CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

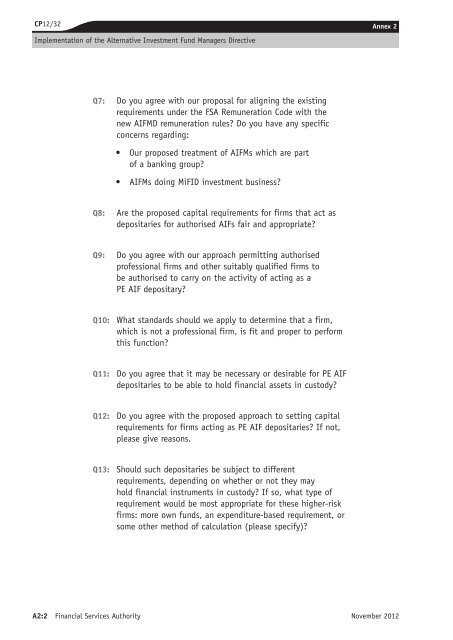

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

Q7: Do you agree with our proposal for aligning <strong>the</strong> existing<br />

requirements under <strong>the</strong> FSA Remuneration Code with <strong>the</strong><br />

new AIFMD remuneration rules? Do you have any specific<br />

concerns regarding:<br />

• Our proposed treatment <strong>of</strong> AIFMs which are part<br />

<strong>of</strong> a banking group?<br />

• AIFMs doing MiFID investment business?<br />

Q8: Are <strong>the</strong> proposed capital requirements for firms that act as<br />

depositaries for authorised AIFs fair and appropriate?<br />

Q9: Do you agree with our approach permitting authorised<br />

pr<strong>of</strong>essional firms and o<strong>the</strong>r suitably qualified firms to<br />

be authorised to carry on <strong>the</strong> activity <strong>of</strong> acting as a<br />

PE AIF depositary?<br />

Q10: What standards should we apply to determine that a firm,<br />

which is not a pr<strong>of</strong>essional firm, is fit and proper to perform<br />

this function?<br />

Q11: Do you agree that it may be necessary or desirable for PE AIF<br />

depositaries to be able to hold financial assets in custody?<br />

Q12: Do you agree with <strong>the</strong> proposed approach to setting capital<br />

requirements for firms acting as PE AIF depositaries? If not,<br />

please give reasons.<br />

Q13: Should such depositaries be subject to different<br />

requirements, depending on whe<strong>the</strong>r or not <strong>the</strong>y may<br />

hold financial instruments in custody? If so, what type <strong>of</strong><br />

requirement would be most appropriate for <strong>the</strong>se higher-risk<br />

firms: more own funds, an expenditure-based requirement, or<br />

some o<strong>the</strong>r method <strong>of</strong> calculation (please specify)?<br />

Annex 2 X<br />

A2:2 Financial Services Authority November 2012