Report of the Local Government Efficiency Review Group

Report of the Local Government Efficiency Review Group

Report of the Local Government Efficiency Review Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

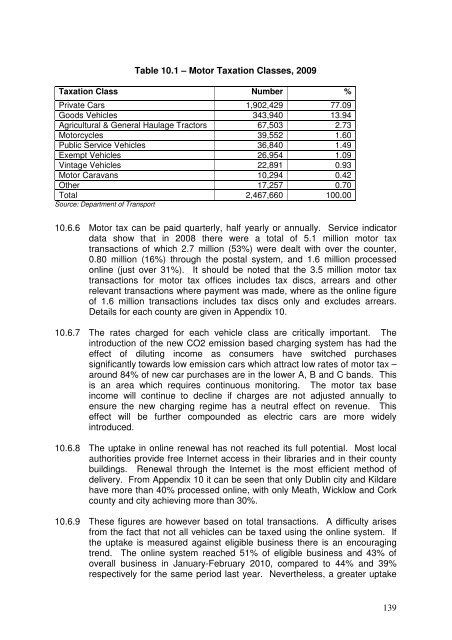

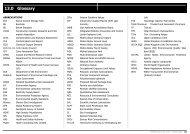

Table 10.1 – Motor Taxation Classes, 2009<br />

Taxation Class Number %<br />

Private Cars 1,902,429 77.09<br />

Goods Vehicles 343,940 13.94<br />

Agricultural & General Haulage Tractors 67,503 2.73<br />

Motorcycles 39,552 1.60<br />

Public Service Vehicles 36,840 1.49<br />

Exempt Vehicles 26,954 1.09<br />

Vintage Vehicles 22,891 0.93<br />

Motor Caravans 10,294 0.42<br />

O<strong>the</strong>r 17,257 0.70<br />

Total 2,467,660 100.00<br />

Source: Department <strong>of</strong> Transport<br />

10.6.6 Motor tax can be paid quarterly, half yearly or annually. Service indicator<br />

data show that in 2008 <strong>the</strong>re were a total <strong>of</strong> 5.1 million motor tax<br />

transactions <strong>of</strong> which 2.7 million (53%) were dealt with over <strong>the</strong> counter,<br />

0.80 million (16%) through <strong>the</strong> postal system, and 1.6 million processed<br />

online (just over 31%). It should be noted that <strong>the</strong> 3.5 million motor tax<br />

transactions for motor tax <strong>of</strong>fices includes tax discs, arrears and o<strong>the</strong>r<br />

relevant transactions where payment was made, where as <strong>the</strong> online figure<br />

<strong>of</strong> 1.6 million transactions includes tax discs only and excludes arrears.<br />

Details for each county are given in Appendix 10.<br />

10.6.7 The rates charged for each vehicle class are critically important. The<br />

introduction <strong>of</strong> <strong>the</strong> new CO2 emission based charging system has had <strong>the</strong><br />

effect <strong>of</strong> diluting income as consumers have switched purchases<br />

significantly towards low emission cars which attract low rates <strong>of</strong> motor tax –<br />

around 84% <strong>of</strong> new car purchases are in <strong>the</strong> lower A, B and C bands. This<br />

is an area which requires continuous monitoring. The motor tax base<br />

income will continue to decline if charges are not adjusted annually to<br />

ensure <strong>the</strong> new charging regime has a neutral effect on revenue. This<br />

effect will be fur<strong>the</strong>r compounded as electric cars are more widely<br />

introduced.<br />

10.6.8 The uptake in online renewal has not reached its full potential. Most local<br />

authorities provide free Internet access in <strong>the</strong>ir libraries and in <strong>the</strong>ir county<br />

buildings. Renewal through <strong>the</strong> Internet is <strong>the</strong> most efficient method <strong>of</strong><br />

delivery. From Appendix 10 it can be seen that only Dublin city and Kildare<br />

have more than 40% processed online, with only Meath, Wicklow and Cork<br />

county and city achieving more than 30%.<br />

10.6.9 These figures are however based on total transactions. A difficulty arises<br />

from <strong>the</strong> fact that not all vehicles can be taxed using <strong>the</strong> online system. If<br />

<strong>the</strong> uptake is measured against eligible business <strong>the</strong>re is an encouraging<br />

trend. The online system reached 51% <strong>of</strong> eligible business and 43% <strong>of</strong><br />

overall business in January-February 2010, compared to 44% and 39%<br />

respectively for <strong>the</strong> same period last year. Never<strong>the</strong>less, a greater uptake<br />

139