CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

Annex X<br />

2.33 We considered o<strong>the</strong>r possible approaches carefully before we published DP12/1, but<br />

concluded that <strong>the</strong>y would not be best for <strong>the</strong> majority <strong>of</strong> future AIFMs, and this remains<br />

our view. The single sourcebook that we are proposing, containing a set <strong>of</strong> rules common<br />

to all AIFMs, and with additional rules applicable to categories <strong>of</strong> AIFs (such as non-UCITS<br />

authorised funds), is likely to be more convenient for most users. We think it will be<br />

possible to include UCITS and <strong>the</strong>ir management companies in this structure without<br />

unduly complicating readers’ navigation <strong>of</strong> <strong>the</strong> rules and guidance.<br />

2.34 The draft instrument in Appendix 1 <strong>of</strong> this paper consists <strong>of</strong> amendments to existing<br />

sourcebooks and a new module, to be known as <strong>the</strong> Investment Funds sourcebook (FUND).<br />

FUND will in due course entirely replace COLL, although <strong>the</strong>re will be transitional<br />

provisions to ease <strong>the</strong> process, particularly for rules applying to UCITS schemes. We will<br />

address this in more detail in CP2.<br />

2.35 We also proposed in DP12/1 that we would reorganise Handbook material relating to <strong>the</strong><br />

prudential requirements for UCITS management companies. We intend to proceed with<br />

<strong>the</strong>se changes.<br />

Structure <strong>of</strong> <strong>the</strong> Investment Funds sourcebook<br />

2.36 FUND will be a single sourcebook combining requirements for AIFs, UCITS and <strong>the</strong><br />

companies that manage <strong>the</strong>m. It will do this in a way that should make it easy for readers<br />

to distinguish which requirements apply to which type <strong>of</strong> fund or fund manager. The new<br />

sourcebook will include rules and guidance on all subjects that are currently addressed by<br />

COLL, but it will have a much wider scope, to reflect <strong>the</strong> range <strong>of</strong> fund managers,<br />

depositaries and o<strong>the</strong>r firms that are affected by AIFMD.<br />

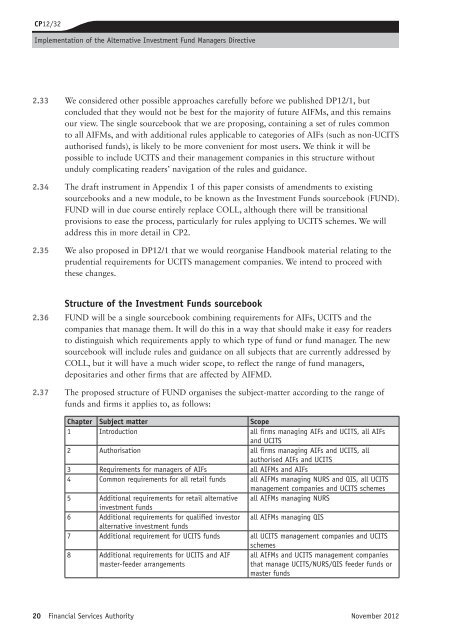

2.37 The proposed structure <strong>of</strong> FUND organises <strong>the</strong> subject-matter according to <strong>the</strong> range <strong>of</strong><br />

funds and firms it applies to, as follows:<br />

Chapter Subject matter Scope<br />

1 Introduction all firms managing AIFs and UCITS, all AIFs<br />

and UCITS<br />

2 Authorisation all firms managing AIFs and UCITS, all<br />

authorised AIFs and UCITS<br />

3 Requirements for managers <strong>of</strong> AIFs all AIFMs and AIFs<br />

4 Common requirements for all retail funds all AIFMs managing NURS and QIS, all UCITS<br />

management companies and UCITS schemes<br />

5 Additional requirements for retail alternative<br />

investment funds<br />

all AIFMs managing NURS<br />

6 Additional requirements for qualified investor<br />

alternative investment funds<br />

all AIFMs managing QIS<br />

7 Additional requirement for UCITS funds all UCITS management companies and UCITS<br />

schemes<br />

8 Additional requirements for UCITS and AIF<br />

master-feeder arrangements<br />

all AIFMs and UCITS management companies<br />

that manage UCITS/NURS/QIS feeder funds or<br />

master funds<br />

20 Financial Services Authority November 2012