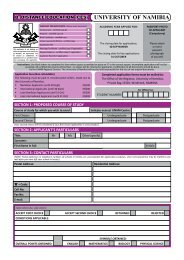

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

UNIVERSITY OF NAMIBIA CENTRE FOR EXTERNAL STUDIES ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

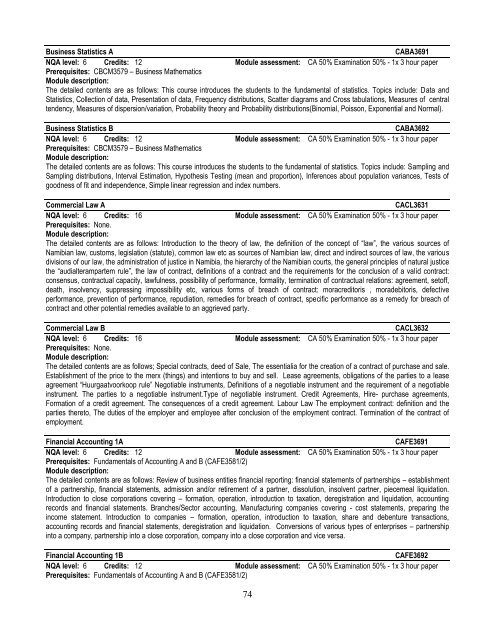

Business Statistics ACABA3691NQA level: 6 Credits: 12 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: CBCM3579 – Business MathematicsModule description:The detailed contents are as follows: This course introduces the students to the fundamental of statistics. Topics include: Data andStatistics, Collection of data, Presentation of data, Frequency distributions, Scatter diagrams and Cross tabulations, Measures of centraltendency, Measures of dispersion/variation, Probability theory and Probability distributions(Binomial, Poisson, Exponential and Normal).Business Statistics BCABA3692NQA level: 6 Credits: 12 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: CBCM3579 – Business MathematicsModule description:The detailed contents are as follows: This course introduces the students to the fundamental of statistics. Topics include: Sampling andSampling distributions, Interval Estimation, Hypothesis Testing (mean and proportion), Inferences about population variances, Tests ofgoodness of fit and independence, Simple linear regression and index numbers.Commercial Law ACACL3631NQA level: 6 Credits: 16 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: None.Module description:The detailed contents are as follows: Introduction to the theory of law, the definition of the concept of “law”, the various sources ofNamibian law, customs, legislation (statute), common law etc as sources of Namibian law, direct and indirect sources of law, the variousdivisions of our law, the administration of justice in Namibia, the hierarchy of the Namibian courts, the general principles of natural justicethe “audialterampartem rule”, the law of contract, definitions of a contract and the requirements for the conclusion of a valid contract:consensus, contractual capacity, lawfulness, possibility of performance, formality, termination of contractual relations: agreement, setoff,death, insolvency, suppressing impossibility etc, various forms of breach of contract: moracreditoris , moradebitoris, defectiveperformance, prevention of performance, repudiation, remedies for breach of contract, specific performance as a remedy for breach ofcontract and other potential remedies available to an aggrieved party.Commercial Law BCACL3632NQA level: 6 Credits: 16 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: None.Module description:The detailed contents are as follows; Special contracts, deed of Sale, The essentialia for the creation of a contract of purchase and sale.Establishment of the price to the merx (things) and intentions to buy and sell. Lease agreements, obligations of the parties to a leaseagreement “Huurgaatvoorkoop rule” Negotiable instruments, Definitions of a negotiable instrument and the requirement of a negotiableinstrument. The parties to a negotiable instrument.Type of negotiable instrument. Credit Agreements, Hire- purchase agreements,Formation of a credit agreement. The consequences of a credit agreement. Labour Law The employment contract: definition and theparties thereto, The duties of the employer and employee after conclusion of the employment contract. Termination of the contract ofemployment.Financial Accounting 1ACAFE3691NQA level: 6 Credits: 12 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: Fundamentals of Accounting A and B (CAFE3581/2)Module description:The detailed contents are as follows: Review of business entities financial reporting: financial statements of partnerships – establishmentof a partnership, financial statements, admission and/or retirement of a partner, dissolution, insolvent partner, piecemeal liquidation.Introduction to close corporations covering – formation, operation, introduction to taxation, deregistration and liquidation, accountingrecords and financial statements. Branches/Sector accounting, Manufacturing companies covering - cost statements, preparing theincome statement. Introduction to companies – formation, operation, introduction to taxation, share and debenture transactions,accounting records and financial statements, deregistration and liquidation. Conversions of various types of enterprises – partnershipinto a company, partnership into a close corporation, company into a close corporation and vice versa.Financial Accounting 1BCAFE3692NQA level: 6 Credits: 12 Module assessment: CA 50% Examination 50% - 1x 3 hour paperPrerequisites: Fundamentals of Accounting A and B (CAFE3581/2)74