, Risk management – nature and types of risk and approachesto risk management, exchange rates differences and interest rates fluctuations, foreign currency risk and hedging.Human Resources ManagementCMHM3771NQF level: 7 Credit: 16 Module assessment: CA 50% Examination 50% - 1 x 3 hour paperPre-requisites: NoneModule description:The purpose of human resource management including the relation to traditional personnel management. The process and techniques ofrecruitment and selection and socialization in meeting organizational objectives, including interviewing, the use and abuse of selectiontests, establishing the employment contract, probation and induction. The following topics are covered:Introduction and overview of human resources management.; functional areas and structure of human resources management anddepartments; the role of human resources in organization; the art and design of work; influences of external factors on human resourcesmanagement; labour demographics and its implication on human resources management; international human resources management.Human Resource Management CMHM 3772NQF level: 7 Credit: 16 Module assessment: CA 50% Examination 50% - 1 x 3 hour paperPre-requisites: NoneModule description:The introduction of different approaches to employee relations e.g. unitary, pluralist and radical frames of reference, human resourcemanagement. The relevance of these to the development of an employee relations policy, the influence of the media on managementsand employees’ perceptions and the effect that this can have on diagnosing problems and on the eventual outcome of a situation. Criteriafor effective pay structures, job analysis and job evaluation. Introduction to industrial psychology, psychology of work and labour relationsincluding the theory of psychometric testing will be covered.Management Information SystemsNQF level: 8 Credit: 8 Module assessment: CA 50% Examination 50% - 1 x 2 hour paperPre-requisites: NoneCMMI387177