CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 67 <strong>of</strong> 91<br />

Appendix 1<br />

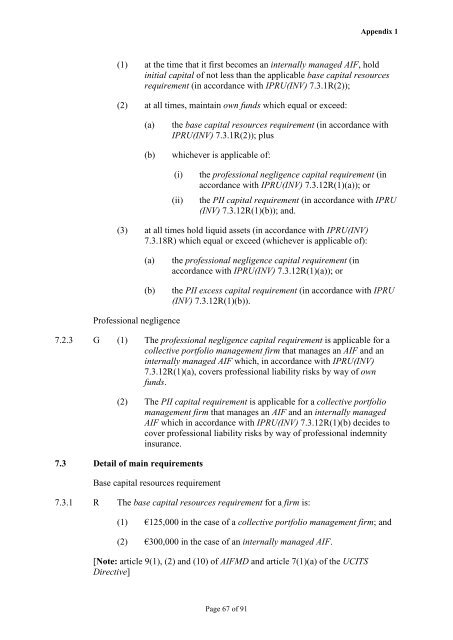

(1) at <strong>the</strong> time that it first becomes an internally managed AIF, hold<br />

initial capital <strong>of</strong> not less than <strong>the</strong> applicable base capital resources<br />

requirement (in accordance with IPRU(INV) 7.3.1R(2));<br />

(2) at all times, maintain own funds which equal or exceed:<br />

(a) <strong>the</strong> base capital resources requirement (in accordance with<br />

IPRU(INV) 7.3.1R(2)); plus<br />

(b) whichever is applicable <strong>of</strong>:<br />

(i) <strong>the</strong> pr<strong>of</strong>essional negligence capital requirement (in<br />

accordance with IPRU(INV) 7.3.12R(1)(a)); or<br />

(ii) <strong>the</strong> PII capital requirement (in accordance with IPRU<br />

(INV) 7.3.12R(1)(b)); and.<br />

(3) at all times hold liquid assets (in accordance with IPRU(INV)<br />

7.3.18R) which equal or exceed (whichever is applicable <strong>of</strong>):<br />

Pr<strong>of</strong>essional negligence<br />

(a) <strong>the</strong> pr<strong>of</strong>essional negligence capital requirement (in<br />

accordance with IPRU(INV) 7.3.12R(1)(a)); or<br />

(b) <strong>the</strong> PII excess capital requirement (in accordance with IPRU<br />

(INV) 7.3.12R(1)(b)).<br />

7.2.3 G (1) The pr<strong>of</strong>essional negligence capital requirement is applicable for a<br />

collective portfolio management firm that manages an AIF and an<br />

internally managed AIF which, in accordance with IPRU(INV)<br />

7.3.12R(1)(a), covers pr<strong>of</strong>essional liability risks by way <strong>of</strong> own<br />

funds.<br />

(2) The PII capital requirement is applicable for a collective portfolio<br />

management firm that manages an AIF and an internally managed<br />

AIF which in accordance with IPRU(INV) 7.3.12R(1)(b) decides to<br />

cover pr<strong>of</strong>essional liability risks by way <strong>of</strong> pr<strong>of</strong>essional indemnity<br />

insurance.<br />

7.3 Detail <strong>of</strong> main requirements<br />

Base capital resources requirement<br />

7.3.1 R The base capital resources requirement for a firm is:<br />

(1) €125,000 in <strong>the</strong> case <strong>of</strong> a collective portfolio management firm; and<br />

(2) €300,000 in <strong>the</strong> case <strong>of</strong> an internally managed AIF.<br />

[Note: article 9(1), (2) and (10) <strong>of</strong> AIFMD and article 7(1)(a) <strong>of</strong> <strong>the</strong> UCITS<br />

Directive]