CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

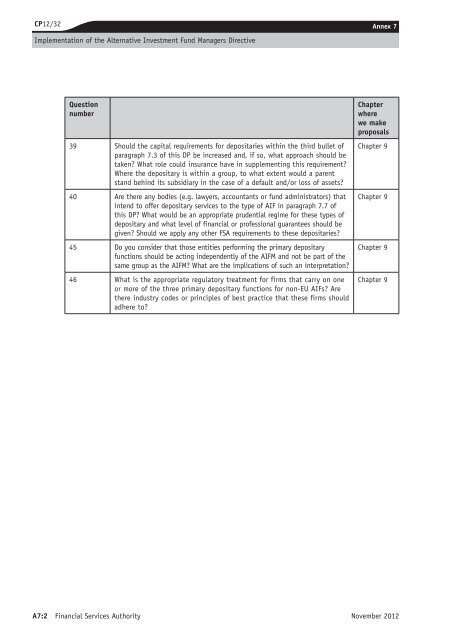

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

Question<br />

number<br />

39 Should <strong>the</strong> capital requirements for depositaries within <strong>the</strong> third bullet <strong>of</strong><br />

paragraph 7.3 <strong>of</strong> this DP be increased and, if so, what approach should be<br />

taken? What role could insurance have in supplementing this requirement?<br />

Where <strong>the</strong> depositary is within a group, to what extent would a parent<br />

stand behind its subsidiary in <strong>the</strong> case <strong>of</strong> a default and/or loss <strong>of</strong> assets?<br />

40 Are <strong>the</strong>re any bodies (e.g. lawyers, accountants or fund <strong>admin</strong>istrators) that<br />

intend to <strong>of</strong>fer depositary services to <strong>the</strong> type <strong>of</strong> AIF in paragraph 7.7 <strong>of</strong><br />

this DP? What would be an appropriate prudential regime for <strong>the</strong>se types <strong>of</strong><br />

depositary and what level <strong>of</strong> financial or pr<strong>of</strong>essional guarantees should be<br />

given? Should we apply any o<strong>the</strong>r FSA requirements to <strong>the</strong>se depositaries?<br />

45 Do you consider that those entities performing <strong>the</strong> primary depositary<br />

functions should be acting independently <strong>of</strong> <strong>the</strong> AIFM and not be part <strong>of</strong> <strong>the</strong><br />

same group as <strong>the</strong> AIFM? What are <strong>the</strong> implications <strong>of</strong> such an interpretation?<br />

46 What is <strong>the</strong> appropriate regulatory treatment for firms that carry on one<br />

or more <strong>of</strong> <strong>the</strong> three primary depositary functions for non-EU AIFs? Are<br />

<strong>the</strong>re industry codes or principles <strong>of</strong> best practice that <strong>the</strong>se firms should<br />

adhere to?<br />

Annex 7X<br />

Chapter<br />

where<br />

we make<br />

proposals<br />

Chapter 9<br />

Chapter 9<br />

Chapter 9<br />

Chapter 9<br />

A7:2 Financial Services Authority November 2012