CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Annex 1<br />

November 2012<br />

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

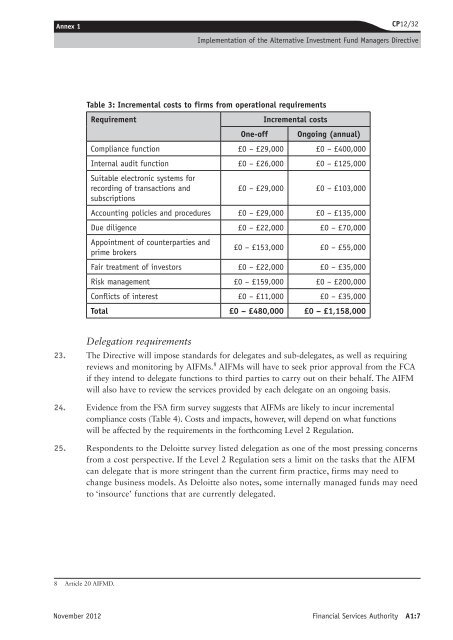

Table 3: Incremental costs to firms from operational requirements<br />

Requirement Incremental costs<br />

One-<strong>of</strong>f Ongoing (annual)<br />

Compliance function £0 – £29,000 £0 – £400,000<br />

Internal audit function £0 – £26,000 £0 – £125,000<br />

Suitable electronic systems for<br />

recording <strong>of</strong> transactions and<br />

subscriptions<br />

£0 – £29,000 £0 – £103,000<br />

Accounting policies and procedures £0 – £29,000 £0 – £135,000<br />

Due diligence £0 – £22,000 £0 – £70,000<br />

Appointment <strong>of</strong> counterparties and<br />

prime brokers<br />

£0 – £153,000 £0 – £55,000<br />

Fair treatment <strong>of</strong> investors £0 – £22,000 £0 – £35,000<br />

Risk management £0 – £159,000 £0 – £200,000<br />

Conflicts <strong>of</strong> interest £0 – £11,000 £0 – £35,000<br />

Total £0 – £480,000 £0 – £1,158,000<br />

Delegation requirements<br />

23. The Directive will impose standards for delegates and sub-delegates, as well as requiring<br />

reviews and monitoring by AIFMs. 8 AIFMs will have to seek prior approval from <strong>the</strong> FCA<br />

if <strong>the</strong>y intend to delegate functions to third parties to carry out on <strong>the</strong>ir behalf. The AIFM<br />

will also have to review <strong>the</strong> services provided by each delegate on an ongoing basis.<br />

24. Evidence from <strong>the</strong> FSA firm survey suggests that AIFMs are likely to incur incremental<br />

compliance costs (Table 4). Costs and impacts, however, will depend on what functions<br />

will be affected by <strong>the</strong> requirements in <strong>the</strong> forthcoming Level 2 Regulation.<br />

25. Respondents to <strong>the</strong> Deloitte survey listed delegation as one <strong>of</strong> <strong>the</strong> most pressing concerns<br />

from a cost perspective. If <strong>the</strong> Level 2 Regulation sets a limit on <strong>the</strong> tasks that <strong>the</strong> AIFM<br />

can delegate that is more stringent than <strong>the</strong> current firm practice, firms may need to<br />

change business models. As Deloitte also notes, some internally managed funds may need<br />

to ‘insource’ functions that are currently delegated.<br />

8 Article 20 AIFMD.<br />

Financial Services Authority A1:7