CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 59 <strong>of</strong> 91<br />

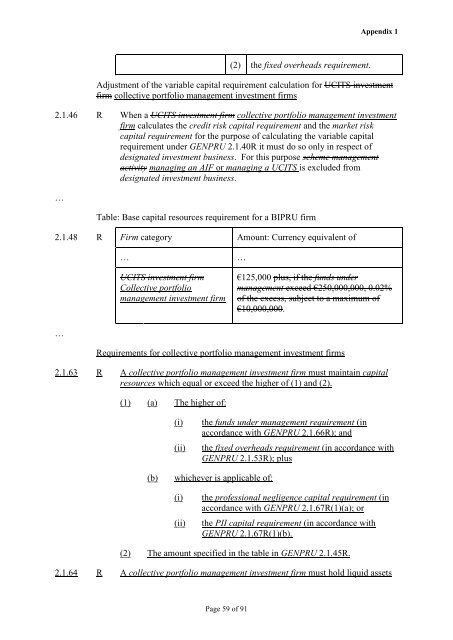

(2) <strong>the</strong> fixed overheads requirement.<br />

Appendix 1<br />

Adjustment <strong>of</strong> <strong>the</strong> variable capital requirement calculation for UCITS investment<br />

firm collective portfolio management investment firms<br />

2.1.46 R When a UCITS investment firm collective portfolio management investment<br />

firm calculates <strong>the</strong> credit risk capital requirement and <strong>the</strong> market risk<br />

capital requirement for <strong>the</strong> purpose <strong>of</strong> calculating <strong>the</strong> variable capital<br />

requirement under GENPRU 2.1.40R it must do so only in respect <strong>of</strong><br />

designated investment business. For this purpose scheme management<br />

activity managing an AIF or managing a UCITS is excluded from<br />

designated investment business.<br />

…<br />

Table: Base capital resources requirement for a BIPRU firm<br />

2.1.48 R Firm category Amount: Currency equivalent <strong>of</strong><br />

…<br />

… …<br />

UCITS investment firm<br />

Collective portfolio<br />

management investment firm<br />

€125,000 plus, if <strong>the</strong> funds under<br />

management exceed €250,000,000, 0.02%<br />

<strong>of</strong> <strong>the</strong> excess, subject to a maximum <strong>of</strong><br />

€10,000,000.<br />

Requirements for collective portfolio management investment firms<br />

2.1.63 R A collective portfolio management investment firm must maintain capital<br />

resources which equal or exceed <strong>the</strong> higher <strong>of</strong> (1) and (2).<br />

(1) (a) The higher <strong>of</strong>:<br />

(i) <strong>the</strong> funds under management requirement (in<br />

accordance with GENPRU 2.1.66R); and<br />

(ii) <strong>the</strong> fixed overheads requirement (in accordance with<br />

GENPRU 2.1.53R); plus<br />

(b) whichever is applicable <strong>of</strong>:<br />

(i) <strong>the</strong> pr<strong>of</strong>essional negligence capital requirement (in<br />

accordance with GENPRU 2.1.67R(1)(a); or<br />

(ii) <strong>the</strong> PII capital requirement (in accordance with<br />

GENPRU 2.1.67R(1)(b).<br />

(2) The amount specified in <strong>the</strong> table in GENPRU 2.1.45R.<br />

2.1.64 R A collective portfolio management investment firm must hold liquid assets