CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annex 1<br />

November 2012<br />

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

56. As a result <strong>of</strong> our proposals in this CP, AIFMs who are members <strong>of</strong> a banking group caught<br />

by CRD3 and AIFMs doing MiFID investment business under Article 6(4) <strong>of</strong> <strong>the</strong> Directive<br />

will be subject to <strong>the</strong> remuneration regimes <strong>of</strong> both CRD3 and AIFMD. To alleviate <strong>the</strong><br />

burden <strong>of</strong> compliance with <strong>the</strong> two regimes, we will produce guidance to <strong>the</strong> Remuneration<br />

Code to <strong>the</strong> effect that compliance with <strong>the</strong> AIFMD remuneration regime will be considered<br />

compliance with <strong>the</strong> Remuneration Code. Never<strong>the</strong>less, we expect some minor costs<br />

relating to <strong>the</strong> overlapping regimes, for example, at <strong>the</strong> remuneration committee <strong>of</strong> <strong>the</strong><br />

group holding company where applicable or supervisory level <strong>of</strong> AIFMs doing MiFID<br />

investment business.<br />

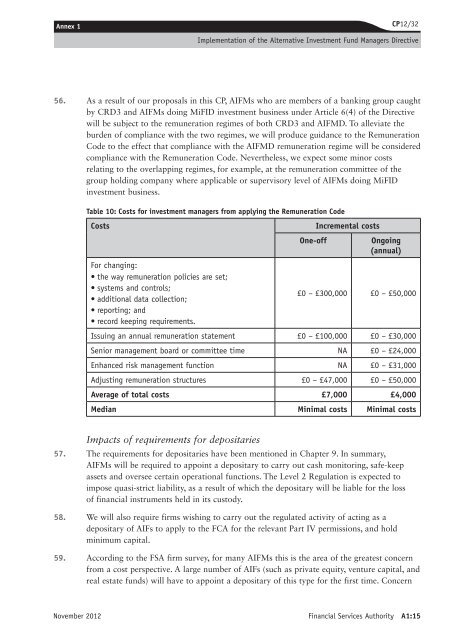

Table 10: Costs for investment managers from applying <strong>the</strong> Remuneration Code<br />

Costs Incremental costs<br />

For changing:<br />

• <strong>the</strong> way remuneration policies are set;<br />

• systems and controls;<br />

• additional data collection;<br />

• reporting; and<br />

• record keeping requirements.<br />

One-<strong>of</strong>f Ongoing<br />

(annual)<br />

£0 – £300,000 £0 – £50,000<br />

Issuing an annual remuneration statement £0 – £100,000 £0 – £30,000<br />

Senior management board or committee time NA £0 – £24,000<br />

Enhanced risk management function NA £0 – £31,000<br />

Adjusting remuneration structures £0 – £47,000 £0 – £50,000<br />

Average <strong>of</strong> total costs £7,000 £4,000<br />

Median Minimal costs Minimal costs<br />

Impacts <strong>of</strong> requirements for depositaries<br />

57. The requirements for depositaries have been mentioned in Chapter 9. In summary,<br />

AIFMs will be required to appoint a depositary to carry out cash monitoring, safe-keep<br />

assets and oversee certain operational functions. The Level 2 Regulation is expected to<br />

impose quasi-strict liability, as a result <strong>of</strong> which <strong>the</strong> depositary will be liable for <strong>the</strong> loss<br />

<strong>of</strong> financial instruments held in its custody.<br />

58. We will also require firms wishing to carry out <strong>the</strong> regulated activity <strong>of</strong> acting as a<br />

depositary <strong>of</strong> AIFs to apply to <strong>the</strong> FCA for <strong>the</strong> relevant Part IV permissions, and hold<br />

minimum capital.<br />

59. According to <strong>the</strong> FSA firm survey, for many AIFMs this is <strong>the</strong> area <strong>of</strong> <strong>the</strong> greatest concern<br />

from a cost perspective. A large number <strong>of</strong> AIFs (such as private equity, venture capital, and<br />

real estate funds) will have to appoint a depositary <strong>of</strong> this type for <strong>the</strong> first time. Concern<br />

Financial Services Authority A1:15