CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

November 2012<br />

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

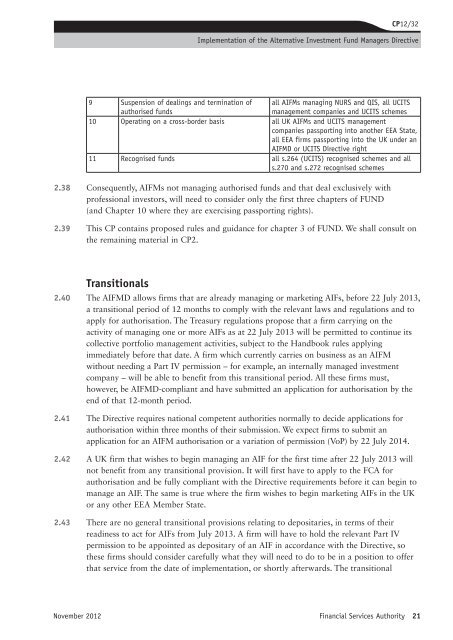

9 Suspension <strong>of</strong> dealings and termination <strong>of</strong> all AIFMs managing NURS and QIS, all UCITS<br />

authorised funds<br />

management companies and UCITS schemes<br />

10 Operating on a cross-border basis all UK AIFMs and UCITS management<br />

companies passporting into ano<strong>the</strong>r EEA State,<br />

all EEA firms passporting into <strong>the</strong> UK under an<br />

AIFMD or UCITS Directive right<br />

11 Recognised funds all s.264 (UCITS) recognised schemes and all<br />

s.270 and s.272 recognised schemes<br />

2.38 Consequently, AIFMs not managing authorised funds and that deal exclusively with<br />

pr<strong>of</strong>essional investors, will need to consider only <strong>the</strong> first three chapters <strong>of</strong> FUND<br />

(and Chapter 10 where <strong>the</strong>y are exercising passporting rights).<br />

2.39 This CP contains proposed rules and guidance for chapter 3 <strong>of</strong> FUND. We shall consult on<br />

<strong>the</strong> remaining material in CP2.<br />

Transitionals<br />

2.40 The AIFMD allows firms that are already managing or marketing AIFs, before 22 July 2013,<br />

a transitional period <strong>of</strong> 12 months to comply with <strong>the</strong> relevant laws and regulations and to<br />

apply for authorisation. The Treasury regulations propose that a firm carrying on <strong>the</strong><br />

activity <strong>of</strong> managing one or more AIFs as at 22 July 2013 will be permitted to continue its<br />

collective portfolio management activities, subject to <strong>the</strong> Handbook rules applying<br />

immediately before that date. A firm which currently carries on business as an AIFM<br />

without needing a Part IV permission – for example, an internally managed investment<br />

company – will be able to benefit from this transitional period. All <strong>the</strong>se firms must,<br />

however, be AIFMD-compliant and have submitted an application for authorisation by <strong>the</strong><br />

end <strong>of</strong> that 12-month period.<br />

2.41 The Directive requires national competent authorities normally to decide applications for<br />

authorisation within three months <strong>of</strong> <strong>the</strong>ir submission. We expect firms to submit an<br />

application for an AIFM authorisation or a variation <strong>of</strong> permission (VoP) by 22 July 2014.<br />

2.42 A UK firm that wishes to begin managing an AIF for <strong>the</strong> first time after 22 July 2013 will<br />

not benefit from any transitional provision. It will first have to apply to <strong>the</strong> FCA for<br />

authorisation and be fully compliant with <strong>the</strong> Directive requirements before it can begin to<br />

manage an AIF. The same is true where <strong>the</strong> firm wishes to begin marketing AIFs in <strong>the</strong> UK<br />

or any o<strong>the</strong>r EEA Member State.<br />

2.43 There are no general transitional provisions relating to depositaries, in terms <strong>of</strong> <strong>the</strong>ir<br />

readiness to act for AIFs from July 2013. A firm will have to hold <strong>the</strong> relevant Part IV<br />

permission to be appointed as depositary <strong>of</strong> an AIF in accordance with <strong>the</strong> Directive, so<br />

<strong>the</strong>se firms should consider carefully what <strong>the</strong>y will need to do to be in a position to <strong>of</strong>fer<br />

that service from <strong>the</strong> date <strong>of</strong> implementation, or shortly afterwards. The transitional<br />

Financial Services Authority 21