CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

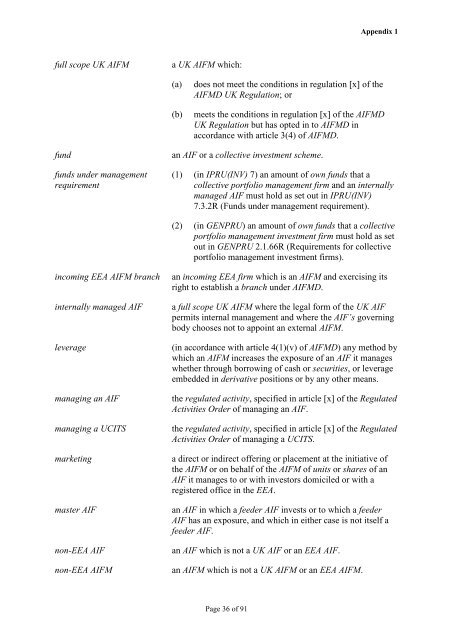

full scope UK AIFM a UK AIFM which:<br />

Page 36 <strong>of</strong> 91<br />

Appendix 1<br />

(a) does not meet <strong>the</strong> conditions in regulation [x] <strong>of</strong> <strong>the</strong><br />

AIFMD UK Regulation; or<br />

(b) meets <strong>the</strong> conditions in regulation [x] <strong>of</strong> <strong>the</strong> AIFMD<br />

UK Regulation but has opted in to AIFMD in<br />

accordance with article 3(4) <strong>of</strong> AIFMD.<br />

fund an AIF or a collective investment scheme.<br />

funds under management<br />

requirement<br />

(1) (in IPRU(INV) 7) an amount <strong>of</strong> own funds that a<br />

collective portfolio management firm and an internally<br />

managed AIF must hold as set out in IPRU(INV)<br />

7.3.2R (Funds under management requirement).<br />

(2) (in GENPRU) an amount <strong>of</strong> own funds that a collective<br />

portfolio management investment firm must hold as set<br />

out in GENPRU 2.1.66R (Requirements for collective<br />

portfolio management investment firms).<br />

incoming EEA AIFM branch an incoming EEA firm which is an AIFM and exercising its<br />

right to establish a branch under AIFMD.<br />

internally managed AIF a full scope UK AIFM where <strong>the</strong> legal form <strong>of</strong> <strong>the</strong> UK AIF<br />

permits internal management and where <strong>the</strong> AIF’s governing<br />

body chooses not to appoint an external AIFM.<br />

leverage (in accordance with article 4(1)(v) <strong>of</strong> AIFMD) any method by<br />

which an AIFM increases <strong>the</strong> exposure <strong>of</strong> an AIF it manages<br />

whe<strong>the</strong>r through borrowing <strong>of</strong> cash or securities, or leverage<br />

embedded in derivative positions or by any o<strong>the</strong>r means.<br />

managing an AIF <strong>the</strong> regulated activity, specified in article [x] <strong>of</strong> <strong>the</strong> Regulated<br />

Activities Order <strong>of</strong> managing an AIF.<br />

managing a UCITS <strong>the</strong> regulated activity, specified in article [x] <strong>of</strong> <strong>the</strong> Regulated<br />

Activities Order <strong>of</strong> managing a UCITS.<br />

marketing a direct or indirect <strong>of</strong>fering or placement at <strong>the</strong> initiative <strong>of</strong><br />

<strong>the</strong> AIFM or on behalf <strong>of</strong> <strong>the</strong> AIFM <strong>of</strong> units or shares <strong>of</strong> an<br />

AIF it manages to or with investors domiciled or with a<br />

registered <strong>of</strong>fice in <strong>the</strong> EEA.<br />

master AIF an AIF in which a feeder AIF invests or to which a feeder<br />

AIF has an exposure, and which in ei<strong>the</strong>r case is not itself a<br />

feeder AIF.<br />

non-EEA AIF an AIF which is not a UK AIF or an EEA AIF.<br />

non-EEA AIFM an AIFM which is not a UK AIFM or an EEA AIFM.