Transend - Appendix 5 Renewal capital expenditure - Australian ...

Transend - Appendix 5 Renewal capital expenditure - Australian ...

Transend - Appendix 5 Renewal capital expenditure - Australian ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

0BInvestment Evaluation Summary<br />

TNM-GS-809-0720<br />

7.1 OPTION 1: MAINTAIN EXISTING TRANSMISSION LINE PROTECTION SCHEMES<br />

AND DEFER REPLACEMENTS<br />

This option comprises maintaining the existing transmission line protection schemes.<br />

This option would not satisfy the investment needs and compliance issues outlined in Sections 3 and 4 of this paper. In<br />

addition, it would not align with the strategies detailed in the EHV Transmission Line Protection Asset Management plan<br />

(TNM-PL-809-0701) and would not be consistent with good electricity industry practice.<br />

Maintaining the existing transmission line protection schemes presents the significant risk of failures impacting on the<br />

operation of the transmission network.<br />

7.2 OPTION 2: REPLACE TRANSMISSION LINE PROTECTION SCHEMES<br />

This option comprises the replacement of the 220 kV transmission line protection schemes with new protection schemes.<br />

This option would satisfy all of the investment needs and compliance issues outlined in section 4 of this paper and would<br />

provide all of the benefits identified in Section 6.<br />

In addition, this option is consistent with the strategies detailed in the EHV Transmission Line Protection Asset Management<br />

plan (TNM-PL-809-0701) and is consistent with good electricity industry practice.<br />

8 OPTION ESTIMATES<br />

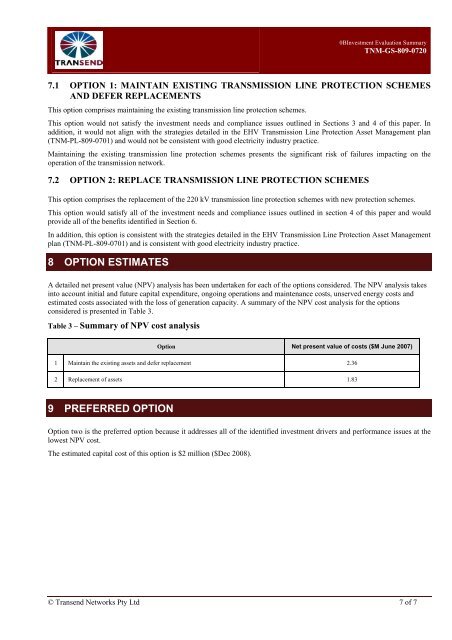

A detailed net present value (NPV) analysis has been undertaken for each of the options considered. The NPV analysis takes<br />

into account initial and future <strong>capital</strong> <strong>expenditure</strong>, ongoing operations and maintenance costs, unserved energy costs and<br />

estimated costs associated with the loss of generation capacity. A summary of the NPV cost analysis for the options<br />

considered is presented in Table 3.<br />

Table 3 – Summary of NPV cost analysis<br />

Option Net present value of costs ($M June 2007)<br />

1 Maintain the existing assets and defer replacement 2.36<br />

2 Replacement of assets 1.83<br />

9 PREFERRED OPTION<br />

Option two is the preferred option because it addresses all of the identified investment drivers and performance issues at the<br />

lowest NPV cost.<br />

The estimated <strong>capital</strong> cost of this option is $2 million ($Dec 2008).<br />

© <strong>Transend</strong> Networks Pty Ltd 7 of 7