CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

CP12/32: Implementation of the Alternative ... - BVCA admin

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annex 1<br />

November 2012<br />

<strong>CP12</strong>/<strong>32</strong><br />

<strong>Implementation</strong> <strong>of</strong> <strong>the</strong> <strong>Alternative</strong> Investment Fund Managers Directive<br />

• setting a maximum level <strong>of</strong> leverage for each AIF under its management;<br />

• disclosing <strong>the</strong> maximum leverage levels to potential investors in a given AIF<br />

and keeping investors informed on <strong>the</strong> levels <strong>of</strong> leverage used 18 ; and<br />

• demonstrating to <strong>the</strong> regulator that leverage levels set for each AIF are reasonable<br />

and that <strong>the</strong> AIFM complies with limits at all times.<br />

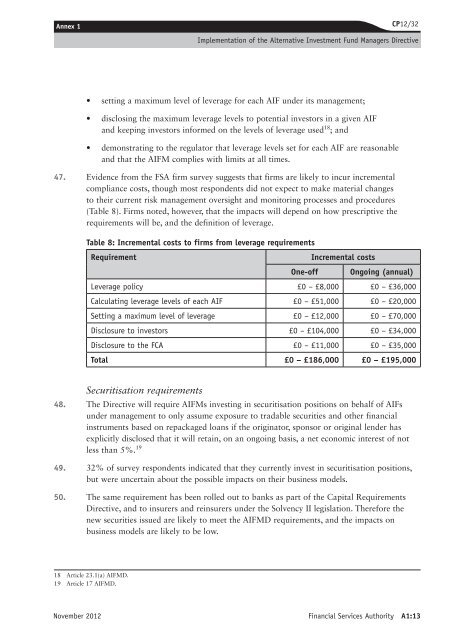

47. Evidence from <strong>the</strong> FSA firm survey suggests that firms are likely to incur incremental<br />

compliance costs, though most respondents did not expect to make material changes<br />

to <strong>the</strong>ir current risk management oversight and monitoring processes and procedures<br />

(Table 8). Firms noted, however, that <strong>the</strong> impacts will depend on how prescriptive <strong>the</strong><br />

requirements will be, and <strong>the</strong> definition <strong>of</strong> leverage.<br />

Table 8: Incremental costs to firms from leverage requirements<br />

Requirement Incremental costs<br />

One-<strong>of</strong>f Ongoing (annual)<br />

Leverage policy £0 – £8,000 £0 – £36,000<br />

Calculating leverage levels <strong>of</strong> each AIF £0 – £51,000 £0 – £20,000<br />

Setting a maximum level <strong>of</strong> leverage £0 – £12,000 £0 – £70,000<br />

Disclosure to investors £0 – £104,000 £0 – £34,000<br />

Disclosure to <strong>the</strong> FCA £0 – £11,000 £0 – £35,000<br />

Total £0 – £186,000 £0 – £195,000<br />

Securitisation requirements<br />

48. The Directive will require AIFMs investing in securitisation positions on behalf <strong>of</strong> AIFs<br />

under management to only assume exposure to tradable securities and o<strong>the</strong>r financial<br />

instruments based on repackaged loans if <strong>the</strong> originator, sponsor or original lender has<br />

explicitly disclosed that it will retain, on an ongoing basis, a net economic interest <strong>of</strong> not<br />

less than 5%. 19<br />

49. <strong>32</strong>% <strong>of</strong> survey respondents indicated that <strong>the</strong>y currently invest in securitisation positions,<br />

but were uncertain about <strong>the</strong> possible impacts on <strong>the</strong>ir business models.<br />

50. The same requirement has been rolled out to banks as part <strong>of</strong> <strong>the</strong> Capital Requirements<br />

Directive, and to insurers and reinsurers under <strong>the</strong> Solvency II legislation. Therefore <strong>the</strong><br />

new securities issued are likely to meet <strong>the</strong> AIFMD requirements, and <strong>the</strong> impacts on<br />

business models are likely to be low.<br />

18 Article 23.1(a) AIFMD.<br />

19 Article 17 AIFMD.<br />

Financial Services Authority A1:13